This is part five in a six-part series covering 3D printing developments in Taiwan. For the other parts in the series, find parts one, two, three, four, and six here.

It may be a surprising fact that the manufacturer that sold the most consumer 3D printers last year wasn’t MakerBot, out of the US, or even Ultimaker, from Europe. No, the manufacturer that sold the most came from Taiwan. As 3D Systems and MakerBot straddled the exhibition floor of CES 2014 with massive booths, a newcomer called XYZprinting had its own sizable booth to unveil the original da Vinci 1.0 3D printer. And, in just two years, the subsidiary of Taiwan’s New Kinpo Group would sell 25% of the total 3D printers sold in 2015, making up the lion’s share of the pie, according to market research firm Canalys. How’d they do it? Well, their printers are among the lowest priced on the market, but, more importantly, the subsidiary’s CEO, Simon Shen, saw the tremendous power an OEM mass manufacturer like New Kinpo Group could wield if, instead of producing goods for other companies, it started to make its own branded products.

When New Kinpo Group started, the manufacturer produced calculators for businesses like Texas Instruments, Gary Shu senior manager of global marketing, tells me and my wife, Danielle, as we tour the shining headquarters of XYZprinting in Taipei. Pointing to an ancient calculator, Shu says, “We manufactured our very first product in 1973, forty-two years ago. Slightly older than myself! We’re still making calculators. Probably more than 70% of the calculators in the world are manufactured by New Kinpo Group.”

The company then shifted from calculators to other handheld electronics. And, with the production of printing calculators, New Kinpo Group had moved from purely electronic devices to mechanical design. “And, then, our first big entry into mechanical devices was the fax machine,” Gary says. “Around 25 years ago, we started to manufacture our own brand of fax machines. Unfortunately, fax machines didn’t last very long in the world.”

While these clients would maintain the IP and supply the design specifications, it was New Kinpo Group’s job to fabricate the end product in massive quantities to be shipped all over the world at the lowest prices possible. “The fax machine may not have been a long-sustained product, but it did give us a step into mechanical devices so that we would have a chance to get a lot of OEM opportunities,” Gary says. As an OEM manufacturing service, the company may be one of the largest global manufacturers of 2D printers from major printer brands. “That’s just the beginning of our 3D printing story,” he adds.

This led to the installation of massive factories in China, Thailand, even Brazil and Mexico. With these plants, New Kinpo Group is among the largest manufacturers of set-top boxes in the world. And they were still making goods for other businesses when the new wave of desktop printing hit in 2012. Most of the major 2D printer makers were still observing the progress of the 3D printing market, when New Kinpo Group decided to jump in with their own branded 3D printers. “So, for forty-two years, we were doing OEM manufacturing services, but, with 3D printing, we started getting into branded products,” Gary says.

When they did, they were able to leverage their experience as mass producers every step of the way. With their own manufacturing capabilities and supply chain connections, plus their mechanical engineering experience, the company was able to introduce some of the lowest priced systems on the market. And quickly, within a year of the da Vinci’s release, there was the da Vinci Duo, followed by the AiO all-in-one scanner and printer, the da Vinci 1.1, and the Nobel SL 3D printer. And, when they received enough feedback about their proprietary filament cartridge system, they put out the da Vinci Pro as a test for how well their open filament system would do on the market.

Other, newer printers that have been unveiled in prototype form, but have yet to hit the market commercially include the da Vinci Jr. 3-in-1, which has built in 3D scanning and the ability to switch out its printhead module for a laser engraver, and the 3D Jet, which uses inkjet technology to print layer thicknesses as fine as 13 microns.

“We showed this at CES last year,” Shu says. “Now, we’re working on commercializing it and bring it to market. We’re trying to spread out the spectrum of our products, make different products for different sectors, some things cheaper and some things more expensive. Making cheaper products is not a problem; that is a strength for us. But we are less mature in technology development, and we are still catching up.” From the looks of their CES show this year, I would say that Shu was being modest. At the event, they are currently displaying eight new printers, new software, and non-3D printing products.

Last year, international audiences were taken by the company’s food 3D printer, capable of extruding food pastes, like cookie and pizza dough, into pre-determined shapes. The issue with such a niche technology, however, is understanding the user behavior that would guide it.

To gain a better grasp on the market for food printers, XYZ has been shipping to Taiwan and China, where they have better market accessibility, before adding new features, such as an internal oven, or manufacturing in large numbers to ship to the US and Europe. After all, who wants to print pizza dough when they can head to the grocery store and pick up something they can heat up in the oven? That’s the sort of question that XYZ is seeking to answer. Still, the machine draws huge crowds at XYZ marketing events and, to this day, “food printing” is the number one search term that brings visitors to Industry.

Much of this product development comes from Shen’s push for branded products. Gary says, “After the success of XYZ for branded products, Simon asked the engineers, ‘Why don’t you come up with your branded products?’ We can’t infringe on any patents, so we can’t use any of our OEM partners’ designs. So, you have to use your own know-how.’ So, he got all of the departments – set-top boxes, storage devices, printers, calculators. They all have different know-how and lots of experience in OEM manufacturing services, so they came up with a lot of stuff. Most of these products are not fully mature, but they’re all new, niche products – even more niche than 3D printing, with lots of market unknowns.”

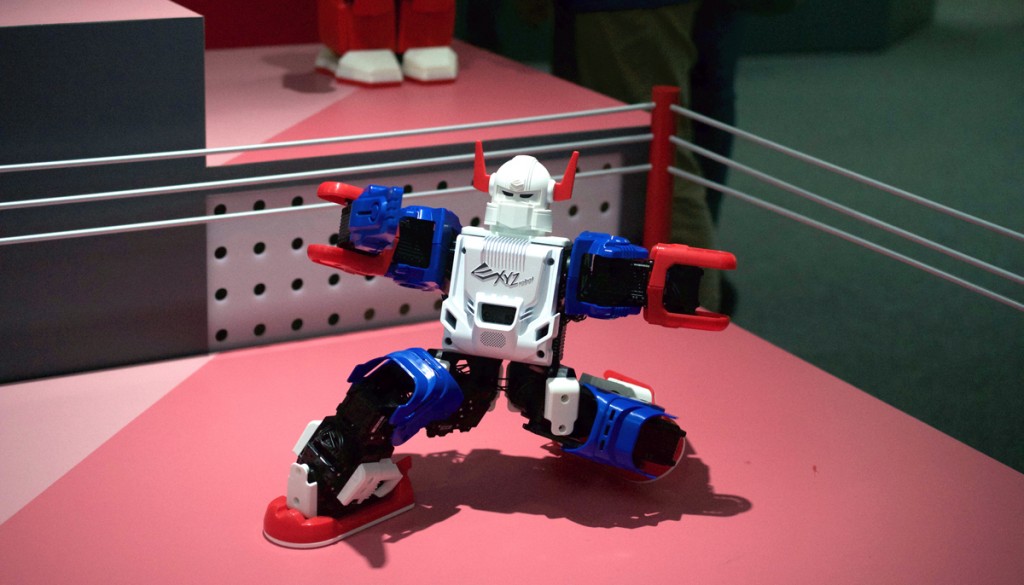

“That’s the trick of getting into branded products,” he continues. “If the sector is mature, then we have no chance and will have to step back and be an OEM manufacturing service.” So far, we haven’t seen many of these hit the market, but we’ve seen at least two of the products from these unique R&D activities become commercialized: the XYZrobot line, and the wearables from XYZlife.

In the XYZ showroom, there were many more XYZ-branded products that could also see the light of day in the future. Among them were home servers for local cloud computing, wireless phone chargers, home decor items, and service robots. XYZprinting’s Smart Service Robot are currently being used in a pilot program in a local Home Depot-style chain called B&Q. Even more exciting than these, however, were urban farming devices.

As a high-tech, niche product, XYZ is exploring the right market for their hydroponic systems. Some grocery stores in Taiwan have them installed and the company is looking into regions with less than ideal agricultural climates, like China and the Middle East, where they might be an alternative for growing fresh produce. But the company has also shrunken these machines into small, tabletop versions for the home. And, while the technology is ready for manufacturing, XYZ wants to understand the market for such a product, as well.

So far, however, 3D printing is the key technology for XYZprinting, and the da Vinci Jr. has opened them up to a far greater audience, as it is the lowest priced consumer system from an established brand on the market. The price, like many of the decisions made in the company, came from Shen, who sought to release the da Vinci Jr. at a cost that would be compelling to consumers, while anticipating the possibility of other low-cost systems entering the market.

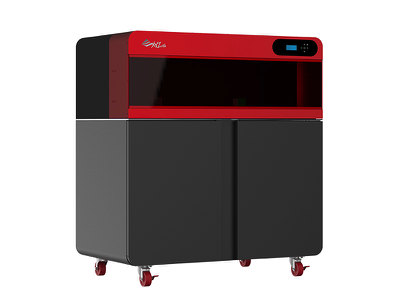

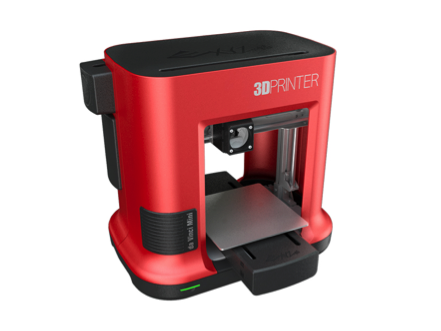

Now, the company is growing in as many directions as possible. In addition to finding the lowest price point in their printer line, they’re moving both up and out, expanding their desktop systems and even developing industrial machines. This direction explains their latest CES releases: the $269 da Vinci Mini, which is even more affordable than the da Vinci Jr. with built-in Wi-Fi; the da Vinci Junior 2.0 Mix, able to blend different colored filaments to produce new colors; and the 3PP0A, an attempt at affordable full-color 3D printing.

Also at CES, the company announced new FDM machines. “One and a half models are totally new. One is totally new: a brand new engine, brand new design,” Shu explains. “Another one is a big modification of a current model. One is a mixed-color printer that can accurately mix two different colors. Say you have red and yellow. You can have red, yellow, and orange in the same print. And they have an algorithm that works out the proper mixture for that. Still not a full-color printer, but it looks good. So, that’s one of our new technologies that we’ve spent the last year developing and we can probably commercialize it in a few months. Another FDM machine is, feature-wise, not that different, but it will be even cheaper than the Jr.” XYZprinting also showed off its new 3D modeling software, the company’s first, at CES. It is meant to be simple like TinkerCAD, so that just about anyone can begin 3D modeling for their low cost machines.

As the other major manufacturers, like Stratasys and 3D Systems, suffer from some PR issues, the time may be right for a company like XYZprinting to step in to recover their market share. Previously, New Kinpo Group has proven that it is capable of doing so when it comes to low-cost, desktop machines, but, as it expands into the industrial sector, will it be possible for them to leverage their 40-year history of manufacturing to undercut the competition? And with a growing library of niche, futuristic products, will they be able to spread out into other sectors, as well? If so, not only will the existing 3D printing leaders have to watch their backs, but so will all of the other businesses for which companies like XYZ have been performing OEM manufacturing these past 40 years.

Leave A Comment