Additive manufacturing service provider and software developer Materialise (NASDAQ:MTLS) has announced financial results for the first quarter of 2019.

For the three months ended March 31, 2019, the company reports year on year revenue increase of 7.3%, up from €43.6 million in Q1 2018 to €47.1 million in Q1 2019. Good performance across all business segments has been cited for this growth. Executive Chairman Peter Leys comments, “Materialise Software and Materialise Medical, which continue to invest in both sales and marketing and research and development, combined healthy double-digit revenue growth rates with solid double-digit EBITDA margins.”

“In spite of the continuing macro-economic uncertainties,” Leys continues, “in particular in the automotive sector, Materialise Manufacturing also realized growth, both in terms of revenue and, more significantly, in terms of EBITDA. We believe we are on track to meet our financial guidance for 2019.”

In the investor call for Q1 2019’s earnings, the company honed in on their strengths in the medical sector, and spoke to the challenges faced in automotive, as well as Europe in general.

Materialise Q1 2019 revenue by segment

By business segment, Materialise Medical experienced the strongest growth compared to the same period last year. For Q1 2019 the Medical reported a revenue of €13.6 million, up 13.6% on Q1 2018 which was €11.9 million.

Following this in terms of growth is the Materialise Software segment. For Q1 2019 Materialise Software reported a 12.3% revenue growth to €9.35 million compared to €8.3 million in Q1 2018.

And finally, Materialise Manufacturing experienced a 2.3% revenue rise in Q1 2019 to €24.2 million, from €23.6 million in Q1 2018.

| Revenues | Q1 FY2019 | Q1 FY2018 | Variance € millions | % |

| Materialise Software | 9,350 | 8,326 | 1,024 | 12.30% |

| Materialise Medical | 13,566 | 11,946 | 1,620 | 13.56% |

| Materialsie Manufacturing | 24,184 | 23,632 | 552 | 2.34% |

| Unallocated | 15 | -5 | – | – |

| Total segments | 47,115 | 43,899 | 3,196 | 7.33% |

Net loss for Q1 2019 was €304 million, equating to -€0.01 EUR per diluted share. In Q1 2018, the company previously reported a net loss of €183 million, rounded to 0.00 per diluted share.

Total deferred revenue from annual software sales and maintenance contracts was €24.9 million at the end of Q1 2019, an increase of €2.3 million from €22.6 million at the end of 2018.

International renown for Materialise Medical and automotive challenges

Highlighting the company’s success in the healthcare sector on the investor call Fried Vancraen, CEO of Materialise, referenced achievements in creating patient specific medical devices. As a result of this expertise, Materialise’ 510(k) clearance for the Mimics Medical software was also renewed in Q1 2019. Cleared across the U.S., EU, Japan and Korea, the Mimics Suite has developed international acclaim which is, according to Vancraen, “illustrated by the fact that it is currently referenced as the tool used in more than 13,500 scientific publications.”

“This number can be objectively obtained from Google Scholar search and it is three times higher than the closest competing software,” he adds.

Expanding its software capabilities, the company has developed a specialist planning tool for heart mitral valve replacement that is currently awaiting 510(k) clearance. It has also advanced efforts in medical imaging through investment in Fluidda, a Begian company that specializes in imaging for the respiratory system.

Also on the call, Vancraen commented on regional performance “I think while the U.S. economy is doing very well at this moment we are facing a much lower situation in Europe.” Internationally, there are also current challenges within the automotive industry. “There are a lot of programs as far as we know on hold, both for the economic situation and the interactions with China and so on,” comments Vancraen, adding that there is a “also a (ph) change because of new regulatory situation especially related to the fuel engines […]”

“[…] this is really impacting our sales at this moment. But in the other sectors, I must say that we face not an very exciting climate but a stable climate […]”

Materialise guidance for full year 2019, the company is expecting a consolidated revenue between €196 million and €204 million. The deferred revenue for annual software licenses and maintenance is also expected to increase by between €2 million and €4 million compared to the €22.6 million reported at the end of 2018.

Ending guidance commence, the company states, “Reflecting the usual seasonality of the company’s business, Materialise expects its financial performance to be weighted towards the second half of 2019.”

Materialise’s full financial results for the first quarter of 2019 can be found online here.

For more of the latest 3D printing financial results subscribe to the Industry newsletter, follow us on Twitter and like us on Facebook. Seeking jobs in engineering? Make your profile on Jobs, or advertise to find experts in your area.

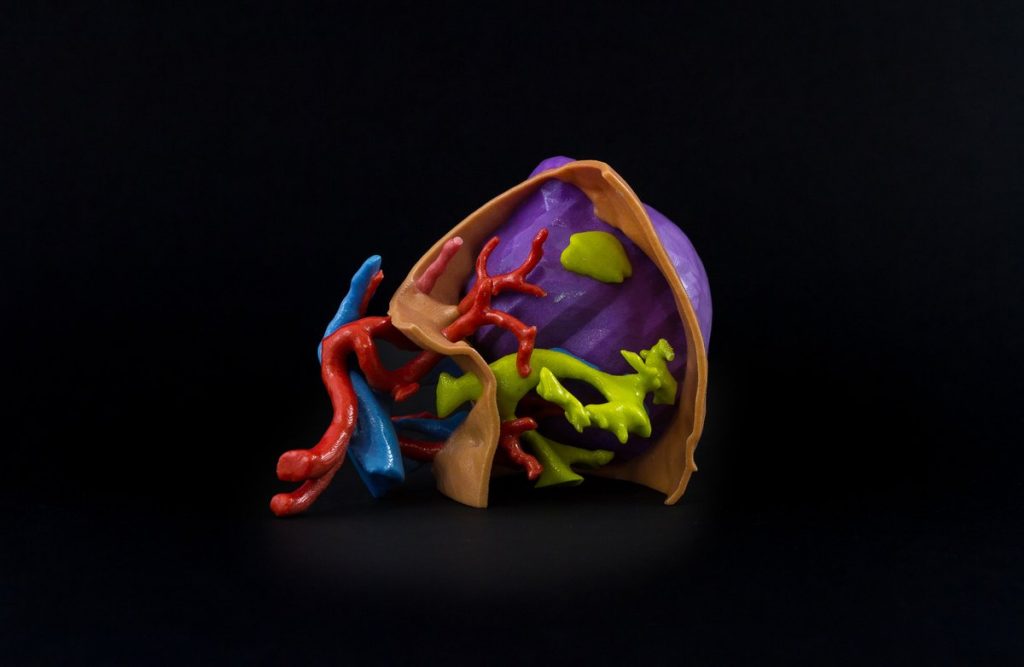

Featured image shows an example of a 3D printed titanium maxillofacial implant designed by Materialise, distributed by DePuy Synthes. Image via Materialise NV on Twitter

Leave A Comment