We left off with Sinterit just over two and a half years ago when we visited the company’s HQ in Cracow to learn about the latest progress and market penetration of the Lisa Pro system. Fast forward to today, across a global COVID epidemic, supply chains crises, rising geopolitical tensions, and the first strong new competitor entering the compact SLS market, and Sinterit is still stronger than before.

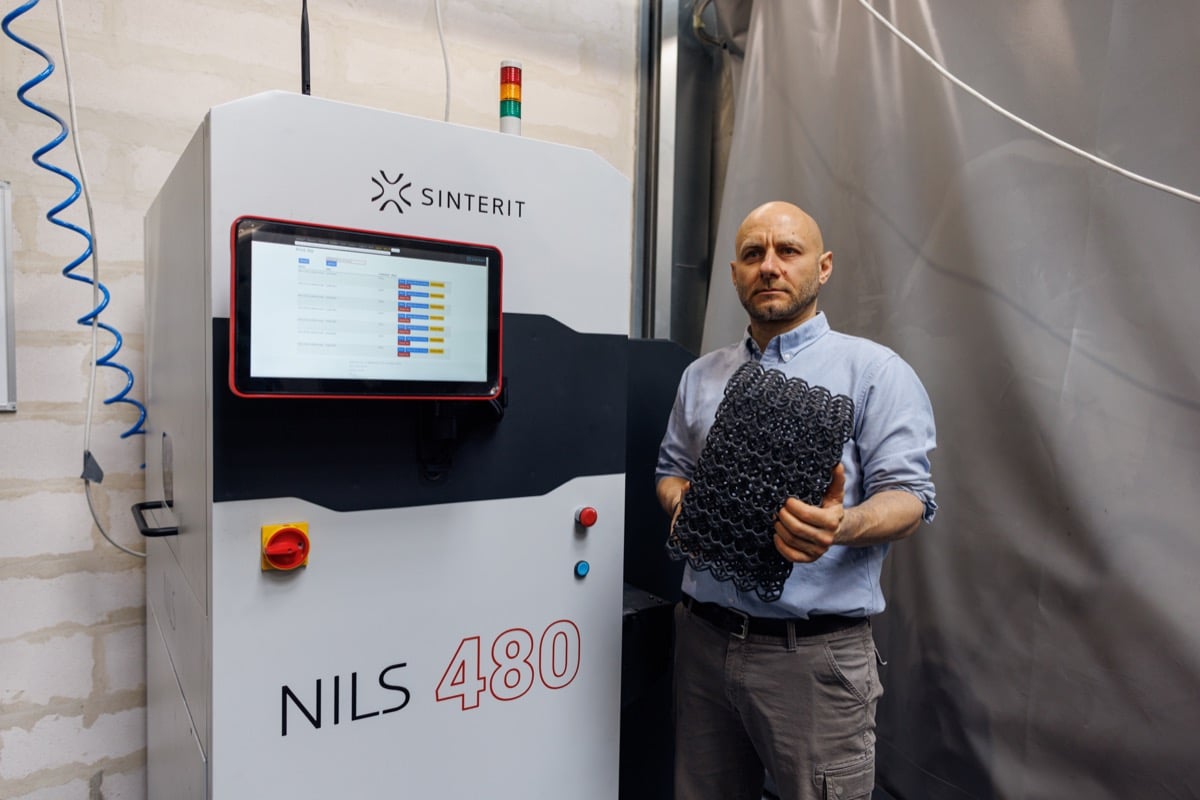

But it was not easy. The young Polish company, founded by ex-Google engineers and now led by CEO Maxime Polesello, could have been overwhelmed. Instead, the entire management team decided to double down and invest in its future growth. The result is that Sinterit is now settled in a new 100-person facility, with a highly organized assembly line. One ambitious product, Lisa X, is hitting the market and one more, even more ambitious, NILS, is getting ready to do so soon. During our visit to the new Sinterit facility, we sat down with Mr. Polesello to understand where the company now fits within the global SLS landscape.

Coming out on top

“When COVID hit and everything shut down we were faced with a dilemma,” Polesello says. “As a young company, we could not be sure how long we could have endured prolonged closures. We decided that we would not change our course of action and would invest all the time and resources available on R&D and training of our employees.”

These efforts lasted all through 2021 and resulted in the development of the two new and significantly more advanced machines, ready to cater to new and larger target audiences. This was made even more necessary by the fact that Formlabs, the company that revolutionized the stereolithography segment machines, finally launched its first compact SLS machine, the Fuse1, after years [1] of engineering. “I would have signed to be where we are now,” Polesello says.

Now Sinterit is ready to go to market. And to do it with two new SLS machines, bringing the total to four, and a full solution comprising the Sinterit Studio software, a new PHS (Powder Handling Station) and post-processing equipment. Will Lisa X be able to surpass Lisa Pro’s success?

“In terms of orders, it already has,” Polesello says. “We already registered a lot more than for Lisa Pro and Lisa. Some Lisa Pro are sold because people don’t want to wait. “According to Polesello only a few of these are upsales from existing customers. Most customers of Lisa Pro and Lisa used it mostly as a stand-alone system for prototyping, while the Lisa X and NILS are targeting production capabilities via their larger build volume and increased workflow automation. This is where it starts to make sense to have 3D printer farms.

“We are now able to address new customers that we couldn’t before because of limitations in terms of size and speed of the previous systems,” says Polesello.

The Lisa X is up to 20 times faster than the Lisa Pro. Compared to larger industrial SLS printers, there are differences in terms of heating up and cooling down. However, the Lisa X, with the new galvo mirror system is in the same range and, according to tests conducted by Sinterit, faster overall than their most direct competitor, the Fuse 1.

“Still, the Lisa X is not going to be used for mass production so productivity is not a killer benefit,” Polesello adds that “in the compact segment we observe that the Lisa, Lisa Pro and Lisa X have positions that make sense: Lisa is for users who are constrained on budget and want to make the first step towards the SLS. Lisa Pro is the first open and multimaterial SLS 3D printer on the market, which opens more possibilities. Lisa X, and eventually NILS, represent the top of our offer. There is room for all three products in the compact segment and we expect Lisa X to be the top seller.

New territories for SLS

While Lisa X has been developed with the clear goal of facing off against a strong competitor in the compact SLS segment, Polesello expects to find less competition in the accessible industrial segment that NILS is targeting. “We feel there really is a hole. Initially, we wanted to develop a compact printer that would fill the gap from zero to industrial level and we realized we couldn’t do that. We found that there is a subsegment, which we refer to as “accessible industrial” where the system costs around €50,000-€60,000. Our partners would consider that as an addition to the current industrial players’ systems.”

Polesello goes on: “One of the main inputs on NILS that we’ve received from the market, mostly from partners that are already selling larger machines, is that they need a machine that is designed to deliver high-quality SLS parts at a lower Total Cost Of Ownership, with more automation. It has to be easy to use and install, and suitable for all manufacturing environments. NILS costs less than half as much as the second most affordable system currently on the market”

Lisa X and NILS are meant to be plug-and-play machines. They come on Euro-pallet, on wheels. “You just take it out, go through half a day of installation,” Polesello says. “So, it’s by far more accessible to more businesses than the other industrial machines are. And I’m just not talking about the upfront investment, but also everything else that comes with it.”

Manufacturing on Demand

That includes the ability to work with many open materials and access to a complete solution that includes the new and reengineered PHS, the Powder Handling Station. According to Polesello, 80% of customers who order Lisa X also purchase the PHS.

“This further validates our strategy of implementing a modular approach to R&D. We started with the printer then developed the post-processing then went back to the printer and the next step will be to create an even more integrated solution. Eventually, we will have a one-stop-shop automated solution to get a finished part out of each print.” Polesello also highlighted how the full ecosystem solution is better suited for Lisa X and NILS, where the extra budget for post-processing is a fraction of the cost of the system itself.

Going global

Now that Sinterit has scaled up system production, the company is looking to streamline and optimize its global reseller network, both in Europe and in the US. This means that the company has modified its strategy in Europe, eventually looking to work away from a master distributor model into one that comprises several direct resellers, all on the same level, in key segments and in key countries such as France and Germany. This would enable Sinterit to be more directly present in each of these markets, but it also requires much more effort.

The most ambitious expansion project is in the US, where Sinterit hired industry veteran Tim Sheehan as VP of Sales and Marketing to head the new facility and create the reseller network, signing partners such as Impact System, Master Graphics, and Vision Miner.

“Customers who chose Sinterit products will now have easier access to them”, Polesello tells us. “Tim Sheehan has been with us for a year during which we’ve established our own warehouse and Tim is coordinating everything connecting and working with the local resellers.”

Polesello feels that it is very important that the company is perceived as being directly present in each of these major markets, which is why it will be present directly at the upcoming Rapid + TCT show in Detroit (along with some local resellers), especially as it scales its operations into more industrial segments. “It has been a lot of work to create this infrastructure, Polesello says, and the launch of the new product was instrumental in getting many of these resellers to partner and sign with us. In fact – he adds – some of these were resellers of HP 3D printers who saw us as a synergic addition to their line-up. Many of them also appreciate the fact that we do not do any direct sales, which means that we position ourselves as a partner rather than as their biggest competitor.”

On the other side of the world (which is just next door to Poland) in Russia, the situation is very different. “It has not been easy,” Polesello says. “We are very close to the consequences of the conflict. There are over 200,000 refugees in Cracow, which is a 20% population increase. Each one of us is impacted and at the same time we had a great relationship with our resellers and partners in Russia. In the end, we had to stop selling our product to all Russian companies because we decided that we needed to be 100% sure that our machines are used in line with our standards and values. Something that we cannot be certain of at this time.”

Sinterit at your service

For most industrial AM hardware system manufacturers, AM service providers are the primary customer segment and their goal is to expand toward final adopters. For Sinterit it’s the exact opposite. Because the Lisa and Lisa Pro are intended as relatively low-cost stand-alone machines, they are used for advanced prototyping mostly by industrial final adopters and not as production systems. That is expected to change with Lisa X and NILS.

“To date, we have sold between 60 and 70 machines to service providers and that’s just a small of the thousands of machines we have installed around the world,” Polesello explains. “We mainly sell to entities for education, R&D, and in-house prototyping.” The Lisa X is expected to represent an evolutionary step. “We expect that it will be used for more functional prototypes in a more advanced stage of development – says Polesello –so it will be much better at solving prototyping challenges. We now have more interest from AM service providers for the NILS, which they see as an industrial system with a very advantageous cost of ownership.

Many customers see SLS as an upgrade from other technology. Once they have reached the limits of the possibilities offered by filament extrusion and stereolithography, they turn to Sinterit as an access point to PBF, the mechanical properties of its materials and its geometric freedom. “They know they need to scale up but they are not ready to make the investment for a large in-house system. We are positioning ourselves to enable this progressive journey through SLS, from Lisa’s entry-level prototyping to NILS’ industrial capabilities.

A big part of this accessibility comes from materials. Sinterit’s open material approach means that companies can develop their own but also that any material company can develop materials that can be used on a Sinterit system. One of these companies is material giant BASF. “In the beginning, it was a huge achievement to have qualified 8 materials for the Lisa Pro out of over 50 materials we tried,” Polesello explains that the machine’s limited power reduced the range of compatible materials. He now expects that the improved capabilities of Lisa X and NILS will pave the way to a much larger selection and most materials in the market for SLS will suit both Lisa X and NILS.

Speaking with Maxime, visiting the Sinterit factory and testing the Lisa X in person (more about this in upcoming articles), it appears clear that Sinterit is a very serious company and that it’s ready to start the next phase of scaling its operations. Having Sinterit’s founders at the beginning of this adventure makes it more impressive and in retrospect, it was clear from the early days that they had a chance to really open up the SLS market. They did this by continuously bringing in qualified managers and investing in both R&D and human resources. They are also able to offer a high-quality advanced technology product, made in Europe, at a very competitive price. “We can do this because, unlike other industrial manufacturers, we come from Lisa.” In a way it’s like making 8-bit videogames and then moving on to today’s gigabyte size games: it’s a lot easier to make everything fit in. And Sinterit now definitely fits in the world of SLS.

* This article is reprinted from 3D Printing Media Network. If you are involved in infringement, please contact us to delete it.

Author: Davide Sher

Leave A Comment