Major 3D printing system manufacturer Stratasys is about to make a big announcement. The company will report financial results for the second quarter of 2019 at the end of July and is set to beat previously issued earnings guidance.

At least that is one way to read the recent share price bump.

First observed on the 28th of June, Stratasys stock rose 14% during the course of a single day trading, reaching $29.44. Stocks rise and fall for an inordinate number of reasons, all of which can be boiled down to the rather prosaic statement – share price reflects the cumulative effect of buying and selling in the market. That fact does not prevent analysts, experts, soothsayers, and other practitioners of the dark financial arts striving to infer meaning. With this in mind, why did Stratasys stock see double-digit growth?

New data about a company is a prime motivation for buying or selling shares in a company. Stratasys has released no such material public information, and in this situation, a market correction, whereby the share price returns to its previous level would typically be expected. However, the stock has trundled along retaining the gain, trading at $29.49 as of writing.

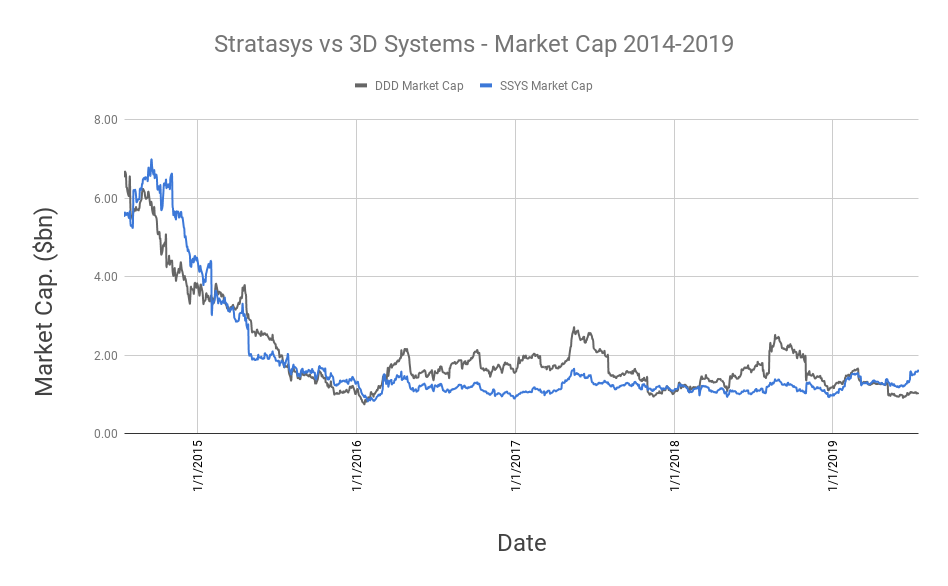

Also of note is the valuation of the company in comparison to its peers, specifically 3D Systems. As the chart below illustrates, 3D Systems (in gray) has historically had a higher valuation by market capitalization than Stratasys.

Industry.” width=”948″ height=”586″ srcset=”https://3dprintingindustry.com/wp-content/uploads/2019/07/Stratasys-vs-3D-Systems-Market-Cap-2014-2019-3.png 948w, https://3dprintingindustry.com/wp-content/uploads/2019/07/Stratasys-vs-3D-Systems-Market-Cap-2014-2019-3-770×476.png 770w, https://3dprintingindustry.com/wp-content/uploads/2019/07/Stratasys-vs-3D-Systems-Market-Cap-2014-2019-3-200×124.png 200w, https://3dprintingindustry.com/wp-content/uploads/2019/07/Stratasys-vs-3D-Systems-Market-Cap-2014-2019-3-500×309.png 500w” sizes=”(max-width: 948px) 100vw, 948px” />

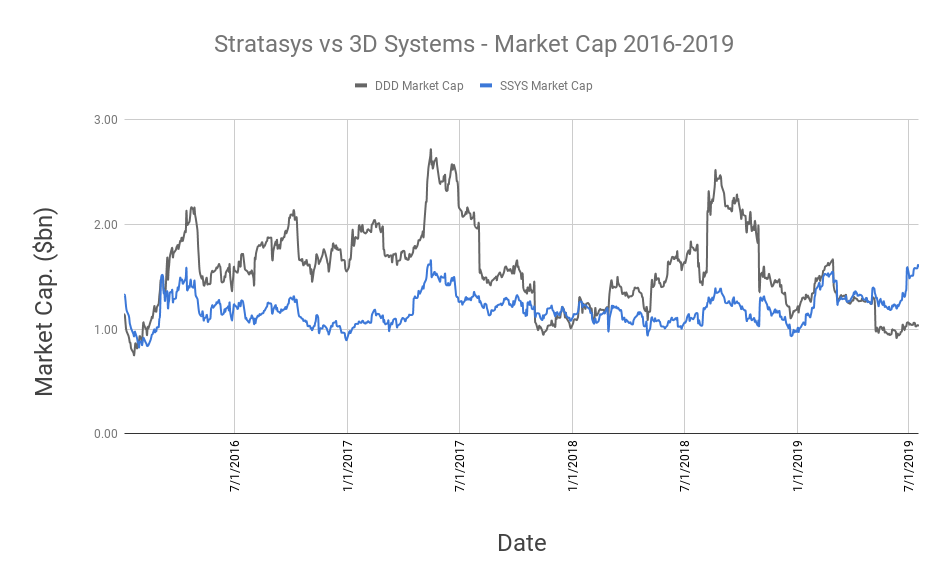

Industry.” width=”948″ height=”586″ srcset=”https://3dprintingindustry.com/wp-content/uploads/2019/07/Stratasys-vs-3D-Systems-Market-Cap-2014-2019-3.png 948w, https://3dprintingindustry.com/wp-content/uploads/2019/07/Stratasys-vs-3D-Systems-Market-Cap-2014-2019-3-770×476.png 770w, https://3dprintingindustry.com/wp-content/uploads/2019/07/Stratasys-vs-3D-Systems-Market-Cap-2014-2019-3-200×124.png 200w, https://3dprintingindustry.com/wp-content/uploads/2019/07/Stratasys-vs-3D-Systems-Market-Cap-2014-2019-3-500×309.png 500w” sizes=”(max-width: 948px) 100vw, 948px” />Over a shorter time period, the difference in market capitalization is clearer.

Industry.” width=”948″ height=”586″ srcset=”https://3dprintingindustry.com/wp-content/uploads/2019/07/Stratasys-vs-3D-Systems-Market-Cap-2016-2019.png 948w, https://3dprintingindustry.com/wp-content/uploads/2019/07/Stratasys-vs-3D-Systems-Market-Cap-2016-2019-770×476.png 770w, https://3dprintingindustry.com/wp-content/uploads/2019/07/Stratasys-vs-3D-Systems-Market-Cap-2016-2019-200×124.png 200w, https://3dprintingindustry.com/wp-content/uploads/2019/07/Stratasys-vs-3D-Systems-Market-Cap-2016-2019-500×309.png 500w” sizes=”(max-width: 948px) 100vw, 948px” />

Industry.” width=”948″ height=”586″ srcset=”https://3dprintingindustry.com/wp-content/uploads/2019/07/Stratasys-vs-3D-Systems-Market-Cap-2016-2019.png 948w, https://3dprintingindustry.com/wp-content/uploads/2019/07/Stratasys-vs-3D-Systems-Market-Cap-2016-2019-770×476.png 770w, https://3dprintingindustry.com/wp-content/uploads/2019/07/Stratasys-vs-3D-Systems-Market-Cap-2016-2019-200×124.png 200w, https://3dprintingindustry.com/wp-content/uploads/2019/07/Stratasys-vs-3D-Systems-Market-Cap-2016-2019-500×309.png 500w” sizes=”(max-width: 948px) 100vw, 948px” />Behind the numbers – a new CEO or a takeover?

Why is this? Well, the aforementioned better than expected financial results could be one driver, as could the appointment of a new CEO.

Another explanation could be a takeover. It can be argued that the recent years of the company have been spent preparing the business for this event. A CEO search has taken more than a year. The task of finding a successor to Ilan Levin, whose departure was announced in May 2018, takes on a different light if we consider that the company is also searching for a potential acquirer.

The tale told by the financial statements over the past years shows a company set on a steady course, focused on cash preservation with a firm hand on expenses.

The most recent full-year accounts report revenue of $663.2 million, flat on a comparative of $668.4M. Cash and equivalents tell a similar story.

Through this lens, looking at several other decisions taken by the company can also be interpreted.

First, the sale of Vulcan Labs to competitor EOS in February 2019.

Second, the development of a metal 3D printing technology – Layered Powder Metallurgy (LPM).

In the case of Vulcan Labs, the sale might be understood as trimming expenses. For LPM, the extension of the Stratasys portfolio to include a proprietary metal AM technology may prove appealing to an acquirer who wants the full spectrum of 3D printing capabilities.

Companies generally abstain from comment on share price movements, and Stratasys is no exception. Shareholders and analysts will have to wait until at least the 31st of July when the company presents financial results to get further insight.

For all the latest 3D printing industry insights and analysis subscribe to our free newsletter. You can also follow us on Twitter and Facebook.

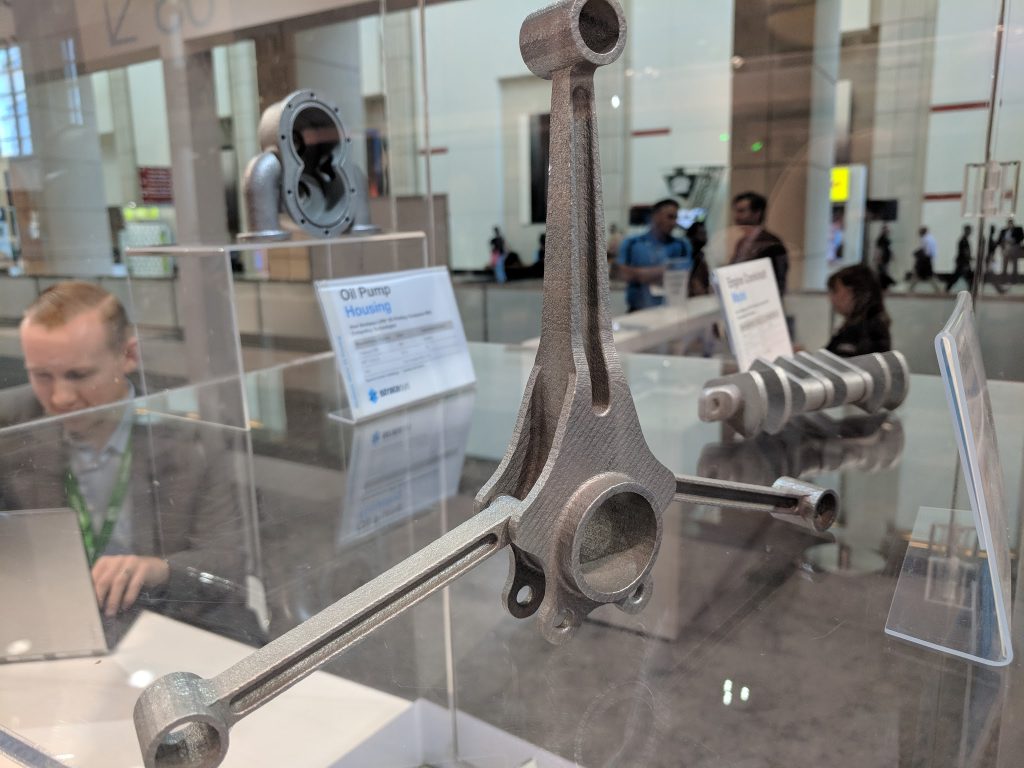

Featured image shows Stratasys at Formnext 2018. Photo by Beau Jackson.

Leave A Comment