Just over a week ago, a widely-circulated Barron’s article, Beware 3-D Printing!, (subscription required) suggests the best 3D printing investments now are those that are adding 3D printing software sales to their revenue mix. With a trailing PE of 16, record net income recently reported for 2013, and 3D printing software sales to begin this year, Cimatron is therefore a stock 3D printing investors should take a close look at as an investment in the space, in my opinion.

Overview/Share Structure

Cimatron develops and distributes CAD/CAM software for the manufacturing industry and is ranked among the top ten CAD/CAM suppliers in every global region. The company has subsidiaries in Asia, North America and Europe, and works with certified independent service providers in over 40 countries worldwide. Cimatron was founded in 1982 and is based in Israel.

CIMT has 9.3 million shares issued & outstanding, a healthy 35% institutional ownership level and a market capitalization of $83 million as of 11th March 2014.

Current Product Lines

CimatronE, an integrated CAD/CAM solution for toolmakers and manufacturers of discrete parts. (See CimatronE video)

GibbsCAM®, billed as “The CAM industry’s recognized ease-of-use leader, offers simple to use, yet extremely powerful, solutions for programming CNC (Computer Numerical Control) machine tools”.

Entering Software Sales

Cimatron brought industry expert Terry Wohlers onto their newly established 3D printing advisory board last year, and CEO Danny Haran stated at the time:

“The creation of a 3D printing advisory board, and Mr. Wohlers’ appointment to it, is aimed at accelerating Cimatron’s efforts in entering the additive and hybrid manufacturing field.”

Terry Wohlers added:

“Cimatron has long been a strong player in the CAD/CAM software market, and it is only natural for the company to leverage its knowledge of manufacturing software solutions by exploring opportunities in 3D printing.”

In the Q4/2013 conference call CEO Danny Haran states:

“2014 will mark our first release of software solutions for the Additive Manufacturing markets also know as 3D printing. CimatronE version 12 scheduled for release in mid-2014 will offer conformal cooling and AMF support, both directly targeted towards Additive Manufacturing. Additional work is also underway on providing additional Additive Manufacturing solutions.

As we expected, we keep discovering new uses and applications of our software in this exciting field. We believe Additive Manufacturing, both from metal and plastics will become a more significant part of our business in the coming years.”

Expected revenue expansion from 3D printing hasn’t gone unnoticed by Chardan Capital Markets either: “Chardan Capital Markets Starts Cimatron Ltd. (CIMT) at Buy; Foray Into 3D Could be ‘Game-Changer.”

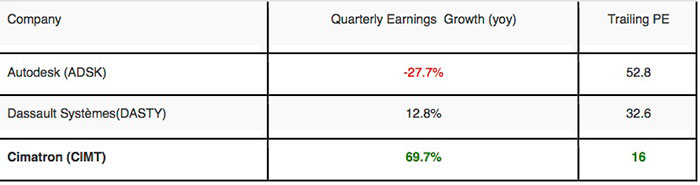

Cimatron EPS Growth and Trailing PE Compared To Other Software Stocks

Conclusion

The Barron’s article, Beware 3-D Printing! isn’t a swipe against all stocks in the 3D printing industry, only those with multiples that can not be supported in a reasonable market. Barron’s suggests “buying stocks of software companies that have something to do with 3D printing but which are diversified into other areas”, in this review.

With a history of sustained revenue and earnings growth, a trailing PE of 16 (using GAAP “real numbers” accounting, not “headline numbers” accounting), and revenue expansion expected to further increase with the launch of their 3D printing software suite this year, I believe Cimatron is one of the best investments in the 3D printing space at the present time.

Disclosure: I am long shares of CIMT

Leave A Comment