3D printing industry earnings season continues with financial results from 3D Systems (NYSE:DDD), and the stock market is not reacting well to the news. The company’s share price has taken almost a 20% hit since publication of the Q2 results.

Is the sky falling?

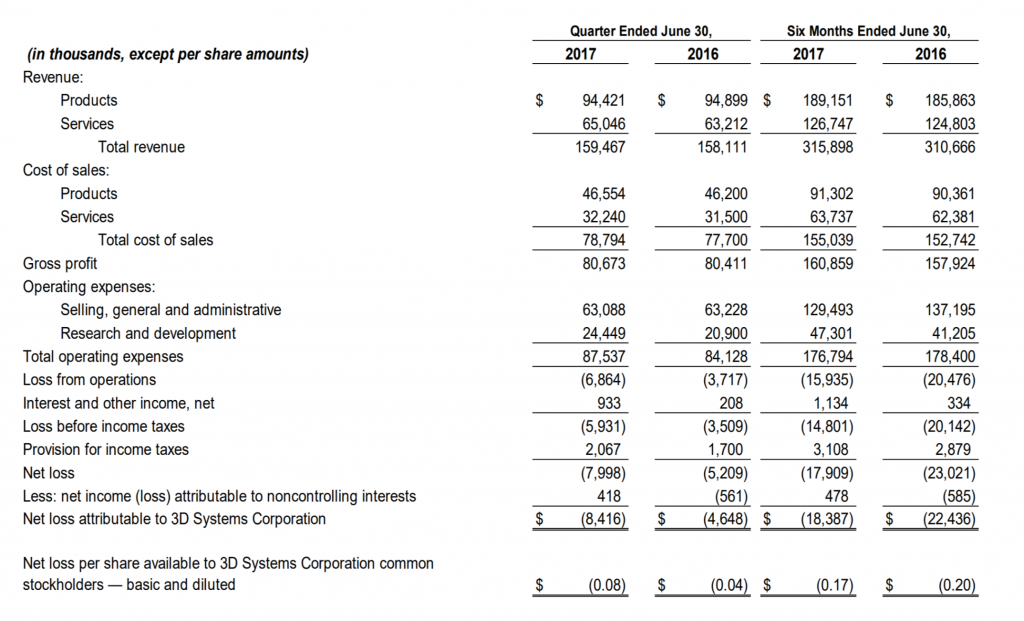

Although 3D Systems reported growth in revenue of 1%, reaching $159.5M versus $158.1M for the second quarter of the prior year, this was not enough to get the Rock Hill company out of the red.

3D Systems reported a second quarter GAAP loss of $0.08 per share, compared to loss of $0.04 per share for comparative period. Non-GAAP earnings were $0.08 per share versus $0.12 per share in the second quarter of 2016.

Speaking to investors and analysts Vyomesh Joshi (VJ), Chief Executive Officer, said, “we have performed very well in some areas and other areas require improvements.”

While it has taken longer and cost more than initially anticipated, we have made significant improvements in quality and reliability and expect these costs to continue throughout the balance of the year. We are putting very clear actions in place both organizationally and operationally to address short-term issues as well as longer term needs of the company to achieve accelerated performance in 2018 and beyond.

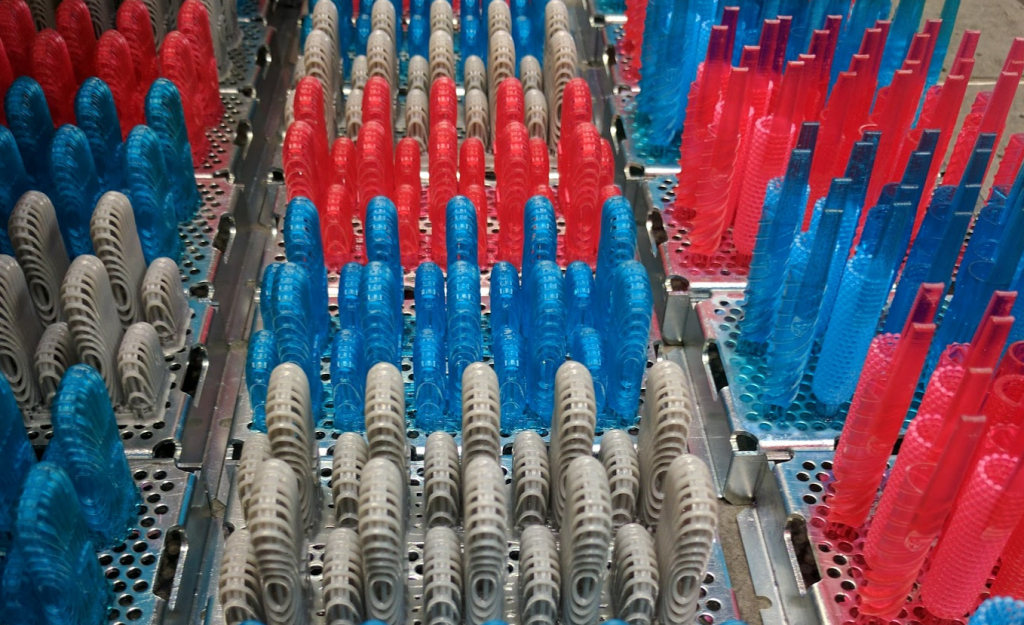

Healthcare sees double-digit growth

Healthcare is one area where 3D Systems undeniably performed well. Revenue for the second quarter of 2017 increased by 25% to $49 million. In Q1 the healthcare business grew 27%.

John McMullen, Executive Vice President and Chief Financial Officer explains that this was “result of growth in all categories within healthcare.”

When speaking about long-term strategy, VJ has consistently pointed to the importance of the healthcare vertical. This was reiterated on yesterday’s call.

3D Systems will seek to replicate success in the healthcare sector across other key verticals, including expansion of the aerospace segment.

We are leaders in precision healthcare and are growing that category at double-digit rates. … We are very successful in metals in the healthcare. And I think our main thing … is we want to expand into the industrial, into the aerospace with the metal opportunity.

VJ also drew attention to other achievements during the period including, “continued growth in software, continued growth in materials, on-demand manufacturing returned to growth, and printer revenue returned to growth.”

While software revenue had previously been flat, the most recent period saw a 9% increase bringing revenue of $24M. On-demand manufacturing did decrease by 5%, however this is an improvement on the 6% decrease for the comparative.

However today’s market reaction was most likely driven by an important line item in the most recent accounts – a 14% drop in revenue from sales of 3D printers.

Declining revenue from 3D printers

Speaking with investors John McMullen explained that, “while total printer revenue decreased, production printer revenue in units increased compared to the prior year’s quarter.”

The CFO added, “there was increased demand for SLA, SLS, and DMP systems which was offset by lower sales of MJP professional printers.”

While reception for the ProJet MJP 2500 Wax printer has been positive, 3D Systems were unable to fully capitalise on this. VJ notes, “frankly, we could have sold more if we had the capacity to build in our production line.”

There was a less positive take on some of the company’s older 3D printers – specifically the ProX 300.

3D Systems singled out two key areas for action on the investor call with VJ saying, “[the] first one is, our quality and reliability issues we had, which continued. Frankly, the problems were deeper than I thought on the quality and reliability.”

I will be the first one to say I was a little bit more optimistic that I could solve the problems and deploy them into the field faster. So I think that was the one issue that probably I miscalculated.

3D Systems makes a distinction between professional printers and production printers. VJ defines the segments as follows, “So, our SLS, our high-end SLA like 800 and 950 and the metal printers are all production printers. The professional printers are MJP, CJP, and the 6000 and 7000 SLA printers.”

The 3D Systems CEO said, “our production printers are really very well designed and they are doing extremely well. It’s really the professional printer that we have some real issues in quality and reliability.”

“Our weakness in Q2 specifically was not SLA, but specifically MJP.”

By region these issues were particularly evident in Japan. 3D Systems has since made changes to leadership in the region – adding a senior leader for the entirety of APAC.

“What we wanted to do was to make sure that, as I said, we want to make customers happy. So it’s really local issues with the professional printers. And I think that’s why having that reliability, quality issue and not making enough of Wax product, the combination is a result. We had a weak revenue in professional printers.”

The second quarter also saw 3D Systems make an aggressive pricing move with an April reduction in the price of the ProX SLS 500. “I believe that with our 30% reduction in SLS and appropriately positioning that product was basically great in terms of total cost of operations and we are seeing the results,” said the CEO.

“We are seeing that our SLS printer both from unit and revenue has grown year-over-year. So I really believe that it is a very positive move on our side.”

Speaking about the challenges from other 3D printer manufacturers VJ spoke to the entry of HP into the 3D printing industry. “A lot of people were concerned about HP and the competition there, and actually we sold more SLS units than last year.”

“I don’t see any issue from competition from Carbon or HP.”

The primary issue holding back sales according to the CEO is execution. This was also the explanation given for the revised earning guidance.

For 2017, 3D Systems are now expecting revenue growth of 2% to 6%. This would result in a revenue range of $643 million to $671 million. The update is a 2% decrease on the top end of the forecast, a figure the company had reiterated as recently as May.

And this is why the share price of 3D Systems is currently down by almost 20%. Markets reward meeting short-term targets and frequently neglect longer term indicators.

Looking to the long term

Taking 3D printing into production and scaling up the technology as complementary to existing manufacturing processes – and in some cases as a replacement – has been a key feature of 2017, not only at 3D Systems.

Carbon has inked a deal with Adidas, while as reported earlier today Stratasys is making progress with the renamed Infinite Build.

For 3D Systems increased investment in R&D and building for the long-term means the Figure 4 platform and further investment in metals.

For example, the January acquisition of Vertex, and subsidiary NextDent, has already contributed to some of the 8% increase in materials revenue, bringing the figure to $44 million for the quarter.

3D Systems will currently be working on the qualification and certification of these materials for use in 3D printing, including the Figure 4 platform. Revenue from Figure 4 is by the end of 2017.

Beyond 2017 VJ says, “this whole long-term approach that I’m taking will allow us to really grow the business double-digit in 2018.”

While today’s market reaction may generate a few inevitable stories about the death of 3D printing, and possibly a few gray hairs for investors, it would be surprising if a correction were not seen later in the year.

For all the latest 3D printing news and insight, subscribe to our free newsletter from the leading source of news about the 3D printing industry.

Also, follow us on Twitter to make sure you’re first with developments in the additive manufacturing industry.

Featured image shows 3D Systems Healthcare Technology Center. Photo by Michael Petch.

Leave A Comment