3D printing stocks have increased dramatically in value during 2013, in part due to the industry’s projected CAGR of 25-30% for the next 3-5 years. While additive manufacturing/3D-printing has been around for two decades, advances in hardware and software technologies as well as expansion in available materials utilized in 3D printing are moving the industry from small sized production and prototyping to manufacturing capabilities.

The four largest publicly traded 3D printing stocks on U.S. exchanges are 3D Systems Inc. (DDD), Stratasys Ltd., (SSYS), The ExOne Company (XONE), and voxeljet (VJET).

Many reasonably conclude that forward growth has been priced into the shares of these companies. Not surprisingly, the best 3D printing stock to invest in now could be a newcomer to the industry that doesn’t have the burden of the above multiples to overcome. But simply being a newcomer with strong fundamentals doesn’t lead to growth in sales or ultimately, in share price. It’s critical that the company is launching a competitive product for the market with patented technology to form a protective moat.

One company I came across recently has all of these- strong fundamentals, an innovative new product launching, and patented technology. It’s a company very few 3D printing stock investors have met to date, making it an undiscovered player with considerable upside potential and (in my opinion), the best 3D printing stock to buy now.

Meet Groupe Gorge

Groupe Gorge is a French engineering company trading on the NYSE Euronext exchange under the ticker GOE. The company has engineering expertise in a variety of fields including development of flight and naval simulators, robotics, command and control systems, as well as nuclear and fire safety systems. The Gorge Group is now making a strategic move into the 3D printing industry with the acquisition of “Prodways”, a 3D printing OEM started by a chief scientist from 3D Systems, Andre-Luc Allanic.

Prodways (formally called Phidias Technologies) sold 17 of their industrial 3D printers during the last 3 years, mostly to German customers. This was accomplished by founder Andre-Luc Allanic with a skeleton crew of help. Since the acquisition, Prodways has added additional engineers, a sales team, and has access to a built-in customer base from the Gorge Group.

The Technology

While it may be too soon to tell, Prodways printers may be a hit technologically. The printers utilize a newly-patented (with patent pending in US) technology that combines UVA LED and moving DLP.

Prodways founder Andre-Luc Allanic on the company’s new 3D printers:

Group Gorge CEO, Rafael Gorge, lists the following competitive advantages in their Prodways lineup of 3D printers:

- Most detailed parts on the market at high throughput : hundreds of tiny parts in just a few hours at a resolution of less than 35-µm

- Unequalled resolution, more than half a billion pixels per layer

- High precision in the 3 dimensions (horizontal AND vertical), essential in many applications such as dental

- Very large sized parts while retaining the same precision required for intricate and exacting parts such as those used in biomedical

- The technology permits the use and development of premium innovative composite and hybrid materials with impressive mechanical, physical, esthetic properties, as well as biocompatible materials for a wide variety of medical applications

- Profitability is significantly improved due to incredible speed and considerable reductions in production costs

- Up to 10 times faster than market standards

- Technology allowing for unequalled production volumes

- Superior surface quality requiring minimum finishing

- Minimum operating costs due to lack of expensive wear and tear on parts

- Replacement of LED light source cheaper than laser

More information on Prodways, their potentially game-changing technology, management, and vision can be found on their web site at Prodways.com.

The Fundamentals

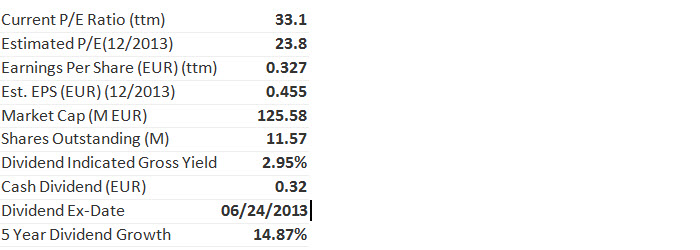

The fundamentals of the Gorge Group are more closely aligned with a value stock than one now entering the high growth 3D printing industry. The company even has a history of paying dividends.

Prodways Successful Launch at EuroMold 2013

The Gorge Group officially launched their Prodways lineup at EuroMold 2013 in Frankfurt last week and according to French online source The New Factory, they had a sales win with a large company in the dental industry while there. Arnaud Guedou, sales and marketing director for Prodways, said that the Prodways booth at the event was so busy he couldn’t even stop for lunch.

M. Guedou wasn’t the only one noticing how busy the Prodways booth was at their EuroMold debut. TCT Magazine stated that the Prodways stand was “conspicuously popular”. After getting to know Prodways technology and capabilities, TCT magazine noted that “It seems highly probably the additive manufacturing community in Europe and further afield will be hearing a lot more about Gorgé, Allanic and their Prodways creations” in their review.

Rachel Park, editor of 3DPrintingIndustry.com said Prodways is “definitely one to take a look at / keep an eye on” in her EuroMold report.

Groupe Gorge Trades on the NYSE Euronext Exchange

Buying shares of The Gorge Group may require an extra step or two for some investors. At the present time the stock trades on the NYSE Euronext Exchange under the ticker GOE. Not all online brokers from across the pond offer trading on foreign exchanges so investors in North America will have to call their broker to inquire. Getting set up to buy shares on the NYSE Euronext is otherwise a simple process taking a few minutes over the phone. The exchange trades from 3:00 a.m.-11:30 a.m. EST.

CEO Raphael Gorge hasn’t ruled out a move to a different exchange. In an interview from 11/29 he stated:

“The potential of 3D printing is almost unknown on European stock market. If this was to last for long, we could envisage any financial strategy that enables us to reach the huge financial leverage our competitors have.”

In my view, this makes buying shares on the Euronext an even more compelling investment since there is clear potential for those shares to trade on a US exchange at some future date.

Conclusion

I’ve been investing exclusively in 3D printing stocks since long before the well known players were priced to perfection. I believe the best opportunities for share price appreciation over the next 3-6 months are with companies that the market hasn’t discovered yet, that have innovative, potentially game-changing patented technology, and a competitive management team ready to take on the established names. This describes The Gorge Group. Moreover, with a forward PE ratio of less than 30, a diverse revenue base from more than 3D printing alone, and a market cap below $200 million, my pick for “The Best Stock to Buy Now” is, unequivocally, Groupe Gorge.

Disclosure: I own shares of Group Gorge. I have not been paid by any company or any third party for this article.

Disclaimer: I am not an investment advisor. The above article is not a solicitation to buy or sell any security, and should not be considered investment advice. Individuals who choose to invest in any security should do so with caution. Investing in securities is speculative and carries a high degree of risk; you may lose some or all of the money that is invested. Always research your own investments and consult with a registered investment advisor or licensed stock broker before investing.

Leave A Comment