Changing Technologies is an interesting company, as is their new subsidiary 6th Dimension. They seem to sit somewhere between a start-up SME with product potential and a concerning publicly floated mystery. As far as existing products, patents and performance go, there is the stylish 3D print kiosk concept, and now a(nother) new press release stating that they are in the “initial stages of development for an innovative online retail portal that will provide consumers a state-of-the-art platform where they can order and purchase 3D printed items.” The small print that goes with investing in company is worth a look. Rachel has her suspicions, as does Mike, expressed in his article a couple of months back about this company.

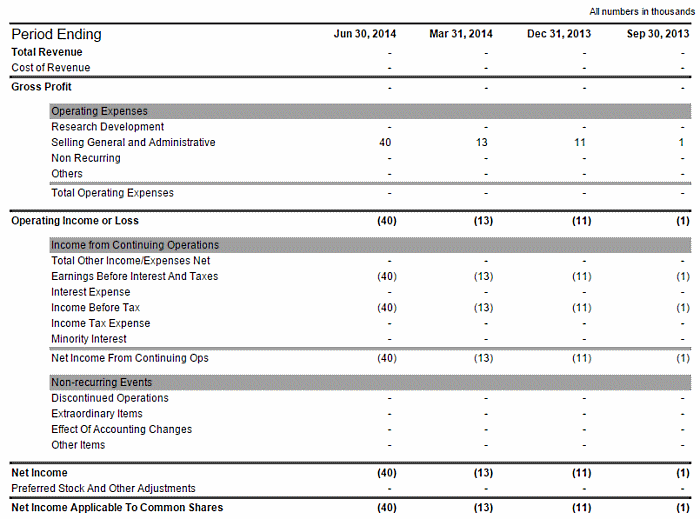

There will be better discernments made from those more accustomed to accountancy and investment than I. However, I wanted to look a little more closely at a company that on one hand states that it is “in the cutting-edge technology sphere alongside companies like Voxeljet AG (NYSE:VJET), Arcam AB (OTCBB:AMAVF) and ExOne Co. (NASDAQ:XONE),” but on the other has a balance sheet as follows:

In terms of product potential, who can truly say what is happening, outside of the company themselves. I’m not here to discard them: although I’m wary, benefit of the doubt is a beautiful thing. Could it be said that it is similar to looking at a crowdfunding project, but rather than crowdfunding the company is asking for a traditional investment. There is a lot of talk of potential. Every venture starts somewhere.

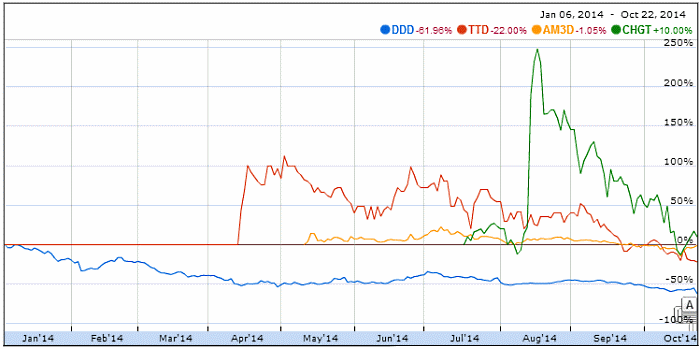

On the flipside, there is a lot of talk of the stats for the wider 3D printing market. Those are a lot of impressive numbers. But they have little to do with the actual company itself unless we are shown an indication of proprietary innovation. Those quotes of numbers could on one hand, inadvertently (or advertently) lull potential investors who are not familiar with the wider technology into parting with money. In turn, however, almost anyone considering investing money would have already noted the footnote on the front webpage: “This website is for informational purposes only. The information contained herein is not an offer to sell or a solicitation to buy CHGT securities as defined under the Securities Act of 1933. Potential investors should carefully read all public filings that the Company has made with the Securities and Exchange Commission, including sections entitled “Risk Factors” which can be found on Forms S-1A and 10-K.” The company is not trying to hide their finances. Though one would have to filter through the outer layers of the onion here first, layers that talk in terms of big figures for 3D printing’s overall market potentital. This approach doesn’t seem to be working for the company anymore, after an initial surge of excitement there has been a decline almost incomparable with any other 3D printing stock.

Compare on the graph below. All these stocks should be born in mind that 2013 saw a huge rise as a number of companies posed their IPO, and the 3D printing hype inflated related stocks, which by now, in 2014 can probably be concluded to be the year of realism, with those stocks returning to a level that reflects the current status of 3D printing, rather than its future potential: voxeljet (VJET) is down 65% for the year, ExOne (XONE) is down 67%. Stratasys represents the more stable pure play 3D printing stock, down 13% — figures thanks to InvestorPlace.

Tinkerine Studios (red), a SME prosumer 3D printer producer that floated publically earlier this year, with shares available ahead of any other prosumer printer company founded on the back of the new wave of FDM printers outside of MakerBot, famously purchased by Stratasys. SLM Solutions Group AG (yellow), the most recently floated industrial additive manufacturing systems producer. Finally, Industry giant 3D Systems (blue) as a staple indication of 3D printing stock levels, although the company took a tumble yesterday, down 15% in morning trading, and itself is down 60% for the year.

There are also press releases — reams of them, daily — which seem strategically aimed to create excitement that is again, generally, not directly related to the company: The latest example of which being a release in which the company’s CEO talks about the first 3D printer in space. Whilst Stratasys (for example) can talk about their industrial systems and MakerBot prosumer printers being used by NASA, Creative Technologies is referring to something wholly unrelated to them.

That said, offering shares in a 3D printing company yet to put a product on the market or make a sale, is not in itself anything new. There was a minor backlash across an investment website early this year when a writer came to understand that Organovo then, and now, has no saleable product. This was towards the end of the initial 3D printing stock peak. But Organovo is very much in the research and development stage, and very much making progress on remarkable bioprinting products that have vast potential in the future. Changing Technologies is not currently visibly showing anything original, the Kiosk concept has a few iterations already on the market such as Piecemaker. A few members of the 3DPI team have mentioned the word hype.

The market for online 3D printing portals is out there, and is indeed projected to grow rapidly, but the number of online interfaces out there is already considerable. Some are so established, Thingiverse, GrabCAD, Shapeways Shops, that a new entrant into the area will require something very special to stand out if it is to take its place among the leaders. There are stand-out examples of existing online portals for 3D printables that aren’t (yet) in the top class of popularity. In terms of the user interface, 3DIndustr.ies stand out for me; in terms of breadth of platform access to 3D printing service providers, an example here would be Additively; there are also those that are networking with giants like eBay, as per 3DLT who also has a deal with the afforementioned Kiosk brand Piecemaker. Each of these take a different approach to providing customers with online access to 3D printable models.

So, unlike Mike, I’m not going to suggest a scam here. But there is a lot to be wary of. This time next year 6th Dimension could have rave reviews of a new online 3D printing portal that stands out from the rest and interfaces seamlessly with Kiosks placed in shopping malls internationally, distributed by some major deal. On the other hand they could have fallen prey to their own business strategy. This has happened elsewhere already. Massive Dynamics is one Mike pointed to (or was it Rachel?). And who can forget BotObjects, a company that was the subject of cynicality and scrutiny last year for its hype ahead of a visible proven proprietary product. Making product promises to makers that don’t stand up when subjected to enquiry over a period of time – even if then later to be validated – can be a risky business approach.

If 6th Dimension can produce the product and service line that they state they are putting together they may have a reasonable or even strong future. For now, they are a very small venture talking in big numbers. But, like I said, every venture starts somewhere and benefit of the doubt still stands.

Leave A Comment