Two reports issued by KPMG provide useful insights into the manufacturing industry and how 3D printing companies may benefit from opportunities in this area. The latest report reveals that more than 50% of business executives either plan to invest, or have already invested in 3D printing.

The Global Manufacturing Outlook (GMO) report released earlier this year is joined this month by the Global Metals and Mining Outlook (GMMO) report.

When read together, these reports provide valuable insights about the opportunities for 3D printing companies and their customers. Also, with close review a number of important market trends become apparent.

The GMO report is based on a survey of, “360 senior executives conducted in early 2016 by Forbes Insights.” Participants in the survey came from 6 industry sectors, Aerospace & Defense, Automotive, Conglomerates, Medical Devices, Engineering and Industrial Products, and Metals. To ensure the report was a truly global perspective care was taken to ensure respondents, “were fairly evenly distributed between the Americas, Europe and Asia.”

The GMMO report surveyed, “62 senior metals sector executives.” Forty percent of those surveyed, “represent companies with annual global revenues of more than US$5 billion and 5 percent represent organizations with revenues of more than US$25 billion.”

The surveys were supported by interviews with senior executives and industry professionals.

“Metals executives should have no concerns about their ability to source raw materials — for the time being, at historically low prices,” says Richard Sharman, KPMG’s global head of commodity trading. However, the processing of these raw materials into feedstock for use in 3D printing is an area where activity during 2016 is beginning to heat up.

Demand for metals by the 3D printing industry is currently met by several of the major players in the industrial sector. ExOne, Arcam, and others supply metal powders that are tailored for use in 3D printing. Specialist metal powder manufactures such as Sandvik Ospery are also active in the market.

Very aggressive intentions

Frequently these companies have invested significant sums in the research and development of production methods. In Arcam’s case this involved the acquisition of AP&C. Arcam have further developed the technology in use at AP&C and expanded production capacity over the past 12 months.

More than 50% of executives in the Global Manufacturing survey described their strategy for growth as aggressive, with over 1 in 6 announcing intentions to be “very aggressive.” Recent activity in the 3D printing industry supports this finding and new competitors will soon join current market participants. This may fuel a round of price competition, and even consolidation activity via merger or acquisition.

In order to grow business the manufacturers in the survey said they planned to make, “significant and often fundamental changes .. in order to drive future growth.” The majority, at 80%, said this would involve entering new sectors. Tom Major, KPMG principle of strategy practice said, “We have seen manufacturers make significant investments into new businesses, models and technologies that help them expand their footprint into new sectors.”

Could this involve expansion into the supply of 3D printing consumables such as spherical metal powder for 3D printing methods or the production of other metal feedstocks for additive manufacturing?

Plasma atomization: for production, and destruction

Arcam supply powder for use with their EBM 3D printing machines, but also to companies using rival technologies such as laser sintering based metal 3D printing. This powder is created using the plasma atomization process.

PyroGenesis Canada Inc. developed the plasma atomization technique for the production of spherical metal powders in the 1990s. In recent years PyroGenesis have focused on other applications of plasma, such as in the disposal of waste by Navy vessels. This year the Canadian company have made a number of public statements about a return to the metal powder market.

Earlier this month PyroGenesis announced a contract that will scale up their, “One-step proprietary PUREVAP process [and] could produce high purity silicon metal from quartz in just one step.” This pilot project with HPQ Silicon Resources will focus on building a facility capable of producing an annual 200 metric tons of silicon metal over the next 2 years. Silicon metal is most widely used in the production of aluminum alloys. A firm announcement on production of metal powder for 3D printing has not yet been made.

The growing market for 3D printed metal has attracted the attention of traditional metal companies, such as industry giant Alcoa. Alcoa are valued at over $13 billion by market capitalization and are vertically integrated throughout the aluminum industry.

Metal competition will be “brutal“

The multinational company are active in all aspects of the metals supply chain including mining, refining and recycling. With the opening of a $60 million plant in Pittsburgh last month Alcoa will produce industrial volumes of aluminum, nickel and titanium powders for 3D printing customers.

This initiative is part of Alcoa’s plans to divide its existing business into two different companies. The new company will be called Arconic and will be active in the 3D printing industry and also other value added activities, while Alcoa will concentrate on upstream primary metals activity.

Arconic will be in direct competition with Arcam’s AP&C division. They will also join companies such as Sandvik Osprey in the group of companies who produce metal powder feedstocks, but do not produce 3D printers.

KPMG’s global manufacturing outlook report notes that with, “Limited baseline growth expected in most markets, manufacturers will need to either invest into new technologies in order to ‘grow the pie’ or resort to a brutal competitive fight to steal market share away from rivals.” Alcoa’s strategy seems to be an example of this.

A new method to reduce 3D metal printing costs

Another potential entrant is UK based company Metalysis. This company hold intellectual property rights over the Fray, Farthing, Chen (FFC) Cambridge process for production of metal powders. This production method may yield a substantial decrease in the cost of metal powders for additive manufacturing.

The company are currently testing their spherical metal titanium powder with users and are scaling up production. They anticipate a production capacity of 10 tons per year, initially for titanium powder. The FFC process has application for, “Around 30-40 elements in the periodic table and all the alloys that are derived from them,” according to Dr. Kartik Rao, business development director.

Cost is increasingly an important factor according to the KPMG GMMO report.

“Whereas 67 percent of our respondents say that cost and performance management was a high priority in the past, 77 percent now say it will be a high priority in the future.”

When Metalysis reach production volume decreased feedstock costs may drive an increase in sales of 3D metal printers as total costs of ownership and operation decline.

Potential customers for metal powders include industries such as aerospace, automotive, medical and energy. Customers also include 3D printing companies such as Stratasys and 3D Systems who offer on demand metal 3D printing services and who will soon have more choices of feedstock suppliers.

High investment in 3D printing forecast to continue

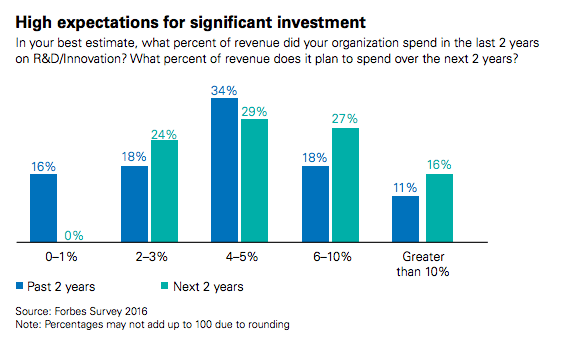

KPMG found that 27% of organizations plan to spend between 6-10% of revenue on research and development over the next two years. A further 16% of those in the survey said their R&D spend would be greater than 10% of revenue.

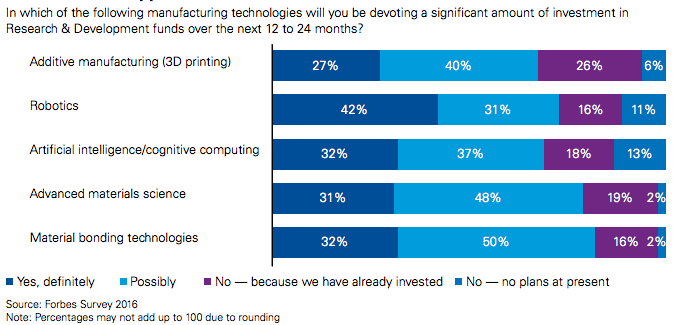

The GMMO survey asked which technologies were likely to benefit from a significant investment over the next 2 years. The results show that 3D printing is still a major focus, with more than a quarter of companies in the survey “definitely” planning such an investment. The percentage planning to invest in 3D printing is below that for robotics, but this is due in part to the fact 26% of respondents have already invested in this area.

“Metals organizations recognize that — when the upcycle does return — they will need to be much more agile and efficient in order to drive profitable growth,” says KPMG’s Eric Damotte.

The consulting firm provide insight into how such efficiency might be achieved. “All signs suggest we are now on the cusp of a new age of automation in the metals and mining sectors,” says Eric Logan, KPMG Managing Director of Strategy. “Automation and robotics can help reduce labor costs, drive efficiency and productivity, enhance safety and improve quality across the metals and mining sectors,” says Logan in the GMMO report.

The Global Manufacturing Outlook 2016 report is available here (PDF) and the Global Metals and Mining Outlook 2016 is here (PDF).

Leave A Comment