Australian metal 3D printer manufacturer Aurora Labs (ASX: A3D) has closed a AU$5 million (US$3.5 million) share placement round.

Managed by capital market company Blue Ocean Equities Pty Limited the 13,157,895 shares comprise approximately 17.5% of Aurora’s issued share capital, and introduces new investors to the company.

Last year the company previously raised AU$8 million (US$6.3 million) for the commercialization of its Large Format Technology (LFT). The latest funding will be used as working capital, and to further develop LFT Rapid Manufacturing Technology (RMT).

Aurora Rapid Manufacturing Technology

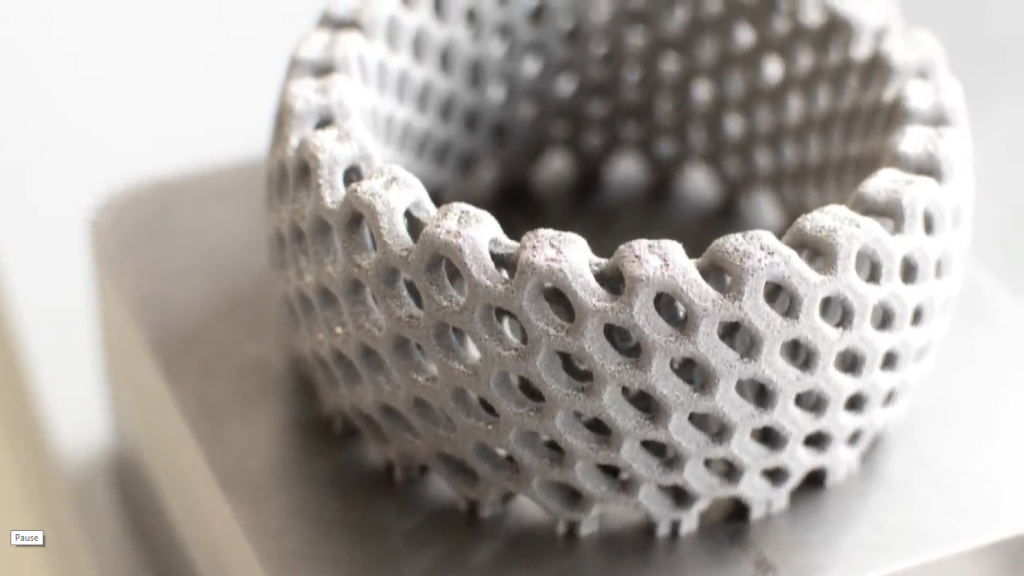

Metal 3D printing at Aurora Labs is a combination of Direct Metal Laser Sintering (DMLS) and Direct Metal Laser Melting (DMLM). Currently, the company has one 3D printer ready to market which is the “Medium Format” (MFT) S-TITANIUM PRO.

The RMP1 is the next machine in the pipeline for Aurora, and should already be rolling out to beta customers. Using the company’s RMT process, the RMP1 anticipates a high speed production rate of 30 kilos per hour. It is an early LFT demonstrator for the company, with the bed measuring 450 mm in diameter by 450 mm high, and a predecessor of the company’s Alpha 1, which is targeting a print rate of 1000 kg per day.

As explained by Nathan Henry, Director of Marketing and Business Development at Aurora Labs, “The Alpha 3D printer, which we’re calling the RMT, is not necessarily the successor the S-Titanium Pro. This is being developed with a focus on addressing the need to make things at a speed that makes it economic […]”

“RMT is currently very high volume but the speed at which it prints [662g/h or 15.88 kg per day], for us it’s still too slow,”

“Where expecting to at least double that speed in our smaller machine which is going to be the RMP1 and that is going to be 450 in diameter with a 450 bed. This will produce around 30 kilos an hour. “

In the latest corporate update from Aurora, the company announced that RMT systems, would be commercially available in 2019 and that it will have planned its large format version of the system measuring 2.5 m x 1.5 m x 1 m.

A solid endorsement for Aurora Labs

As lead manager of Aurora’s latest Placement Blue Ocean Equities Pty Limited is entitled to 5% of the proceeds, and will be issued with 367,107 unquoted options upon settlement of the placement. The company commenced trading of the shares on the ASX on February 11, 2018, and is expecting a settlement on February 14. The expected dated of quotation of Placement Shares on the ASX is February 15.

David Budge, Managing Director of Aurora Labs, states:

“The strong support of new institutional and sophisticated investors in this capital raising is a solid endorsement of our company,”

Also, Budge adds, it “places Aurora in a stronger position to deliver on the exciting developments with Aurora’s Rapid Manufacturing Technology (“RMT”) and accelerate the growth of its business over the year ahead.”

Is Aurora Labs your Metal 3D Printer OEM of the Year? Nominate them and more now for the 2019 Industry Awards.

For more of the latest 3D printing business news follow us on Twitter, like us on Facebook and subscribe to our newsletter.

Featured image shows a Rhoms Ball 3D printed by S Titanium Pro 316L. Photo via Aurora Labs.

Leave A Comment