3DPI asked industry experts for their initial reaction to GE’s $1.4 billion tender to takeover 3D printing businesses SLM Solutions Group AG and the Arcam Group AB.

Magnus Rene is Arcam’s CEO, he tells me the deal has ramifications beyond the three companies directly involved. “There are still people out there who are skeptical and see 3D printing as mostly for prototyping,” he says. “I think those people will now understand that is not the case and 3D printing is going live basically.”

3D printing industry experts were on the whole positive about the news, the bid is scheduled for completion by October 14th. If successful, the historic deal will bring the German and Swedish 3D printing companies under the control of GE Aviation. Combined revenue for the two enterprises is $142 million: based on full year numbers for 2015. GE has set a revenue target of $1 billion within the next four years.

Consolidation is a sign that an industry is maturing. Rene believes that for the 3D printing industry, “Consolidation is unavoidable and also necessary. What you have seen lately is that there are a lot of new entrants coming in on the laser side, and on the plastics side you can’t count them all.”

3D printing targets for acquisition

This news has generated much speculation about the consolidation, or takeover, of other 3D printing enterprises. Specifically, the response by GE’s competitors. For example, the UK’s Rolls Royce (LON:RR) has a close relationship with 3D printing manufacturer Renishaw (LON:RSW). Renishaw’s co-founder, David McMurtry, was previously the chief engineer on a Rolls Royce engine project.

In the U.S. the major aerospace and defense company Lockheed Martin (NYSE:LMT) has close links with several 3D printing businesses. These include Chicago’s Sciaky, Inc. and also Norsk Titanium. In the later case Norsk’s CEO, Warren M. Boley, was previously president of Aerojet: a company Lockheed Martin acquired in 2013. Norsk Titanium is currently working on large-scale 3D metal printing. Both companies are privately owned.

GE’s Vic Abate reminded investors that the company had, “opened our GE Center for Additive Technology Advancement in Pittsburgh, which focuses on factory design, industrialization of additive technologies and scale.”

Lockheed Martin also operates Sandia National Laboratories, where the foundations of Optomec’s technology were laid. Ken Vartanian at Optomec says the GE tender, “Is another validation that 3D printing is indeed ready for industrial use.” He added, “GE continues to be a first mover in acquiring and investing in additive manufacturing technologies for metals and electronics that are strategic to their business initiatives.”

Germany has long been acknowledged as a global center of excellence for laser based 3D metal printing. It is SLM’s home country and other major players include EOS and Concept Laser. Recently, rumors about the sale of Concept Laser began to circulate. A spokesperson for the company politely declined to comment on the accuracy of this speculation.

Stratasys (NASDAQ:SSYS) do not currently have a metal 3D printing system and GE’s bid narrows the field should they decide to add this capability by acquisition. Tim Bohling, CMO of Stratasys said, “While it is too early to comment on this development, but GE’s move and this news further reinforces the significant role additive manufacturing plays in the 3D printing market today and will also play in the future.” Stratasys also continue to build partnerships with the wider manufacturing industry.

Arcam’s CEO believes there is, “more consolidation to come, both on the metal and the plastic side,” in the 3D printing industry. This is a view echoed by others, including Simon Fried, CBO & Co-founder of Nano Dimension who said,

“Today’s news was certainly very significant. The 3D industry has been recovering from the hype hangover. The belief that the excitement surrounding AM is justified is now confirmed. Seeing a large industrial player choosing to buy the means of production confirms it. I expected it would be the larger 3D printing companies that would continue merging and acquiring, but this is vertical integration of the means of production. In a world of innovation it’s now the case that firms win as much by their equipment’s flexibility as by their final product. This isn’t yesterday’s leaner manufacturing and just in time logistics, this is about having the best craftsmen aka the best 3D printers. I expect this pattern will repeat itself, it’s the new ‘war for talent’.

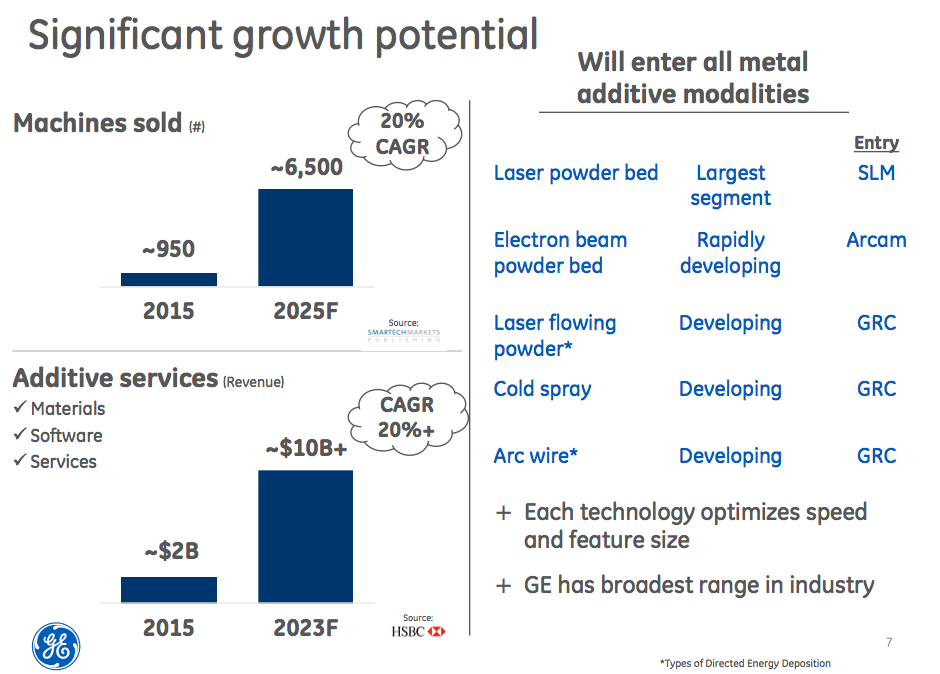

Industry Growth Potential (image courtesy GE)” width=”940″ height=”674″ srcset=”https://3dprintingindustry.com/wp-content/uploads/2016/09/Screen-Shot-2016-09-07-at-14.04.49.png 940w, https://3dprintingindustry.com/wp-content/uploads/2016/09/Screen-Shot-2016-09-07-at-14.04.49-770×552.png 770w, https://3dprintingindustry.com/wp-content/uploads/2016/09/Screen-Shot-2016-09-07-at-14.04.49-200×143.png 200w, https://3dprintingindustry.com/wp-content/uploads/2016/09/Screen-Shot-2016-09-07-at-14.04.49-500×359.png 500w” sizes=”(max-width: 940px) 100vw, 940px” />

Industry Growth Potential (image courtesy GE)” width=”940″ height=”674″ srcset=”https://3dprintingindustry.com/wp-content/uploads/2016/09/Screen-Shot-2016-09-07-at-14.04.49.png 940w, https://3dprintingindustry.com/wp-content/uploads/2016/09/Screen-Shot-2016-09-07-at-14.04.49-770×552.png 770w, https://3dprintingindustry.com/wp-content/uploads/2016/09/Screen-Shot-2016-09-07-at-14.04.49-200×143.png 200w, https://3dprintingindustry.com/wp-content/uploads/2016/09/Screen-Shot-2016-09-07-at-14.04.49-500×359.png 500w” sizes=”(max-width: 940px) 100vw, 940px” />Consolidation = less options?

However, Magnus Rene does not think that consolidation will limit the options available to those outside the large multinationals. One of things about the bid he likes is that,

“GE are taking a big stance on additive and they are not trying to make this propriety, or bring it all in house. They are making this business unit with additive solutions. Which I think is important. You can imagine a situation where large corporations bring all the different processes in-house. But this is not the case. This is GE taking a bet on additive will be a new large industry, which I completely agree on.”

Frank Marangell, President and CEO, Rize Inc. agrees, “GE jumping in as a 3D printer supplier is great for the industry because it legitimizes 3D printing for manufacturing. Of course Arcam and SLM offer metal 3D printers, but the 3D printing transition from prototyping to manufacturing is also exploding for plastic 3D printing which is currently 80% of the market, presenting enormous opportunity for companies like Rize.”

By 2025, the “growth of additive in GE [will drive] the need for more than a 1,000 machines,” says GE’s Vic Abate. Building the lion’s share of these machines is likely a task for SLM and Arcam. Other 3D printing companies might expect this particular avenue for revenue to disappear. Japanese multinational Ricoh Co Ltd said, “we feel that we can expect further growth.”

However, the news was well received by several companies who offer 3D printing support services, such as motion control, software or monitoring sensors. Sigma Labs manufacturer non-destructive inspection systems and Mark Cola, President & CEO of Sigma Labs, Inc. (OTCMKTS:SGLB) said,

“GE’s recent announcement of its acquisition of 3D machine manufacturers Arcam and SLM Solutions was exciting news for Sigma Labs. For some time, Sigma Labs has been working with GE’s aerospace business unit, GE Aviation, through our Joint Technology Development Agreement as well as a principal team member of its America Makes-sponsored program for IPQA® for aerospace components. Products from both machine manufacturers are well-suited to benefit from Sigma Labs’ platform-independent, PrintRite3D® QA software.”

Bernhard Langefeld at consulting firm Roland Berger highlighted the fact that, “With the acquisition of Arcam GE will be in a monopoly situation for EBM powder bed fusion.” Langefeld adds that EBM, “is highly relevant for AlTi turbine blades and MedTech applications.”

Accelerating Progress

The takeover move will also bring greater resources, including R&D funds, to accelerate the pace of technological change. As Langefeld says, “Access to the application know-how and global service and sales network of GE will boost the growth rates of SLM.”

These additional resources may be a welcome boost. A recurring conversation with companies active on the frontier of 3D printing is that while they have many great, and patented, ideas they do not have the funds to simultaneously develop everything.

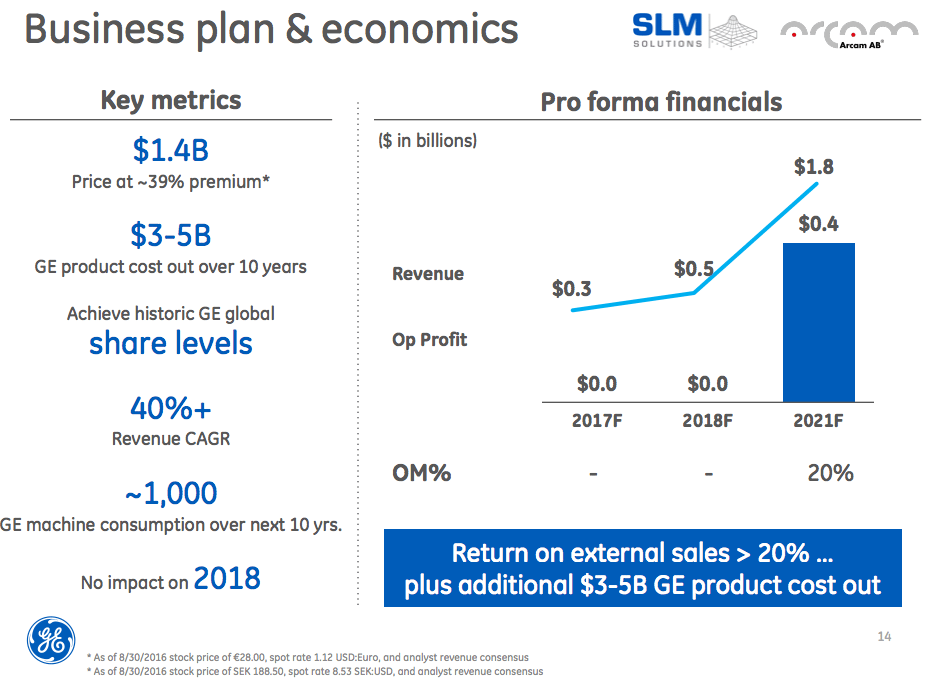

In a call with investors and analysts GE’s CEO, Jeff Immelt said he expects the business to have, “about $300 million of revenue in 2017.” Furthermore, 3D printing will “facilitate $3 billion to $5 billion” of cost savings over the longer term.

Dror Danai at Xjet commented,

This is great news for the Additive manufacturing industry as it confirms the move of this sector into the main stage of manufacturing. The global manufacturing is estimated to be in the range of 10 trillion USD. The Additive Manufacturing (or digital manufacturing sector) is estimated to be in the range of a few billion only and the growth in recent years shall continue and even increase as it [gains] the attention of a growing community of decision makers. Specifically, in the metal arena, the capability of additive manufacturing to create virtually any geometry is opening a new frontier for product design.

Tim Caffrey, owner of Seventh Son Consulting says, “For GE to follow its 2012 acquisition of Morris Technologies with these acquisitions is a compelling endorsement of metal AM as a manufacturing technology.”

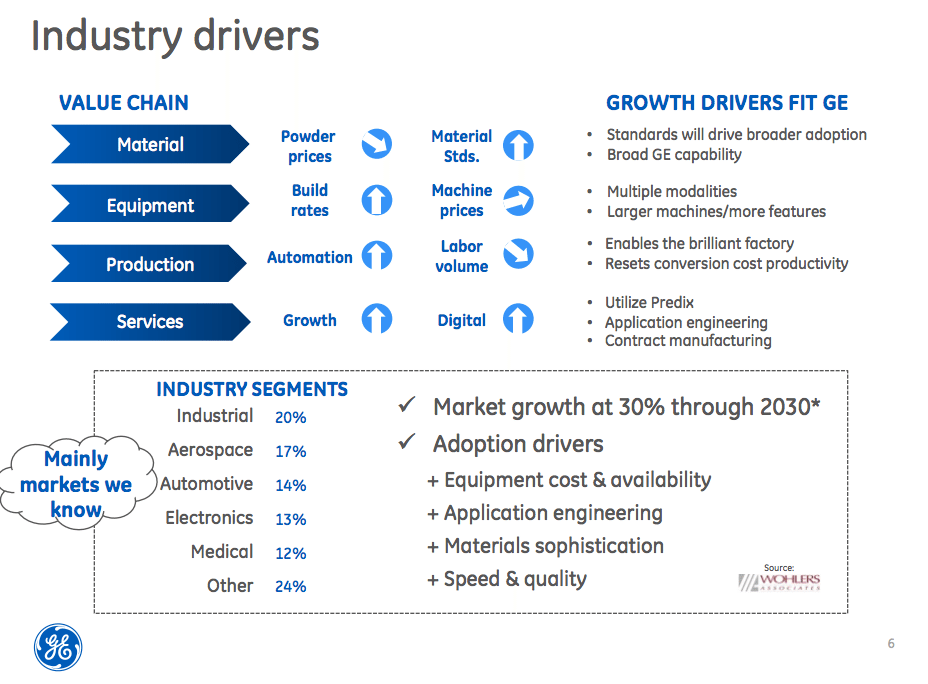

Industry Value Drivers (image courtesy GE)” width=”928″ height=”684″ srcset=”https://3dprintingindustry.com/wp-content/uploads/2016/09/Screen-Shot-2016-09-07-at-14.05.21.png 928w, https://3dprintingindustry.com/wp-content/uploads/2016/09/Screen-Shot-2016-09-07-at-14.05.21-770×568.png 770w, https://3dprintingindustry.com/wp-content/uploads/2016/09/Screen-Shot-2016-09-07-at-14.05.21-200×147.png 200w, https://3dprintingindustry.com/wp-content/uploads/2016/09/Screen-Shot-2016-09-07-at-14.05.21-500×369.png 500w” sizes=”(max-width: 928px) 100vw, 928px” />

Industry Value Drivers (image courtesy GE)” width=”928″ height=”684″ srcset=”https://3dprintingindustry.com/wp-content/uploads/2016/09/Screen-Shot-2016-09-07-at-14.05.21.png 928w, https://3dprintingindustry.com/wp-content/uploads/2016/09/Screen-Shot-2016-09-07-at-14.05.21-770×568.png 770w, https://3dprintingindustry.com/wp-content/uploads/2016/09/Screen-Shot-2016-09-07-at-14.05.21-200×147.png 200w, https://3dprintingindustry.com/wp-content/uploads/2016/09/Screen-Shot-2016-09-07-at-14.05.21-500×369.png 500w” sizes=”(max-width: 928px) 100vw, 928px” />Metal Powders and Materials

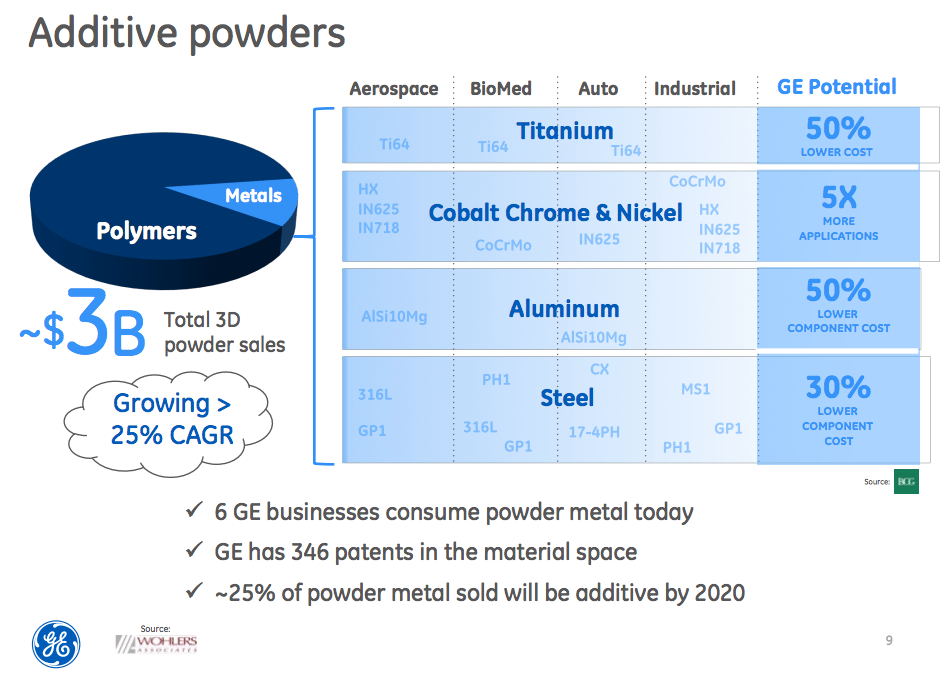

With the successful acquisition, GE will also establish a foothold in the 3D printing materials market. The powder market is valued $3 billion according the Wohlers report. GE’s David Joyce says “we assess the market for additive powders growing at more than 25% CAGR, metals represents approximately 12%, which by 2020 we estimate could be as high as one quarter of the additive powder industry.”

Arcam have spoken about the expansion of their metal powder facilities in the recent past, so I asked their CEO whether the tender means the company would be scaling up the AP&C facility even further. “It’s too early to say, we are already scaling the facility very aggressively. But we could if we need to of course,” he says.

Rene estimates that Arcam control between 50% – 70% of the market for titanium powder for 3D printing. With companies such as Metalysis and Alcoa now targeting the additive manufacturing powder market, this looks like an area of intensive competition in the coming years. Arcam’s CEO welcomes this prospect and says, “Yes, and that is good. It’s a very important part of the industry being successful.”

Metal Powder Market (image courtesy GE)” width=”945″ height=”679″ srcset=”https://3dprintingindustry.com/wp-content/uploads/2016/09/Screen-Shot-2016-09-07-at-14.04.29.png 945w, https://3dprintingindustry.com/wp-content/uploads/2016/09/Screen-Shot-2016-09-07-at-14.04.29-770×553.png 770w, https://3dprintingindustry.com/wp-content/uploads/2016/09/Screen-Shot-2016-09-07-at-14.04.29-200×144.png 200w, https://3dprintingindustry.com/wp-content/uploads/2016/09/Screen-Shot-2016-09-07-at-14.04.29-500×359.png 500w” sizes=”(max-width: 945px) 100vw, 945px” />

Metal Powder Market (image courtesy GE)” width=”945″ height=”679″ srcset=”https://3dprintingindustry.com/wp-content/uploads/2016/09/Screen-Shot-2016-09-07-at-14.04.29.png 945w, https://3dprintingindustry.com/wp-content/uploads/2016/09/Screen-Shot-2016-09-07-at-14.04.29-770×553.png 770w, https://3dprintingindustry.com/wp-content/uploads/2016/09/Screen-Shot-2016-09-07-at-14.04.29-200×144.png 200w, https://3dprintingindustry.com/wp-content/uploads/2016/09/Screen-Shot-2016-09-07-at-14.04.29-500×359.png 500w” sizes=”(max-width: 945px) 100vw, 945px” />The Other View

The 3D printing industry is still a small subsection of the wider manufacturing sector, so it can be interesting to see how non-experts view the announcement. Jim Cramer is a highly visible financial commentator who makes many predictions. He said, “I don’t think it’s a needle mover for GE and the reason I say that is because GE is such a big company.” Cramer suggested that Alcoa was a more interesting investment prospect. Cramer claimed Alcoa “have a lot of propriety technology in 3D” and added, “I’m surprised GE did this one over in Europe, as Alcoa is better.”

Patrick Newton at investment analysts Stifel agreed and said, “we see limited read-through to our coverage given GE management’s commentary that the company has a clear focus on metals and not the plastics market.”

Newton disregards the rumors that Concept Laser are actively seeking bidders, “We see acquisitions of metal functionality by GE competitors as unlikely given EOS and Concept Laser are privately held and seem unwilling to sell based on our prior conversations.” J.P Morgan’s Steve Tusa said the bid was a, “relatively outsized and expensive bet, with no near-term return.”

Certainly, the pressure to deliver on a short term “number” at the expense of the long-term is a well-documented phenomenon in the investment industry. Several users of the Seeking Alpha investment blog called this out. Comments included, “Most analysts can’t see beyond next quarter” while another sarcastically said, “Oh, well if there are no short-term benefits….”

Investment Opportunities

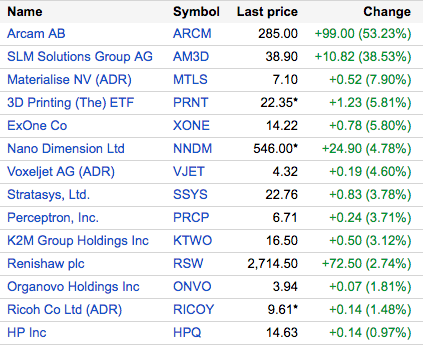

Terry Wohlers of Wohlers Associates says the news, “underscores how vitally important AM technology is to large corporations in the product development and manufacturing business. Already, the acquisitions have boosted the share prices of publicly-traded AM companies.”

Share Price Movements on Tuesday” width=”423″ height=”345″ srcset=”https://3dprintingindustry.com/wp-content/uploads/2016/09/Screen-Shot-2016-09-06-at-17.14.23.png 423w, https://3dprintingindustry.com/wp-content/uploads/2016/09/Screen-Shot-2016-09-06-at-17.14.23-200×163.png 200w” sizes=”(max-width: 423px) 100vw, 423px” />

Share Price Movements on Tuesday” width=”423″ height=”345″ srcset=”https://3dprintingindustry.com/wp-content/uploads/2016/09/Screen-Shot-2016-09-06-at-17.14.23.png 423w, https://3dprintingindustry.com/wp-content/uploads/2016/09/Screen-Shot-2016-09-06-at-17.14.23-200×163.png 200w” sizes=”(max-width: 423px) 100vw, 423px” />As option traders are acutely aware, new information is always likely to prompt a movement in share prices, in one direction or another. Indeed, stocks in many 3D printing companies across the market received a boost from this week’s announcement. As the saying goes, ‘a rising tide raises all ships.’

Catherine D. Wood CEO & CIO at tech investors, ARK Investment Management LLC said,

“GE is ringing the bell for 3D printing, a market that is roughly $5 billion today, mostly in prototypes, to what McKinsey estimates could be a market of nearly $500 billion within 10 years. GE is making that projection more of a reality. ARK has stressed that the industrial space needs to adopt innovative new technologies in order to do things cheaper, faster, and better, especially in response to the strong dollar of recent years. This is the main idea behind ARK’s Industrial Innovation ETF, ARKQ, and The ETF, PRNT. GE is proof that this is happening at an accelerated rate.”

GE is poised to join HP as the latest multinational with deep pockets to deepen their investment in the 3D printing industry. The ongoing industrialization of 3D printing, and the implications for Industry 4.0 lend credence to the idea that revolution is taking place in manufacturing. This takeover, and its implications, will be a hot topic for some time to come.

And with one of the major manufacturing conferences around the corner, IMTS in Chicago, more news is certain.

Leave A Comment