SLM Solutions Group AG (ETR:AM3D) joins the growing list of 3D printing companies enjoying a positive earnings season. Results for the first half of 2016 show sales have increased by 85% compared to the same period in 2015.

Commenting on the financial results, SLM chairman, Dr. Markus Rechlin said, “In just six months we have achieved the same volume of business as in the full year 2014.” In year-on-year growth this most recent quarter demonstrated a 105% increase in revenue.

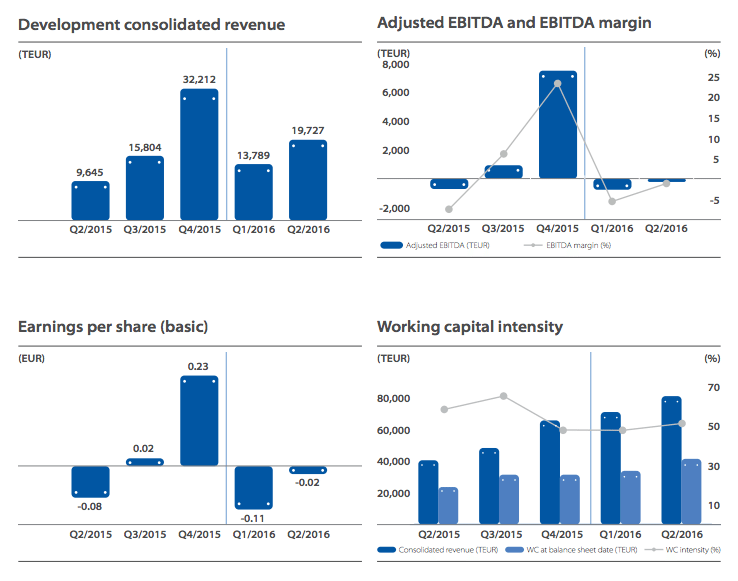

The results show total revenue of €33.5 million (H1 2015 €18.1 million). The company have increased order intake by 40%, which includes two-thirds of orders coming from new customers.

SLM manufacture selective laser melting (also SLM) additive manufacturing machines. The 3D printers they sell use the metal powder bed technique in common with EOS, 3D Systems, Concept Laser and Renishaw. The SLM powder bed fusion method is a key area of focus for programs such as DARPA’s open manufacturing initiative and also for America Makes, featuring heavily in their roadmap for the industrialization of 3D printing.

Advancements in laser based 3D printing have often come from the Fraunhofer institute and the latest machines from SLM use “multibeam” technology similar to that developed by the research lab. As previously reported melt pool control and monitoring is a critical component of such systems. SLM approach this by tracking the thermal radiation along the laser track.

A pot of gold?

Last week shares in the German company rose in value by 8% as the market priced in the future prospects for the enterprise. Early share price performance from SLM’s IPO on the Frankfurt Börse in 2014 had been more of a marathon than a sprint. Other than a slumped period between last August and March 2016, before the company’s TechDAX listing, the stock price had given investors little to write home about.

However, since March the 56% gain will have made savvy investors more than a little proud, and Christmas may have come early for those chasing the pot of gold at the end of the “regenbogen.” Having added almost €100 million to their market valuation since Q1 returns, SLM are now trading at an EBITDA multiple of 56, compared to 40 for the previous reporting period. This indicates investors are optimistic regarding the future prospects for the company.

Compared to negative returns on the STOXX Global tradable index of -11.6% during the reporting period these latest results are impressive. Investment professionals in the main are upbeat on the prospects of SLM, with the most optimistic predicting a €32.00 (US$36.00) share price.

Market trends to watch

In a statement issued by the company, attention is drawn the fact this quarters growth is above the average rate forecast by leading 3D printing consulting firm, Wohler’s Associates. In the wider manufacturing environment companies such as SLM may benefit from trends towards the use of 3D printing by industry. These trends include an increasing focus on cost and further automation of production.

Investors and analysts will be paying particular attention to SLM’s sales figures in the final quarter of this year as these will be, “decisive” in determining whether the company can meet full year targets. Analysis of leading economic indicators, such as figures for durable goods capacity utilization, may provide a clue as to how 3D printing companies will fare in the remainder of the year.

The most recent analysis conducted by Gardner shows that machine tool orders are contracting at their slowest rate this year. While the June figures show month-on-month machine tool orders continued to drop for the 14th consecutive month the analysis suggests an improvement of 2.7% above the forecast level of peak contraction.

Gauging future demand via economic indicators is still regarded by some as a dark art, frequently with the emphasis on art rather than science. Nevertheless, on demand manufacturing bureau Proto Labs pointed to a decline in the consumption of cutting tools as useful leading indicator in their most recent earnings report. Macro-factors worthy of consideration are levels of uncertainty in the business climate brought on by the U.S. presidential election and the future of the European Union. These factors will persist for the remainder of 2016 and are likely to deter sizeable capital commitments, at least if history is any guide.

Management forecasts for year-end revenue remained in the range between €85 and €90 million (US$95 – $100 million).Of these results Uwe Bögershausen, CFO, said,

“Viewed on an intra-year basis, our laser melting systems business regularly shows a distinct seasonal pattern. Also when assessing our current half-year figures, it should be borne in mind that in selling some older demonstration machines to an established customer, we allowed some discounts that had a one-off impact on profitability. With our new, even more user-friendly version of the SLM 500HL, we are very well positioned in the market.”

Geographical analysis

From their base in Lübeck, Germany have expanded into a global presence. Earlier in 2016 SLM opened a Moscow branch in order to capitalize on a market they see as one of the top ten for additive metal manufacturing.

SLM also have subsidiaries in Singapore, Shanghai, Michigan and Austria. On a global basis the company employs over 280 employees, a 10% expansion so far this year. Rechlin expects the continuous hiring program to, “pay off for us in the medium to long-term.”

For their active markets, the strongest economic growth forecast is in China and the ASEAN region in general. The IMF forecast 6.4% growth for 2016 across the ASEAN economies, almost double the global forecast of 3.1%. The U.S. economy is forecast to grow by 2.2%.

In concluding remarks the CEO added,

“As a metals specialist we find ourselves in the most dynamic segment of the additive manufacturing market, and we are playing our part in breaking down the barriers that currently obstruct wide-ranging application. With our joint ventures in software and consumables, we are also taking the next steps towards becoming an integrated systems supplier.”

Leave A Comment