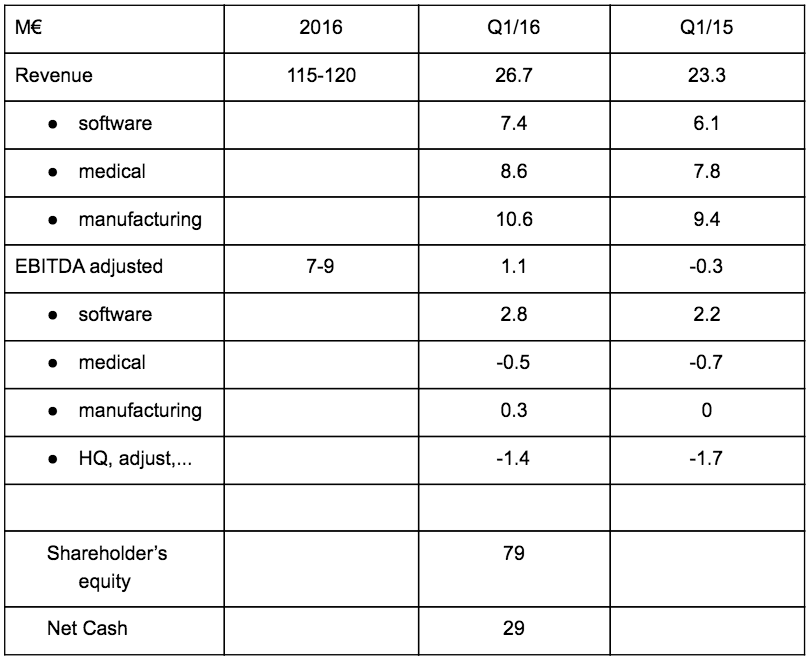

Materialise (MTLS) reported yesterday its result for the first quarter of 2016. Revenue increased by 14% at €26.7M over the same period last year. The company is reiterating its guidance following the results. Adjusted EBIDTA improved from €-0.3M to €1.1M following the sales growth, a better gross margin and costs under control. Overall the company will need to improve its profitability over the next quarters to reach its guidance and justify its current market valuation.

Key financial data:

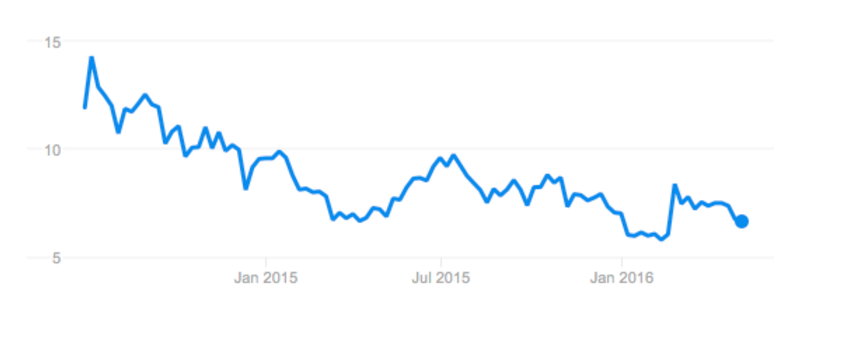

Current market valuation could prove too high

Based on the current market capitalisation of $320M and net cash available of €29M, Materialise valuation of €250M implies a multiple of 31 times the mid value EBITDA forecast for 2016. Considering the risks faced by the company to maintain its margin, current share price could suffer significant downward pressure. The lack of liquidity may exacerbate any price movement.

Finally the company will keep investing significantly in the coming years, limiting the capacity to generate net cash. From the transcript of the 2015 financial results presentation, the management stated: “The continued growth of Materialise in general, and of Materialise Manufacturing in particular, will require continued capital expenditures in 2016, resulting in an expected increase in depreciation of approximately 30%.”

Leave A Comment