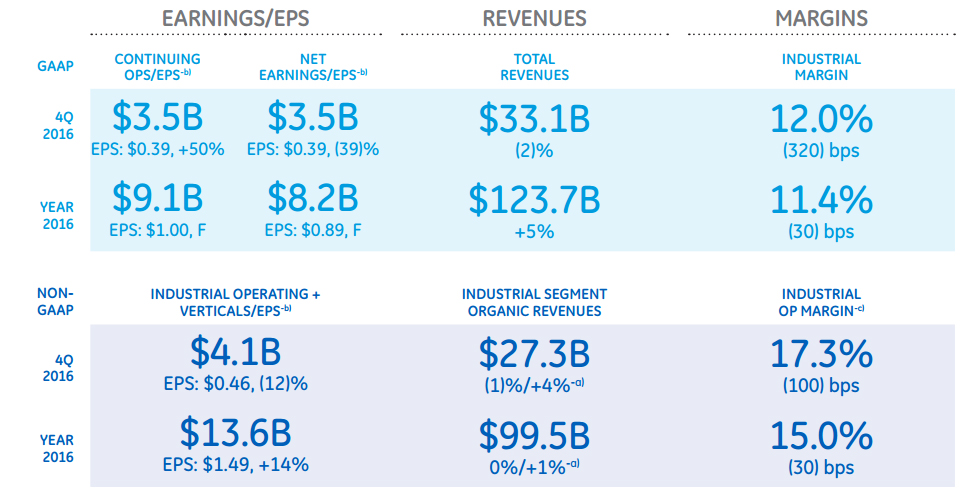

The General Electric Company (NYSE:GE) has reported full year financial results for 2016. With $123.7 billion in full year revenue, the company shows a 5% year on year increase and expects 3D printing to make an important contribution to the future of the business.

Largest 3D printing deal in history

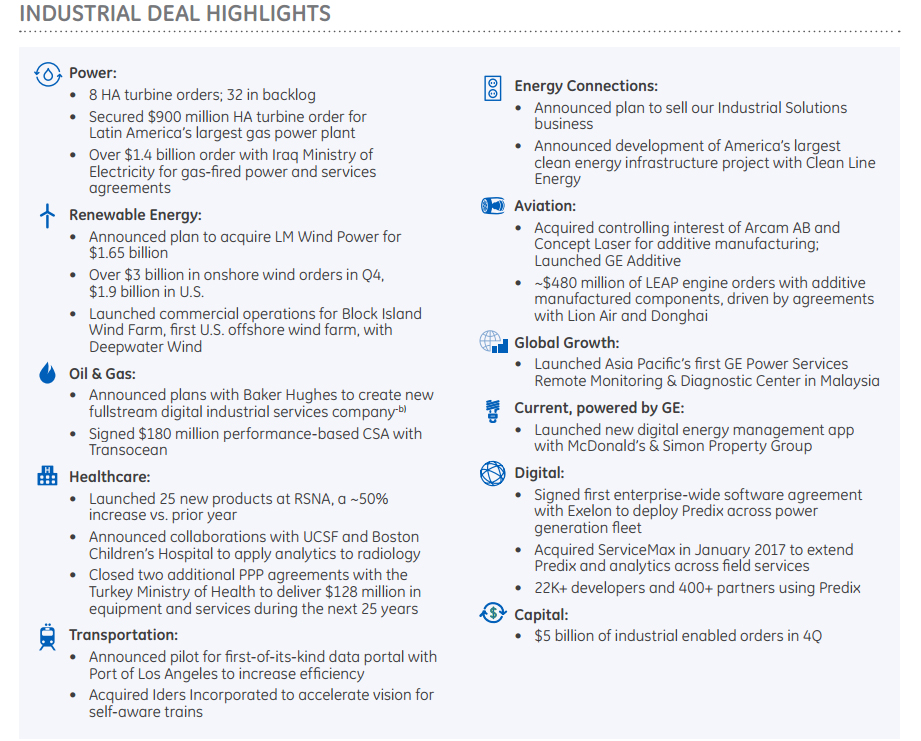

GE’s $1.4 billion deal last year for Concept Laser and Arcam AB was the largest in 3D printing history to date. In recent weeks rumors that GE are preparing to add another 3D printing company to its portfolio have circulated. Some commentators have speculated that 3D Systems might be next in line. When contacted by Industry a spokesperson for 3D Systems reiterated that it was company policy not to comment, “on market activity and speculation.”

While the existing acquisitions are yet to be fully integrated into GE, already the company is forecasting the impact of 3D printing on their bottom line. Specifically in setting out their cost program for 2017-2018 GE highlight the application of additive manufacturing. The company forecast an incremental 50 basis points saving as part of the integration of 3D printing into its business. GE CEO Jeff Immelt said, “In total, we’re working on list of close to $1.7 billion with a target of getting a $1 billion of cost out over two years.”

3D printing for the oil and gas markets

The most visible use of 3D printing at GE is in the aviation division. However the technology will also have an impact on several other areas. Speaking about GE Capital CEO Jeff Immelt said, “We closed $86 billion of asset sales in 2016 and the move to become an industrial finance company is very positive for GE.” As we recently reported through its GE Capital division, loans for 3D printers will be available.

3D printing may also be applied to the company’s energy activities. The most recent revenues from the power, oil and gas markets were lower than expectations. The company attributed this to slow growth and a volatile environment, partly due to the uncertainty that accompanies an election year. While GE say there are still challenges in the oil sector the company are now more optimistic about the U.S. economy.

3D printing can be used to cut the lead time drastically when it comes to manufacturing turbine blades and other vital components for this industry. We have also seen how 3D printing can be used to repair components in this market. Speaking about one large deal in this segment CEO Jeff Immelt said, “we booked some big global orders including a $1.4 billion order with the Iraq Ministry of Energy for gas turbines.”

The advance of the 3D printed jet engine

For the final quarter of 2016 GE reports LEAP engine orders of $480 million, this equates to 255 units. At the core of the LEAP engine is the 3D printed fuel nozzle, this demonstrates one of the primary reasons why the company was keen to add a PBF company to its portfolio. The purchase of the manufacturers of DMLS means that GE has secured this element of the LEAP production process. Jeff Bornstein, SVP and CFO, said, “Arcam and Concept Laser are great platform additions to our capability.”

Bornstein continued to expand on the performance of the Aviation division. Remarking that the business, “had a very good year.” During that time GE delivered its first LEAP engines and, “currently 20 A320neos powered by LEAP are flying across six different customers.” Bornstein added, “We had expected to ship a total of about 100 engines in 2016, but in coordination with the airframers, we delivered 77 for the total year, meeting all our commercial commitments.”

Speaking about the ongoing production of engines Bornstein said,

Orders in the quarter were $7.2 billion, up 5% with equipment orders higher by 2%. Commercial engine orders were down 4% on lower CF-6, CFM and GEnx orders, partially offset by strong GE90 and LEAP orders. $1.8 billion of new commercial engine orders included $478 million from LEAP, a $186 million in orders for CFM, $577 million orders for GEnx and $326 million in orders for GE90. Military equipment orders of $360 million were up 2%, driven by another large T700 order for 306 units.

Bornstein adds, “our estimate is we’ll ship something close to 500 million — 500 LEAP engines next year.”

Concluding a meeting with investors and analysts the GE CEO provided forecasts for 2017, “we see EPS of a $1.60 to $1.70; operating cash flow of $16 billion to $20 billion; and cash to investors of $19 billion to $21 billion in buyback and dividends.”

Nominations are open for the 1st Annual Industry Awards.

Featured image shows testing of the GEnX series engine that contains 3D printed parts.

Leave A Comment