In the additive manufacturing industry, publication of the Wohlers Report is long-standing fixture marked on the calendars of manufacturers, commentators and analysts alike.

Industry asked Terry Wohlers, principal author and president of Wohlers Associates, about some of the dominant trends and surprises while preparing the Wohlers Report 2017. In this article Terry Wohlers also gives more information about the underlying reasons behind the headline trends.

The largest survey of the additive manufacturing industry

Now in it’s 22nd year of consecutive publication, the Wohlers Report is produced with information, “collected from 100 service providers, 61 industrial system manufacturers, and 19 producers of third-party materials and low-cost desktop 3D printers.”

To produce the report, Wohlers Associates worked with a report development team of 76 individuals and organizations in 31 countries. Ian Campbell, Olaf Diegel, and Joseph Kowen, associate consultants and principal authors, were a vital part of the team who produced the report. “It would not have been possible to produce it without them,” said Terry Wohlers.

Double-digit additive manufacturing growth

According the Wohlers Report 2017, the Additive Manufacturing industry, “grew by 17.4% in worldwide revenues in 2016, down from 25.9% the year before.” We asked Wohlers for the underlying reasons for this year-on-year decline in growth rate, he told us,

The single biggest contributing factor to declined industry-wide growth was weak performance by the two largest companies in the business. They represented $1.31 billion (21.7%) of the $6.063 billion AM industry in 2016.

The Wohlers Report 2017 records that 97 manufacturers produced and sold Additive Manufacturing systems in 2016. In 2015 this figure was 62 and only 49 in 2014. With new market entrants, competition in the 3D printing industry is increasing. The Wohlers Report describes levels of competition as, “unprecedented.”

An ongoing shift in the market

Wohlers also notes that, “This wave of development and commercialization is putting pressure on the established producers of AM systems.” This is clearly evident in our regular conversations with those across the 3D printing industry, furthermore there has been a perceptible shift in the tone of marketing communications during the first quarter of 2017.

We asked Wohlers whether there were any surprises for him or the team during preparation of this years report. One particular surprise was, “the growing number of American manufacturers of industrial AM systems. They grew from five in March 2013 to 20 in March 2017,” said Wohlers.

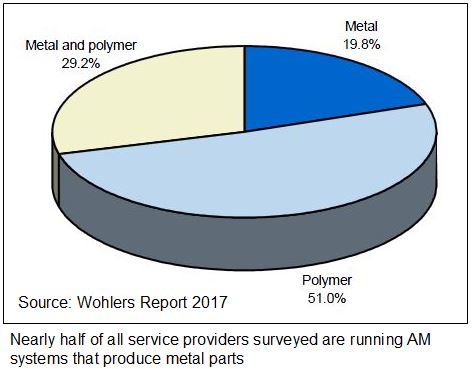

Regarding the dominant trends seen during the preparation of the Wolhers Report 2017, he says, “Another trend is the growth of metal powder sales, which grew by more than 2.5 times over the past two years (2015 to 2017).”

Metal powder competition to intensify

It’s more than likely that those in the metal powders market have read past editions of the Wohlers Report and are acting on this information. As Industry has noted, several challengers to the primary metal powder for AM supplier are preparing to enter the market in earnest.

These providers of metal powder for additive manufacturing include Arconic, Pyrogenesis and Metalysis. Each company is at a different stage of development and later entrants may find it difficult to establish a foothold in market. Particularly because metal AM manufacturers, at least those who have the capacity to do so, often prefer to restrict a machine to a single type of metal powder.

For more information, and to order the Wohlers Report 2017 use this link.

To stay up to date with all the latest Industry news, click this link to receive our free newsletter and follow our active social media accounts.

Also, our readers have nominated the additive manufacturing enterprises and technologies they consider the more important. You can vote now in the Industry Awards, or let us who else should receive an award here.

Leave A Comment