Founded in 2013, Seattle’s MatterFab had a promising pitch – a low-cost 3D metal printer.

After hearing about GE’s use of additive manufacturing Matt Burris and Dave Warren were inspired to try their hand at building a 3D printer. Initially ordering components from ebay the duo began constructing what they intended to be a laser based powder bed fusion 3D printer.

A year after founding MatterFab Burris and Warren’s company caught the attention of the media – investors would soon follow. An initial seed investment from patent attorney Jeff Schox in September 2014 was followed by much larger sum less than 6 months later.

MatterFab received $7.48M in February 2015 and an additional $5.75M in May of that year, making the startup one of the most funded new enterprises in the 3D printing industry. Investors included GE and Autodesk.

By July 2015 MatterFab had answered the call of America Makes and was included in a GE Research led team focusing on development of metal powder bed fusion AM.

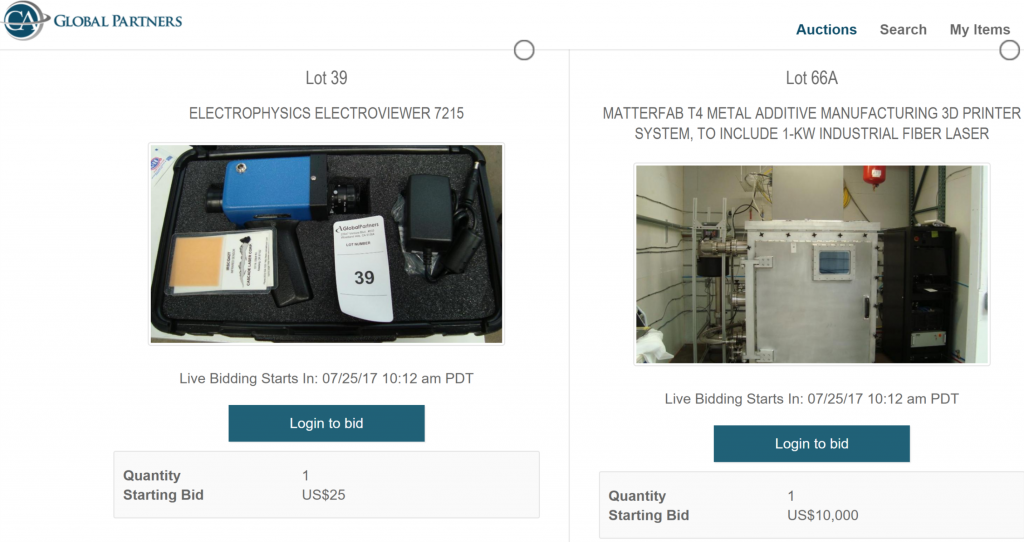

Assets up for auction

The project has come to an end with the MatterFab T4 metal additive manufacturing system now labelled as lot 66A in an auction selling of what remains of the company’s assets.

Josh Ewing, a director in Corporate Development at Autodesk explains, “We believed in MatterFab’s approach and vision, but unfortunately it didn’t succeed in the marketplace.”

Dave Warren – co-founder and former CTO – left MatterFab in March 2016 to become Project Manager at a Stealth Drone Startup. The other co-founder, Matt Burris, left MatterFab in October 2015. The explanation given was that the investors wanted a more experienced management team to lead the business.

That team included Matt Paterson, the CTO brought in to replace Warren. Patterson left MatterFab in March 2017 and is now working on a new project – currently in stealth mode. Patterson declined to comment for this article, as did Lauren Formicola, MatterFab’s VP of Business Operations, Marketing, and Communications.

Spending half a million a month

While a number of other MatterFab employees give their LinkedIn status as currently seeking new opportunities, and have March 2017 as the end date of service at the company – a question remains. What happened to the money?

With over $13 million raised since Feburary 2015, MatterFab appear to have burned through over half a million a month.

In the bigger scheme of things and for investors with deep pockets, these figures may be immaterial. Autodesk’s Josh Ewing notes,

“We’ve made several start-up investments in this space and we continue to identify other investment opportunities where we can support furthering significant improvements in the industry. This is what venture investing is all about. You make bets on promising technologies, some succeed, some do not.”

Furthermore, with GE’s purchase of established metal AM enterprises – Concept Laser and Arcam – and plans to launch the world’s largest metal 3D printer – the ATLAS – a desire to develop the T4 may have faded.

It looks like little of the $13 million will be recouped from the fire sale of office furniture and fittings. Yesterday’s auction closed with limited enthusiasm and lot 66A – with an asking price of $10,000 – remained unsold.

Back to the future?

2014 was considered by many as a high-water mark in terms of market exuberance. Spiking share prices spurred by the potential of 3D printing were followed by an inevitable fall as investors began to unpack the facts behind 3D printing at the touch of a button.

While not reaching the same heights yet, 2017 has brought some remarkable investment news.

Desktop Metal recently attained unicorn status when the private company passed the $1 billion mark in terms of valuation. Stock prices in leading 3D printing enterprises Stratasys and 3D Systems are both performing well, with 25% and 24% year-on-year gains respectively.

With 3D printing earnings season about to begin in earnest, we’ll be watching closely to see if history is repeating or whether this time the exuberance is rational.

For all the latest 3D printing news and insight, subscribe to our free newsletter from the leading source of news about the 3D printing industry. Also, follow us on Twitter to make sure you’re first with developments in the additive manufacturing industry.

Leave A Comment