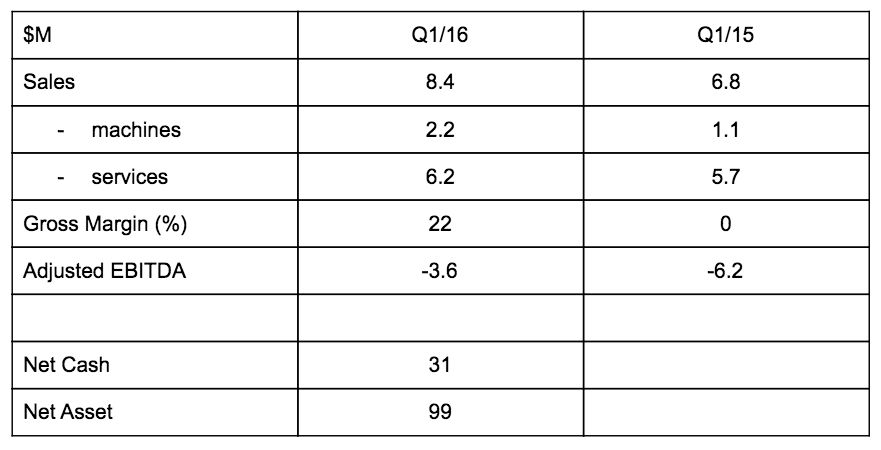

ExOne (XONE) reported mixed results in the first quarter of 2016. Year on year net sales increased by over 20%, but gross margin remain still not good enough at 22%. The management is working to reduce the cost structure. These efforts were insufficient in the period under review. EBITDA remain significantly negative at -$3.6M.

Still a long way to go before profitability

ExOne will need to grow significantly its revenues over the next years to become profitable. In the meantime competition is becoming more aggressive. The company has a high cost structure (over $20M run rate on Selling, Admin and General costs). It’s not clear at this moment if the management will push further down on cost reduction.

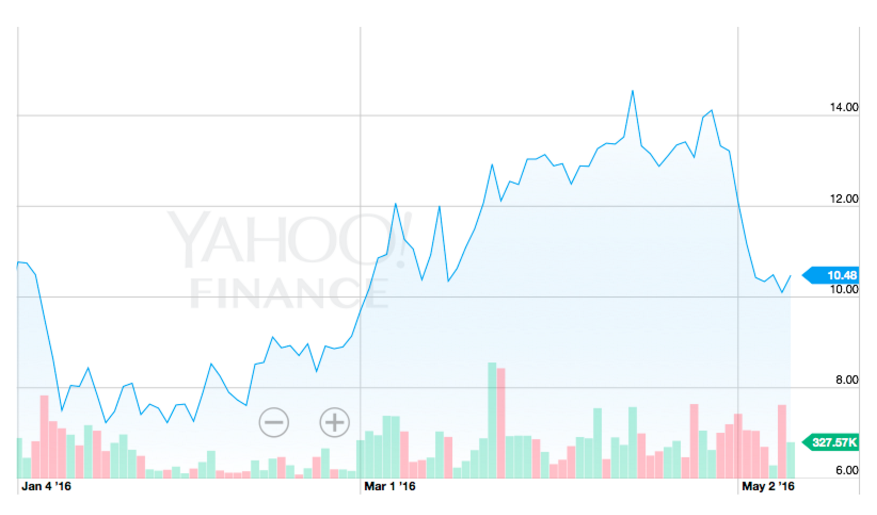

The CEO and main shareholder is showing good support to the company. He acquired 1.4M shares in the first quarter at a price of $9 per share. The cash injection combined with a tight control on the cash flow helped the company increasing its net cash during the first three months of 2016 by $12M, from $19M at end 2015 to $31M.

Based on 16M shares outstanding at end March 2016, the current market capitalisation is $170M, giving a market valuation for the company of $140M. This might seem high in light of the loss expected by the company over the next 3 years.

Key financial data:

Leave A Comment