investment news for 2018 gets underway with a potential hostile takeover of leading British engineering firm, GKN Plc (LON: GKN).

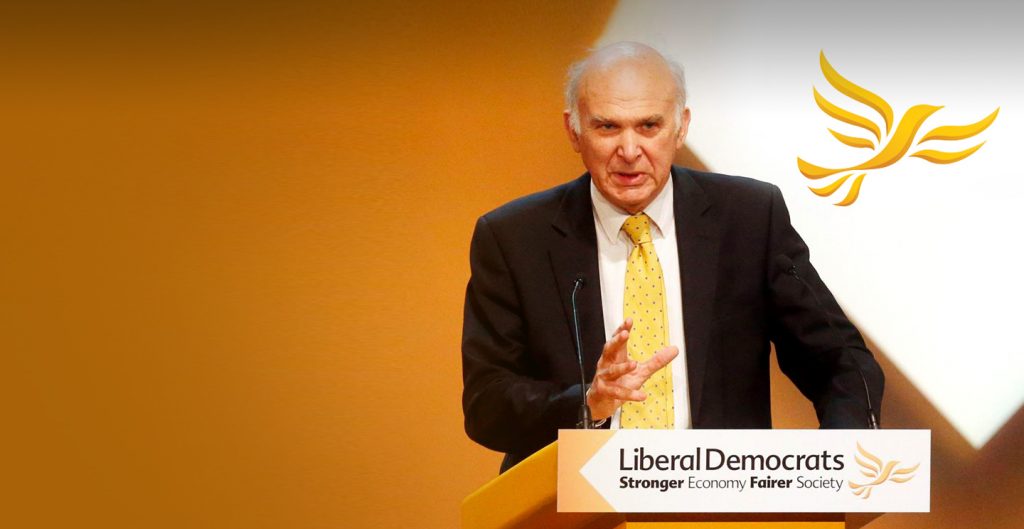

Melrose Plc (LSE: MRO) is a British investment company, who “specialise in the acquisition and performance improvement of good manufacturing businesses.” Less charitably, Melrose are described as “asset strippers” by Vince Cable, the leader of the Liberal Democrats – a British political party.

Melrose has valued GKN at £7bn or 420p per share. The offer was made last week and has sent GKN’s share price soaring to almost 450p. Of course, the bid from Melrose is far from a done deal. Outwardly GKN are opposed to the takeover and have issued a statement on the “unsolicited proposal from Melrose.”

GKN believes that the Melrose proposal is, “entirely opportunistic and that the terms fundamentally undervalued the Company and its prospects.” In reply Melrose issued a statement saying, “there would be significant operational and commercial benefits arising from Melrose’s ownership of GKN’s businesses, reversing a history of existing GKN management not delivering on margin targets.”

Dayton Horvath, AM industry analyst, gave his perspective on the news, “It’s not surprising that GKN’s multiple business units and manufacturing strengths in light of recent profit warnings and a high (58,000) employee count, have drawn takeover attention.”

The shadow of a takeover has loomed over GKN for some time. Analyst consensus is that the company has been poorly managed and failed to capitalise on opportunities. A slowdown in the U.S. aerospace division, with inventory write-downs potentially reaching £130m led to a profit warning and the departure of former CEO Kevin Cummings in 2017.

With blood in the water, other potential buyers may appear. GKN is already working with GE Additive and speculation as to whether Siemens or Oerlikon may acquire GKN has also been raised.

Additive manufacturing analyst Dayton Horvath adds, “The unique perspective for this potential takeover is the ultimate sale of GKN’s powder metallurgy business, which stands to gain significant value on two fronts. First, the powder metallurgy market maintains respectable single digit growth while the additive manufacturing market experiences continued double digit compounded growth and both of these markets demand metal powder from the likes of GKN, Sandvik, and Oerlikon Metco amongst others.”

For Melrose the £7 billion takeover would be their largest to date, with a long line of engineering enterprise acquisitions stretching back to 2005. In September 2016, Melrose brought Nortek, ventilation equipment manufacturer, for £2.2 billion. Other deals include Dynacast, a manufacturer of diecast parts and components, McKechnie, an engineering group, and Elster, a metering business.

Observers have remarked that breaking up a major engineering group like GKN would be disadvantageous for the UK. Politician Vince Cable states, “GKN stands for long term investment in advanced manufacturing whereas [Melrose] are in the business of short-term financial engineering.”

at GKN

GKN has said that 3D printing is a “primary focus” for the company in terms of investment activity.

GKN both supply 3D printing materials and use 3D printing in several business units. The GKN Driveline division performs work for many automotive makers – including Fiat Chrysler and Ferrari. Using Stratasys 3D printers GKN Driveline reportedly saved 70% on car production lead time.

In June last year production of metal powder for additive manufacturing commenced at GKN subsidiary, GKN Hoeganaes – the powder metallurgy division. The AncorAM range of titanium powders for 3D printing are made in the 10,000 sq ft hall at GKN’s Powder Innovation Center in New Jersey, this asset may be one of the first to be sold off after a takeover.

Hoeganaes produces over 240,000 tons of metal powder per year, and has approximately one fifth of the wider market.

The full list of divisions at GKN consists of:

GKN Aerospace, mainly based in the UK, Sweden and the Netherlands.

GKN Driveline, primarily Europe and North America with a joint venture in China.

GKN Powder Metallurgy, mainly North America with sites in Europe and Asia Pacific.

GKN Land Systems are mainly based in Europe and North America

Speaking at an event in 2017, Guido Degen, Senior Vice President Business Development & Advanced Technology explained the importance of metal 3D printing, “we are fully committed to taking a pioneering role in the industry in terms of digitalizing our company and our offers. We will actively shape the future and demonstrate that we can do this with the next step we take with our Metal AM serial production plant,”

Reportedly GKN may sell off their aerospace division to prevent further approaches.

Horvath agrees and states, “Although GKN’s current powder business and production-capable additive manufacturing infrastructure have benefited from the continued demand for advanced manufacturing technologies in various industries, it won’t be a deciding factor in a takeover when compared to the larger auto and aero business units.”

However, to the $6 billion additive market, the prospect of streamlining or selling GKN’s powder metallurgy and additive business would not only make headlines, but further confirm the bull market for additive service provider production capacity.

Both Melrose and GKN will now commence campaigns designed to convince shareholders of the merits of the arguments for and against a takeover. Industry will be following the progress of the bid closely.

GKN declined to provide further comment for this article.

For all the latest news and insight about the 3D printing industry, subscribe to our free newsletter and follow our active social media accounts.

Our readers will select the best 3D printing enterprises of 2018. Make your nominations for the Industry Awards now.

Featured image shows a a Jaguar Formula E racing car developed with GKN technology. Photo via GKN.

Leave A Comment