3D printing investors might want to keep a close eye on Cimatron Ltd. (CIMT). The company scores extremely well in a CAN SLIM forward growth projection and is entering the 3D printing software market this year. Cimatron reported the best Q3 in their 32 year history in November 2013, sports a trailing twelve month PE of 22 and has announced plans to enter the 3D printing space this year with industry leader Terry Wohlers on its 3D printing advisory board. If that wasn’t enough to get your attention, Cimatron registers as a CAN SLIM slugger that appears ready to power to new higher highs.

For those new to “CAN SLIM”, it’s the acronym of a screen for high growth stocks developed by William J. O’Neil, successful investor, entrepreneur and founder of Investor Business Daily. O’Neil began using his CAN-SLIM methodology in 1953, and the approach is generally regarded as one of the most effective screens for finding high growth stocks that will lead their sector and trade to higher highs. Great growth stocks share seven characteristics in the CAN SLIM screen and CIMT has them… in addition to 3D printing software sales coming online in 2014.

Overview/Share Structure

Cimatron develops and distributes CAD/CAM software for the manufacturing industry and is ranked among the top ten CAD/CAM suppliers in every global region. The company has subsidiaries in Asia, North America and Europe, and works with certified independent service providers in over 40 countries worldwide. Cimatron was founded in 1982 and is based in Israel.

CIMT has 9.3 million shares issued and outstanding and a market capitalization of $92 million as of 1/5/2014. Cimitron enjoys a healthy 36% institutional ownership and investors have enjoyed a dividend history with an annualized dividend yield of 4.6%.

Current Product Lines

- CimatronE, an integrated CAD/CAM solution for toolmakers and manufacturers of discrete parts:

GibbsCAM®, billed as “The CAM industry’s recognized ease-of-use leader, offers simple to use, yet extremely powerful, solutions for programming CNC (Computer Numerical Control) machine tools”:

CAN SLIM

- C stands for Current earnings. Per share, current earnings should be up to 25% versus the same quarter in the previous year. Additionally, if earnings are accelerating in recent sequential quarters, it’s a positive prognostic sign.

Cimatron’s Q3 GAAP earnings reported on 11/12/13 came in at .10/share versus .06/share for Q3 of 2012 (a 67% increase), strongly beating the 25% growth mark required for this metric.

EPS accelerated from .08 in Q1 of 2013, to .11 in Q2 of 2013 and then stalled a bit in Q3 at .10 due in part to some share dilution to 9.73 million shares versus 9.36 million shares in Q2 of 2013.

I expect Q4 to show continued growth based on CEO Danny Haran’s statement in the Q3 conference call:

“Generally, and this has been true almost every year. Q4 is the strongest quarter of every year. We expect this year to be no different, and we expect it could be stronger than the other three quarters. However, it is too early in the quarter to give more qualitative guidance, as you know, our quarters in general are back-ended. We see much of the activity coming towards the end of the quarter, so I cannot say much more beyond that we again expect it to be the strongest quarter of the year.”

- A stands for Annual earnings which should be up 25% or more in each of the last three years.

Here, Cimatron knocks it out of the park with annual EPS results as follows:

2010 EPS = .18 2011 EPS = .29 2012 EPS = .40

These numbers far exceed the 25% threshold required to meet the annual earnings growth metric of CAN SLIM.

- N stands for New product or service, more specifically a product or service that fuels earnings growth for the “C” and “A” above. This forward look allows the company’s stock to break out of prior ranges to new highs. This “N” is partly what propelled Apple, America Online, Amazon.com, eBay and other high-fliers over the last two decades, and it’s what should help drive Cimatron’s stock higher over time.

In this case the “new product or service” is 3D printing.

Cimatron brought leading industry expert Terry Wohlers onto their newly-established 3D printing advisory board last year. Cimatron CEO Danny Haran stated at the time:

“The creation of a 3D printing advisory board, and Mr. Wohlers’ appointment to it, is aimed at accelerating Cimatron’s efforts in entering the additive and hybrid manufacturing field.”

Terry Wohlers added:

“Cimatron has long been a strong player in the CAD/CAM software market, and it is only natural for the company to leverage its knowledge of manufacturing software solutions by exploring opportunities in 3D printing.”

Cimatron’s new 3D printing software product line will be introduced in mid-2014 according to CEO Danny Haran:

“We are starting to work and develop products and solutions for the software side of 3D printing. We don’t have any intentions to go into the machines or materials, but we do see some opportunities in the software side of that market. We will come with the first solution for what’s known as conformal cooling for molds in the next version of CimatronE, which as I mentioned is expected about mid-2014.”

Expected revenue expansion from 3D printing hasn’t gone unnoticed by Chardan Capital Markets: ”Chardan Capital Markets Starts Cimatron Ltd. (CIMT) at Buy; Foray Into 3D Could be ‘Game-Changer.” I expect Chardan to raise their price target well into the teens as Cimatron’s 3D printing software product launch nears.

- S stands for Supply and demand. A stock’s demand can be seen by the trading volume of the stock during price increases and decreases. Investing basics tell us that a rising stock price along with rising volume indicates demand for shares out pacing supply, and a drop in share price on high volume shows investors heading for the exits. The Money Flow Index (MFI) is useful here as a trend of averaged stock price and volume changes together over time. I won’t go into the calculation specifics of the MFI, but if it consistently runs between 30-80, then it’s a picture that says “follow the money”.

In CIMT’s case, the MFI has ranged in that sweet spot of 30-80 for almost all of the last 6 months. While the stock has traded in a broad range from $5.65-$10.00 during that period, the MFI tells us that there has been, on average, more buying pressure than selling pressure, printing the “S” very nicely in Cimatron’s CAN SLIM profile.

- L stands for Leader or laggard? Buying a strongly trading stock in a leading industry keeps the focus on strength, not weakness, and helps separate winners from losers. This measurement can be seen in the Relative Price Strength Rating (RS) of the stock. The RS is a measurement of stock performance over a defined period (usually one year) in comparison to the rest of the market.

Here again, CIMT outperforms. The stock’s relative strength based on the trailing twelve months compared to all companies in the Fidelity Investments database comes in at a healthy 92, meaning CIMT outperformed 92% of the stocks screened and is up 108% over a 12 month period.

The stock has been under accumulation in the last 3 weeks and has appreciated some 40% from December lows. Investors may want to wait for a pullback for entry, but of course there are no guarantees a pullback will be happening near term. Last week the stock gained nearly 7% while there was broad weakness in the pure play 3D printing stocks.

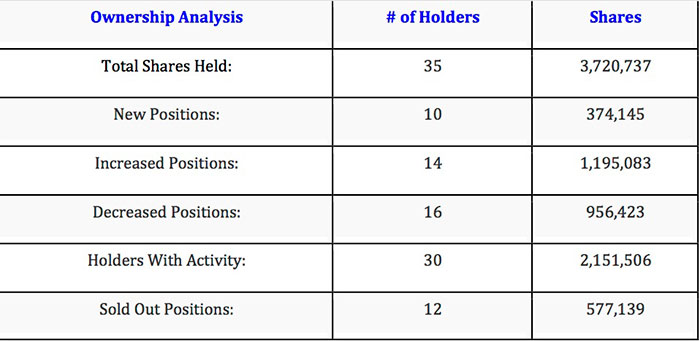

- I stands for Institutional sponsorship which (unsurprisingly) looks at mutual funds, insurance companies, credit unions, banks and other large players buying the stock. Institutional sponsorship should be increasing in the most recent two quarters, and not trailing off.

This is the only area in the CAN SLIM valuation where Cimatron doesn’t shine. Institutional ownership numbers tend to vary somewhat depending on the source, but I typically like to use Nasdaq.com here.

The table above shows new and increased positions by institutions totaling 1.57 million shares, while other institutions reduced or sold out 1.53 million shares for a negligible gain in the most recent results available.

- M stands for Market indexes, particularly the Dow Jones, S&P 500 and NASDAQ. This part of the acronym is based on market timing and trends. The goal is to invest in stocks that meet the above “CAN-SLI” criteria while there is an uptrend in the Dow Jones, S&P 500 and NASDAQ. The theory (based on historic trends) is that the stocks of good companies outperform in a rising market. In a declining market and souring economy, institutions as well as individuals leave high growth/high tech companies to buy defensive stocks such as utilities, consumer staples and health care.

In a rising market as we’re currently experiencing a high-growth cyclical company like Cimatron historically outperforms. It may sound trite to say “the trend is your friend”, but it is still true nonetheless.

“CAN SLIM SLUGGER +”

With the exception of institutional sponsorship, which was essentially unchanged, Cimatron meets all of the CAN SLIM criteria and knocks several of the metrics out of the park. This is what it takes for stocks to power to new highs, assuming market conditions remain healthy.

In addition to the strong forward-looking CAN SLIM results, I believe Cimatron has three other desirable attributes:

- Strong balance sheet with $20.4 million in current assets and $10.9 million in current liabilities for a good (but not great) current ratio of just under 1.9. That said, included in their current liabilities is $4.8 million in deferred revenue that will be credited to sales or service revenues in the upcoming quarter(s).

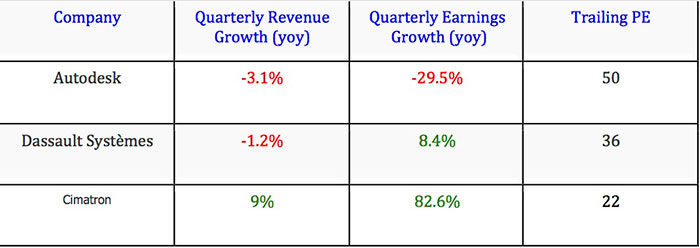

- Industry consolidation with Autodesk (ADSK) recently snapping up Cimatron rival Delcam for $277 million, and Dassault Systèmes (DASTY) taking an 84% stake in Realtime Technology AG, the potential for Cimatron to be acquired is real.

- Comparative value + high growth as an emerging 3D printing software play as the chart below indicates.

Conclusion

As a “CAN SLIM Slugger” and 2014 entrant into the 3D printing software space, Cimatron is a company investors in 3D printing might want to research further. I believe the stock is undervalued and will strongly outperform if current overall market conditions remain intact.

Disclosure: I am long shares and options of CIMT. I was not paid by Cimatron Ltd. or any third party for this article.

Leave A Comment