It’s like déjà vu all over again! Earlier this year, when Stratasys announced that their 2014 and this year’s Q1 financials had not met their projections, recent investors took to the courtroom, claiming that the company had concealed information about the business to inflate Stratasys stock. Stratasys wasn’t alone in disappointing earnings and it turns out that they’re not alone in being sued by angry investors. Scott+Scott, Attorneys at Law, LLP has filed a class action complaint on behalf of all who purchased (or otherwise acquired) 3D Systems stock between October 29, 2013 and October 22, 2014.

In this case, the lawsuit is quite similar, claiming that 3DS violated the Exchange Act, specifically Rule §§10b-5 and 20(a). The Securities Exchange Act of 1934 saw the creation of the SEC and, according to Cornell University Law School Legal Information Institute, “is designed to force companies to make public information that investors would find pertinent to making investment decision.” According to a Scott+Scott press release, the complaint argues that 3D Systems drove up their stock through the use of false and misleading statements, specifically in relation to 3DS’ “(i) ability to increase the capacity of its metal printing business; (ii) demand for its consumer products; (iii) the value of multiple companies it was acquiring; and (iv) expected earnings.” Then, on October 22, 2014, the suit claims, 3D Systems released weak Q3 results, followed by a drop in their 2014 revenue predictions, which resulted in a big drop in the price of DDD stocks.

The complaint filed (.PDF) is a pretty juicy one, if you’re into dry legal documents. The document quotes what the plaintiffs consider “false and misleading” statements made by 3D Systems during the above Class Period, before bringing individual defendants CEO Avi Reichental and EVP of Mergers & Acquisitions Damon J. Gregoire into the suit, as well. The suit also claims that the inflated stock prices allowed the Defendants to make profits off of the sale of their stocks:

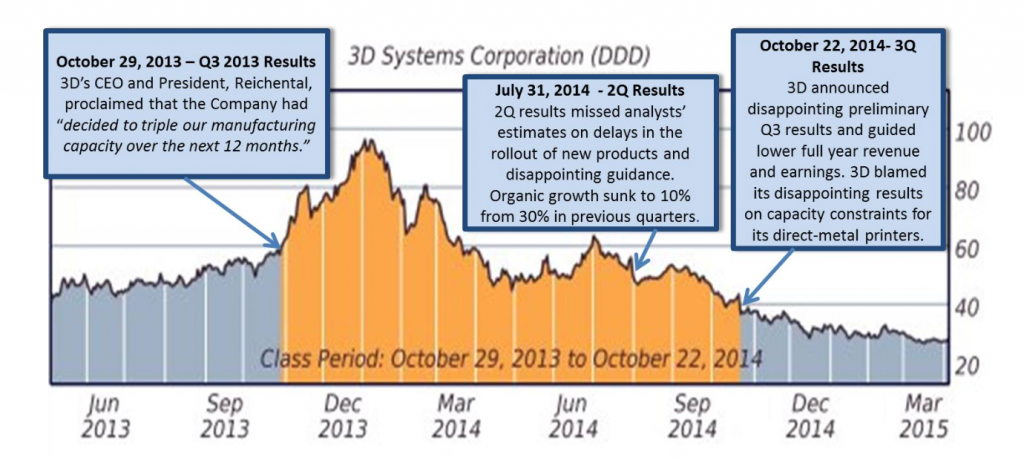

For example, on October 29, 2013, 3D’s CEO and President, Defendant Reichental, proclaimed that the Company had “decided to triple our manufacturing capacity over the next 12 months, as well as accelerate the development of additional direct metal 3D printer models.” Defendant Reichental also touted the strategic value of the Company’s recent acquisitions. In addition, on February 28, 2014, Reichental also represented that “our plan is [to] quadruple [direct metal printing] sales over the next 12 to 18 months.”

However, contrary to Defendants’ positive statements concerning the Company’s growth, Defendants had no basis to represent that the Company would be able to triple its metal printing capacity and/or quadruple direct metal printing sales.

Specifically, as was later disclosed, many of the Company’s acquisitions were not strategically acquired in an effort to boost revenue through acquisition and would require significant additional investment to integrate into 3D.

3D’s inflated share price allowed Defendants to receive over-sized profits from the sale of 3D stock. For example, on May 29, 2014, 3D offered 5,950,000 shares of its stock, netting approximately $300 million. Similarly, the Individual Defendants sold approximately $4.5 million in 3D stock during the Class Period. 3D could not conceal its serious problems indefinitely. On July 31, 2014, 3D issued its second quarter results whereby the Company missed analysts’ expectations and reported revenue of $151.5 million on delays in the rollout of new products and disappointing guidance. On this news, the Company’s share price fell nearly 11%. The truth was finally revealed on October 22, 2014, when the Company surprised the market when by announcing disappointing preliminary Q3 results and guided lower full year revenue and earnings. In a press release, the Company blamed its disappointing results on capacity constraints for its direct metal printers. On this news, 3D shares plummeted over 15% on high volume.

The language ventures from boring legalese to the dramatic (including a section titled “The Truth Finally Emerges”) and even almost religious in nature (the document concludes with a section titled “PRAYER FOR RELIEF”, which is probably just more legalese somehow).

If you bought DDD stock during the above time period, you have a chance to be a part of this fun legal circus and must enter into the suit by August 11, 2015. And if you want to be the lead plaintiff through the counsel of your choice, feel free to step right up. To join in, contact Scott+Scott via the web at [email protected], or over the phone at (800) 404-7770 or (860) 537-5537. And, most importantly, remember to have fun!

Leave A Comment