Gary Anderson, 3DPI’s newest regular contributor, backs up his latest 3D printing stock prediction as Sigma Labs’ share price stands at .075 and with a market cap of a mere $43M.

Now that raised some eyebrows, I’m sure, but I base my prediction on three things: fundamentals, technicals and the expected commercialization of a product that meets a need in metals additive manufacturing today. The title wasn’t written just to get attention. I wrote it because I believe it will outperform based on the research I’ve done, and I look forward to checking back in March of next year to see if I’m correct.

Most investors haven’t heard of Sigma Labs, but I’ve been an investor in the company since the first week of June, just after Greg Morris, (GE Aviation’s business development leader for additive manufacturing), had the following to say about Sigma Labs in a press release by GE Aviation:

“Today, post-build inspection procedures account for as much as 25 percent of the time required to produce an additively manufactured engine component,” said Greg Morris, GE Aviation’s business development leader for additive manufacturing. “By conducting those inspection procedures while the component is being built, GE Aviation and Sigma Labs will expedite production rates for GE’s additive manufactured engine components like the LEAP fuel nozzle.”

Sigma Labs has patented technology on a hardware and software system for real-time quality inspection during 3D printing called PrintRite3D. You can read all about PrintRite3D, the work Sigma is doing with GE Aviation, their patents, and plans for commercialization in this PDF right here.

Further evidence that Sigma Labs is on to something in the additive manufacturing space is its invitation by industry leaders to participate as panelists at the upcoming 2013 Aerospace/Additive Conference in Los Angeles, next month.

The company has also signed a recent Memorandum of Understanding with Los Alamos National Labratory, an institution familiar to those for whom additive manufacturing is nothing new, and where some of the earliest breakthroughs in what we now more commonly call “3D printing” came from.

These are indications that despite the trading price and tiny market cap, I believe Sigma Labs is known a great deal more by the additive manufacturing industrial leaders than it is 3D printing investors.

I believe there are three drivers for Sigma Labs that could now increase share price dramatically over the next 3-6 months: Fundamentals, technical indicators, and several “irons in the fire” for further development and commercialization of PrintRite 3D.

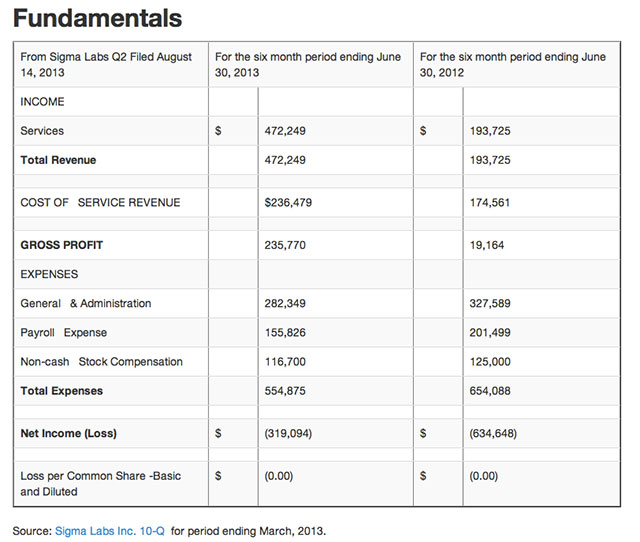

Revenue from the consultancy side of Sigma Labs services rose from under $200,000 to $472,000 for the first six months of this year as compared with last year. In Q2 alone, Sigma Labs reported just over $308,000 in revenue and a net loss of just $320,000.

For the sake of comparison, this is nearly 3X revenues of 3D bio-printing R&D company, Organovo Holdings (ONVO), which reported $120,000 in revenue and a loss of $3.8M for the same period. Organovo also has a market cap of $450M vs. Sigma Labs $43M. While they’re obviously in very different niche areas of 3D printing R&D, they are both considered 3D printing companies and the comparison, I believe, is fair.

The company is almost breaking even here, and should they successfully launch PrintRite3D next year, the potential for Sigma Labs to become profitable could be within reach.

Technical Indicators

Sigma Labs has traded with a series of higher lows and higher highs over the last month, and has outperformed established “big boys”, namely, 3D Systems, ExOne, Stratasys, Organovo, and even Arcam AB.

I believe the share price uptrend and comparative performance vs. more established players will continue as Sigma Labs gets closer to expected commercialization of PrintRigt3D.

There are some who say technical indicators are not as reliable in microcaps, but Sigma Labs has shown a propensity to bounce off key moving averages like the 100 day moving average in the first week of August and is steadily riding the 50 day moving average up. The parabolic move in late July and resulting high volatility curve has been replaced with a more gradual volatility curve that I personally favour as an investor.

“Irons In The Fire”

One of the strongest drivers of share price is the launch of a new product or service. This is an essential part of William J. O’Neil’s ”CAN-SLIM” stock valuation method that I often use, and wrote about using 3D Systems as an example previously. My conclusion (in May) was that 3D Systems would continue to increase in share price and I’m happy to report as a DDD shareholder that it is nearing all-time highs even as I write now.

With the success GE Aviation has reported using Sigma Labs’ beta test of PrintRite3D and the potential for new product development with Los Alamos National Laboratory, there appears to be more than one path the company can take in the commercialization of PrintRite3D.

Another path to commercialization of PrintRite3D could be through their talks with Burke E. Porter Machinery, a metals manufacturing company with a 50 year operating history, clients like GM, Volvo, Toyota, Ford, etc. and operations in the US, Belgium, Brazil, China, Germany, India, Japan and Korea.

Management also stated that they are: “In talks with two of the three largest 3D metals companies” as revealed during an investor conference. I have a copy of the transcript here for those interested. Under the non-disclosure agreement few people know where they stand in those talks now. However, I think it’s important to note that Sigma Labs also had a non-disclosure agreement with GE Aviation that did result in an official partnership for beta testing of PrintRite3D.

Conclusion

Sigma Labs is a development stage R&D microcap company with a potentially game-changing product launch that has received very positive results in beta testing with GE Aviation. Their balance sheet isn’t the usual wreck you find in this sized R&D company, and they appear to have forged several paths towards potential commercialization of their lead product, PrintRite3D. There are a few “penny stocks” in 3D printing that I wouldn’t touch with a 50 foot pole – I won’t even mention them in this article. But I believe, based on the positive results reported by GE Aviation in beta testing, and their history of NDAs and MoUs actually resulting in something, this little company will in fact outperform its big brothers in 3D printing between now and the end of Q1, 2014.

Disclaimer: I am not making a recommendation to buy, sell, or hold shares of Sigma Labs. While I see a great deal of potential in the company over the next 3-6 months and beyond, it is a “penny stock” and as such has additional risks for investors.

Disclosure: I am long shares of Sigma Labs Inc. I have not been paid by Sigma Labs or any third party for this or any article found on 3DPrintingStocks.com or 3dprintingindustry.com.

Leave A Comment