With another somewhat unconventional public move, Nano Dimension Ltd. (Nasdaq: NNDM) has submitted a revised offer to acquire Stratasys Ltd. (Nasdaq: SSYS) for $19.55 per share in cash (the previous offer was $18 per share and it had been turned down by Stratasys board. At the height of the 2013-2014 period, Stratasys stocks traded above $120 per share. At the same time, Nano Dimension has filed a lawsuit against its own shareholders, Murchinson Ltd. (“Murchinson”), Anson Advisors, Inc. (“Anson”), Boothbay Fund Management (“Boothbay”) and their affiliates, “for improperly acquiring and misusing their shareholding interests in Nano Dimension.” Nano Dimension also just reported full FY 2022 revenues of $46 million (Stratasys generated roughly 14 times as much).

Let’s try to go in order. You can consult previous coverage here and here to follow the entire saga from the beginning. It is a very complicated saga that mostly revolves around two key elements: the fact that Nano Dimension raised nearly $2 billion in cash on the stock market a couple of years ago (and, after acquisitions and expansion, still sits on about $1.5 billion) and the fact that both Stratasys and Nano Dimension’s stock value (like all stocks and in particular most 3D printing related stocks) have since lost most of their value and are trading near all-time lows. Clearly, it is very convenient to buy many publicly traded 3D printing companies now, which is what Nano Dimension wants to do with Stratasys (of which it is the largest shareholder), finding an ideal place to put all its cash. Murchinson and associates want to do the same thing with Nano Dimension, in this case, to take control (for relatively low investment in terms of stocks) of the company’s technologies as well as the $1.5 million in cash.

Both Stratasys’ and Nano Dimension’s current leaderships are fighting off the takeover attempts, confident that the companies’ value is much higher than what their stock price says today. The two cases are of course also very different. While Stratasys is rejecting all Nano Dimension’s offers and the board is doing everything it can to resist the acquisition (we have argued that it might not be such a bad thing if the Stratasys board were able to find the most advantageous agreement, but we do not have all the elements) Nano DImension is alleging criminal misconduct and “seeks to immediately halt the Defendants’ unlawful actions and to compensate Nano Dimension for the misconduct”.

Nano Dimension FY 2022 revenues up 300%

Nano Dimension just closed its FY 2022 reporting revenues of $43.6M, +316% compared to about $10M in FY2021 (and +1,200% compared to FY 2020). Nano Dimension also reported audited consolidated revenues of $12.1 million for the fourth quarter ended December 31st, 2022, a 61% increase over the fourth quarter of 2021 and 21% increase over the third quarter of 2022.

“We have delivered very significant revenue growth in 2022, demonstrating further progress in our strategy to drive rapid innovation that meets customer needs. We also achieved several key customer and sales milestones, including strengthening our defense customer base with orders from a European-based military force and western global aerospace and defense contractor, as well as key transactions with academic and research institutions. We also made significant strides in executing against our goal of becoming the leading AI/deep learning framework for industrial applications. The advancements we’ve made are empowering all machines in the extended Nano Dimension ecosystem through advanced industrial inspection, print quality optimization, process optimization and monitoring and maintenance of machines, a significant value-add to new and existing customers.

We hope to accelerate our organic growth in the year ahead and remain well-positioned to execute on our M&A strategy – including our recently announced offer to acquire Stratasys Ltd. which we view as a strategic, complementary asset in the relatively mature polymer-based AM market segment – within a flexible capital deployment framework. With the intensive help of our financial advisors, Greenhill and Lazard, in addition to our ongoing exchange with Stratasys, we continue building and pursuing our pipeline of additional prospective synergistic M&A transactions.”

The Company also highlighted the organic revenue growth of previous acquisitions: AM/Admatec revenue grew +60% over 6 months since the acquisition. Additive Electronics/Essemtec revenue grew +8% over 12 months since the acquisition, while AM/GIS revenue grew +4% over 12 months since the acquisition.

Stratasys takeover

Under the terms of this improved proposal, Nano Dimension would acquire the remaining shares of Stratasys it does not currently own for an aggregate of approximately $1.2 billion on a fully diluted basis. This offer represents a premium of 37% to the closing trading price as of March 3rd, 2023, a 40% premium to the Company’s 30-day VWAP, 51% premium to the 60-day VWAP and a 47% premium to the 90-day VWAP as of March 3rd, 2023. Nano Dimension has been the largest shareholder of Stratasys since July 2022 and currently owns approximately 14.5% of Stratasys’ outstanding shares (13.7% on a fully diluted basis).

Manufacturing on Demand

“Our increased, all-cash offer demonstrates our commitment to consummating this strategic combination, which will deliver immediate and certain value to Stratasys shareholders at a compelling premium and enable us to create the preeminent leader in the rapidly growing AM market,” said Yoav Stern, Nano Dimension’s Chairman and Chief Executive Officer. “We are prepared to move quickly to complete our due diligence and engage with Stratasys to finalize a mutually agreeable transaction.”

Mr. Stern continued, “Nano Dimension believes in the quality of Stratasys management and its line-leaders, and we are therefore extending this Improved Proposal. We again invite the Stratasys’ board of directors (“Stratasys’ Board”) to engage in an open and constructive dialogue with us around a combination of our businesses. We also urge the Stratasys Board to take immediate steps to remove the company’s ‘poison pill’ and allow shareholders to voice their opinion on the proposed transaction and we are committed to giving Stratasys shareholders the power to decide on the merits of our compelling offer.”

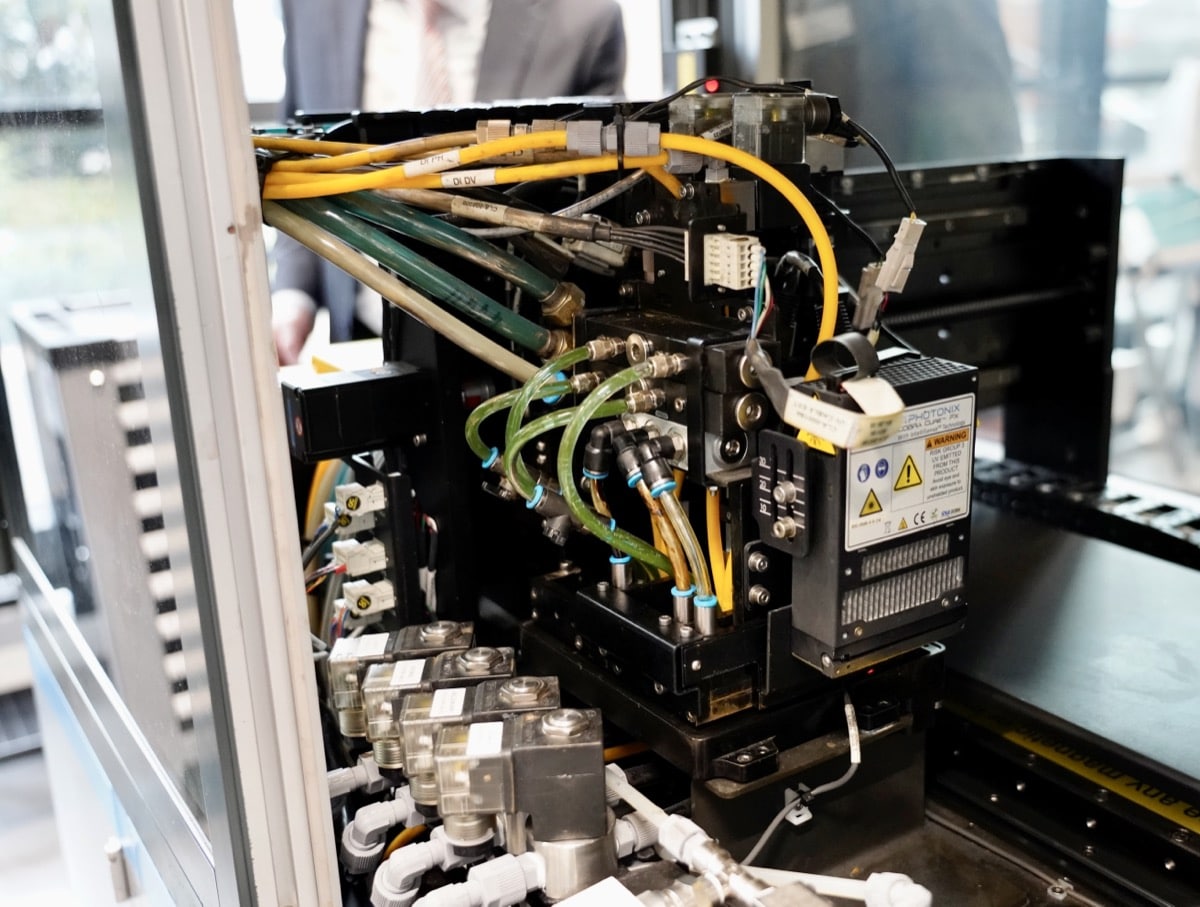

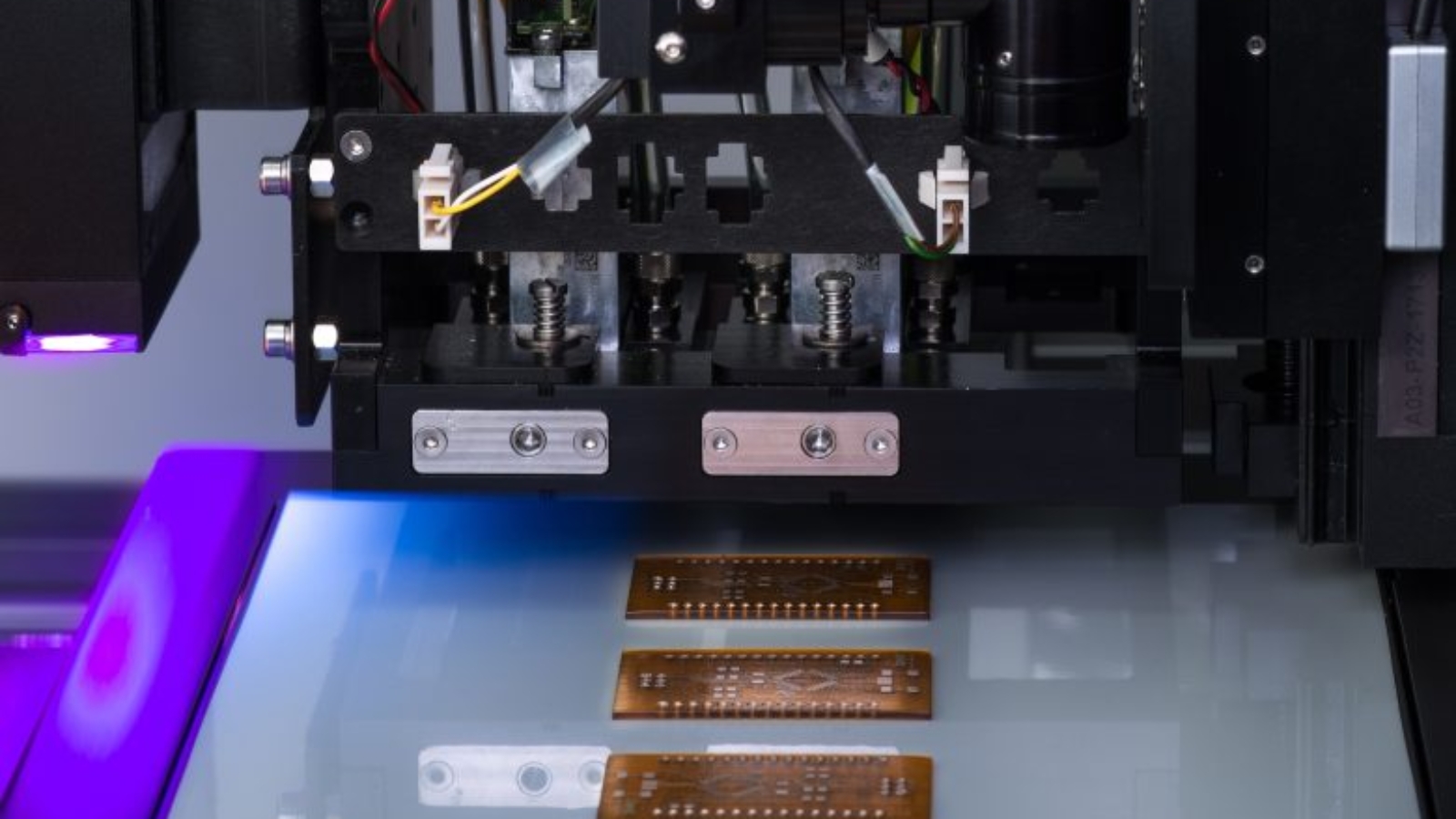

Nano Dimension’s Improved Proposal represents an increase in value of $1.55 per share, or 9%, as compared to its March 6th, 2023, proposal and offers compelling and certain value to Stratasys shareholders at a time of ongoing market volatility. As in the previous offer, Nano Dimension also lists the benefits of such a transaction in terms of growth, value-creation opportunities, market consolidation, organizational synergies and the complementary nature of Stratasys’ polymer-based 3D printing systems (which include FDM, SLA, high-speed DLP and SAF polymer PBF technologies) as well as PolyJet AM machines are ideally complementary to Nano Dimension’s ceramic, and metals AM & AME capabilities, providing a full suite of products to the additive manufacturing segment.

Nano Dimension takeover

In its lawsuit, Nano Dimension asserts that the defendants have a long history of coordinated efforts against Nano Dimension itself and the interests of its shareholders. The complaint alleges that the defendants conspired to obtain a large stake in Nano Dimension by working in tandem to lower the price of the Company’s public securities in order to purchase shares at a discount. According to the lawsuit, on September 7th, 2022, just two days after Murchinson made a non-binding offer to acquire the Company, Anson and Boothbay executed purchases totaling 1.86 million shares, or $4.5 million, within a matter of minutes.

Murchinson’s offer was, at this point, supposed to be confidential, but, according to Nano Dimension’s filing, the trades allowed Anson and Boothbay to profit off the non-public material information that Murchinson had made an offer to purchase Nano Dimension. In the months that followed Murchinson, Anson, and Boothbay continued to acquire large amounts of Nano Dimension securities without disclosing their growing interests or close coordination.

Other elements highlighted in the lawsuit include the fact that the defendants “sought to take control of the company and capture its $1 billion in cash for themselves, rather than allowing it to be invested in the Company’s ongoing success and benefit of all shareholders”; and that the “evaded disclosure requirements by attempting to hide the existence and purpose of their group as legally required and by filing false and misleading regulatory disclosures with the SEC.” Nano Dimension alleges that the “defendants began secretly acquiring shares in summer 2022, increasing their holdings from approximately 300,000 shares on March 31, 2022, to more than 23,632,500 shares by year-end – acquiring a more than 9% interest in the company, and they continued to conceal a creeping accumulation of Nano Dimension’s shares. By January 11th, 2023, the Murchinson-Anson-Boothbay group held above 10% beneficial ownership of Nano Dimension’s shares, and either failed to file Schedule 13Ds or omitted material information when they did file – never disclosing the existence and purpose of their group as legally required.”

As detailed in its complaint, Nano Dimension said it has provided evidence of prior coordination by the defendants at other companies in an effort to gain a trading advantage at the expense of other shareholders, and that the defendants separately engaged in unlawful schemes in concert with additional investment funds.

The next chapter in this saga is yet to be written.

You might also like:

SWISSto12 launches US entity, St12 RF Solutions Inc.: SWISSto12 SA (St12), one of Switzerland’s fastest-growing aerospace companies and a leading global provider of innovative RF solutions, has recently incorporated St12 RF Solutions, Inc. The new entity has business offices in Manchester, NH, and will focus on engaging government and industry partners in the United States to commercialize advanced RF solutions.

* This article is reprinted from 3D Printing Media Network. If you are involved in infringement, please contact us to delete it.

Author: VoxelMatters

Leave A Comment