Closing the first round of series D funding, Carbon, the company behind high-speed Continuous Liquid Interface Production (CLIP) 3D printing, has raised a total of $200 million.

Estimates now place the valuation of Carbon at $1.7 billion – creating the second 3D printing unicorn of 2017.

The money has been contributed by a number of strategic investors including Hydra Ventures (the corporate capital fund backed by adidas) and GE Ventures.

Expanding additive for end use production

As discussed in our interview with Carbon CEO and co-founder Joe DeSimone, the company’s goal is “to change the way people design, engineer, make and deliver the product to the customer.” He adds,

“Carbon is really focused on production, and I think we’re uniquely positioned in that regard.”

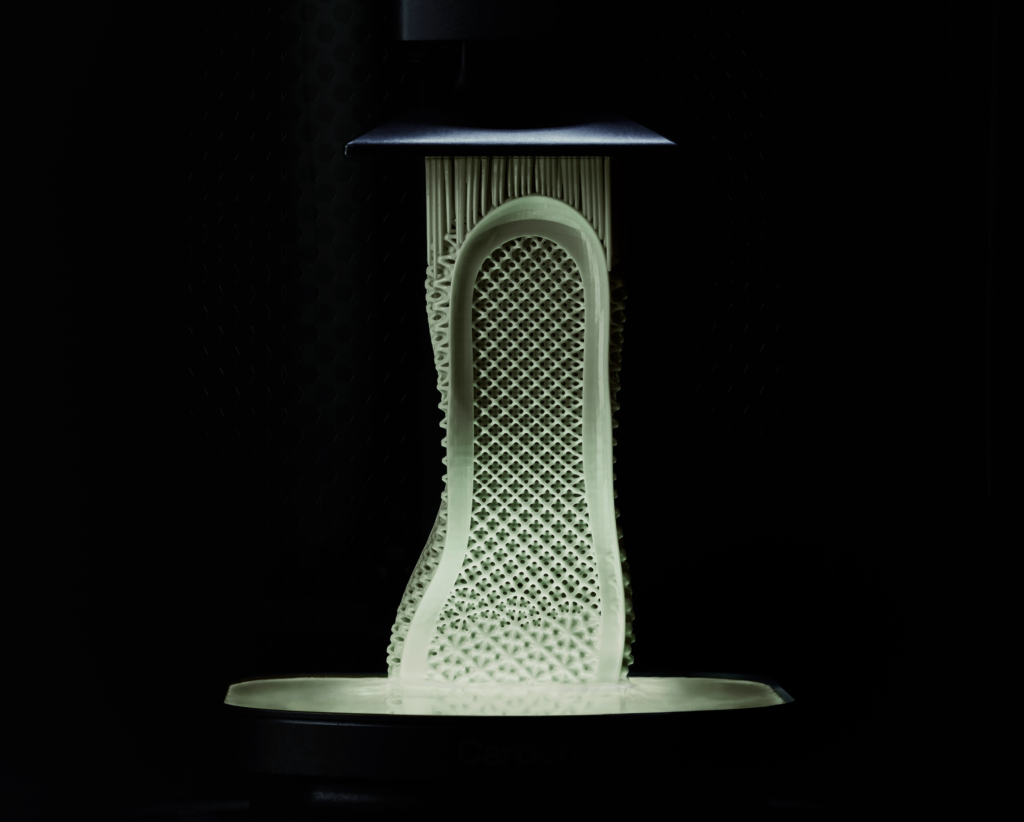

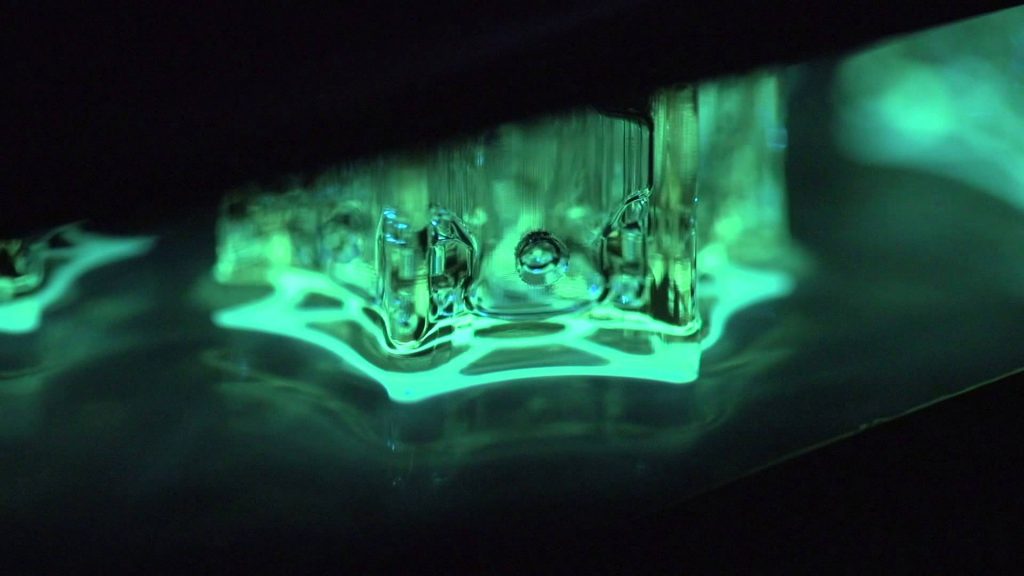

This year, Carbon has been ramping up its efforts to achieve additive manufacturing at scale. At the start of the year the company announced the high profile Futurecraft 4D sneaker project with adidas, and later it launched the SpeedCell system as a all-in-one industrial post processing solution.

Funds from this round will reportedly be used to “fast-track” the company’s “product roadmap.” This includes further integration with cloud-based product lifecycle management solutions, cemented by a partnership with Oracle Cloud. 3D scanning, sensor and simulation technologies will also find further use with CLIP and, according to DeSimone, Carbon will be looking toward the production of personalized products “that have been previously impossible to produce.”

Global expansion

Carbon has also set its sights on a global expansion. Investment partner JSR Corporation, a chemicals company headquartered in Tokyo, has been helping Carbon reach Japan and the Asia Pacific region. “We believe Carbon’s digital light synthesis technology will play a crucial role in transforming manufacturing in multiple industrial sectors,” comments Nobu Koshiba, President of JSR, “We are looking forward to continuing this momentum together.”

Other investors in this round include America’s Fidelity Management & Research Company, Hong Kong’s ARCHINA Capital, Emerson Elemental and Scottish investment company Baillie Gifford. Peter Singlehurst, Investment Manager at Baillie Gifford, says, “Carbon is delivering on the long standing but elusive promise of 3D manufacturing at scale,”

“Coupled with an innovative business model and a first-class team, we believe that Carbon has the makings of a large, valuable, and important business.”

Subscribe to the Industry newsletter, like us Facebook and follow us on Twitter to stay up to date with all the latest business news.

Nominate 3D printing company of the year and more in the second annual Industry Awards.

Featured image shows Carbon co-founder and CEO Joe DeSimone presenting CLIP 3D printing in an introductory TED Talk. Photo by Bret Hartman/TED

Leave A Comment