Carpenter Technology’s (NYSE:CRS) financial results for the second quarter of FY 2018 mark a strong entry into the earnings season for metal alloy manufacturing.

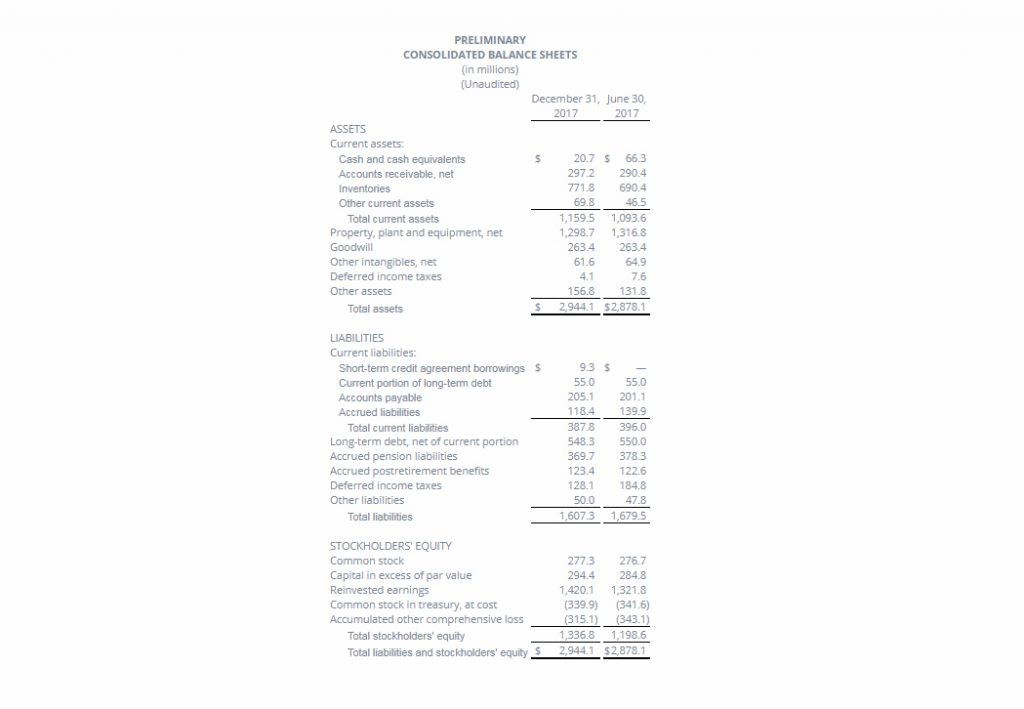

During the 3 months of the period ending December FY 2018, Carpenter reported a revenue of $487.8m, up by $60.4m on the same period in FY 2017 from $427.4m. The 13% increase was driven in part by the unexpected performance of the company’s Performance Engineered Products (PEP) segment, which includes metal 3D printing materials manufactured by Carpenter Powder Products (CPP).

Tony Thene, President and CEO of Carpenter Technology, stated, “Our SAO [Specialty Alloys Operations] segment recorded its best second quarter and best first half since fiscal year 2014, while results at our PEP segment finished well ahead of our expectations.”

Key businesses

Carpenter’s revenue is reported under two segments. Specialty Alloys Operations (SAO) relates to the production of solid metal alloys, forged to a premium for customers worldwide. Performance Engineered Products (PEP) on the other hand encompasses Carpenter’s differentiated operations, particularly from the Dynamet solid titanium business and CPP.

The SAO segment is Carpenter’s primary business. In Q2 FY 2018, SAO sold 60,080,000 pounds of product, equating to net sales of $406.3m. In Q2 FY 2017, SAO sold 51,314,000 pounds, accruing net sales of $348.6m.

For the second three month of Q2 2018, PEP sold 3,282,000 pounds at net sales of $104.8m, compared to only 2,350,000 pounds in Q2 2017 at net sales of $83.2 m.

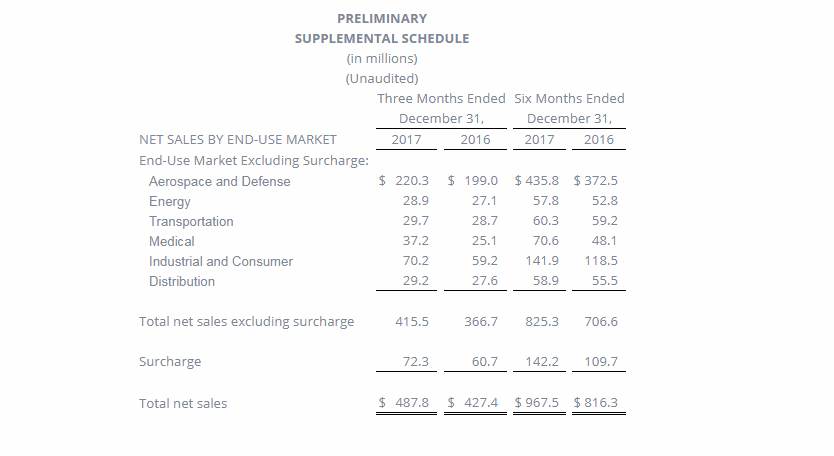

Sales by market

Aerospace and Defense is the primary market for Carpenter products and services, generating sales of $220.3m (excluding surcharge) in Q2 2018. The medical sector was noted for its strong demand in Thene’s speech, up to $37.2m from £25.1m in 2017.

Thene comments, “In the Aerospace and Defense end-use market, new engineplatform demand is increasing and we are further benefiting from our strong position across a range of attractive sub-markets […] demand for our solutions portfolio in the Medical end-use market remains high while the recovery in the oil & gas sub-market is strengthening.”

Q2 2018 also provided Carpenter Technology investors a dividend payment of $0.18 per share of common stock, equating to $17.2 million up £0.2m on dividend payment in FY 2017.

Continued investment in additive manufacturing

“Moving forward,” notes Thene, “we will continue to strategically invest in our core long-term growth capabilities […] we plan to accelerate our investment into key areas including additive manufacturing and soft magnetics, which is consistent with our commitment to being a leading solutions provider for our customers.”

Incidentally, the report was also filed a year since the company’s $35 million acquisition of metal additive manufacturing materials producer Puris LLC – operations included under the PEP segment.

Market performance has also led to an increase in prices of Carpenter’s high temperature, electronic, and premium alloy steels “across all product forms.” On average the price of these products (on new non-contract orders) will increase by 5%. Last year, the company’s stainless steel products experienced and increase of 3% to 8%.

With a current valuation at 10x EBITDA and strong sales, Carpenter offers an attractive estimate for the year to come.

Is Carpenter Technology one of the leading additive manufacturing materials producers? Make your nominations for the 2018 Industry Awards now.

For more of the latest 3D printing news and financials subscribe to the free Industry newsletter, follow us on Twitter, and like us on Facebook.

Featured image shows the spherical quality of Carpenter’s Puris titanium powder. Image via Puris.

Leave A Comment