3D Systems financial results for Q1 of 2019 show a decline in revenue at the 3D printer manufacturer. Dissatisfaction with the latest results led to a dramatic 20% fall in the company’s share-price.

On a call with investors and analysts, 3D Systems CEO Vyomesh “VJ” Joshi stated, “Revenue in the first quarter was $152 million, an 8% decrease from the first quarter of 2018. Excluding large enterprise customer orders from both periods, total revenue decreased 5%.”

In the earnings call, VJ detailed the ongoing efforts around reduced operating costs and the continued development and sales of materials, in particular, dental materials.

Revenue by segments

3D Systems revenue is reported by the company in two business segments: Products and Services. In Q1 2019, Products revenue for the company fell 12.4% to $92.3 million from the comparative figure of $105.4 million in Q1 2018. Services revenue in Q1 2019 decreased 1.3% to $59.6 million from $60.4 million in Q1 2018.

| Revenue | Q1 2019 ($k) | Q1 2018 ($k) | Variance ($k) | % |

| Products | 92,347 | 105,447 | -13,100 | -12.42% |

| Services | 59,633 | 60,422 | -789 | -1.31% |

| Total | 151,980 | 165,869 | -13,889 | -8.37% |

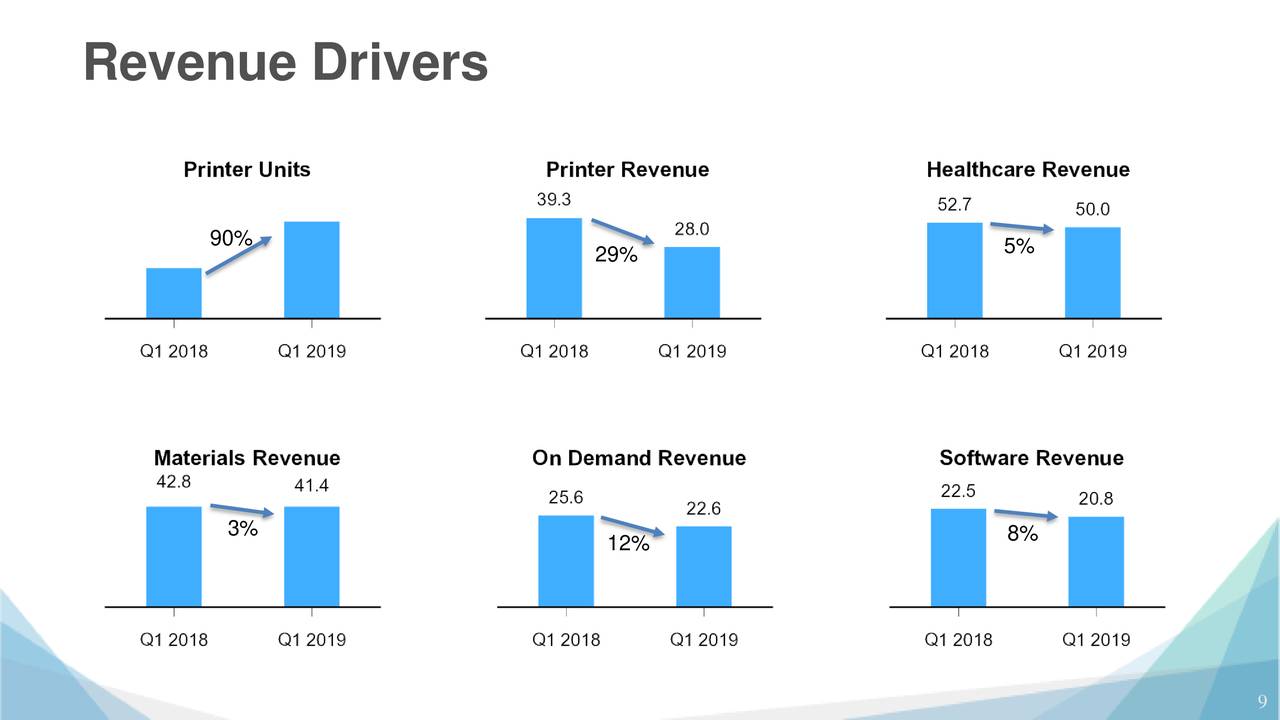

In the Products segment, despite the fact that the number of 3D printers sold rose by 90% in Q1 2019, total 3D printer revenue dropped by 29%. In addition to this, income from software fell by 8% to $20.8 million and materials revenue declined by 3% in Q1 2019.

In the Services segment, on-demand manufacturing services revenue fell 12% to $20.8 million in the first quarter of 2019. Healthcare and simulation revenue (also in Services segment) increased in Q1 2019. Joshi explained the movements were offset by the timing of large customer orders, therefore the total healthcare solutions revenue dropped by 5% to $50 million in the first quarter of 2019.

Executive Vice President and Chief Financial Officer of 3D Systems, John McMullen, said, “Excluding the larger enterprise customers orders from each year, healthcare revenues increased approximately 18%.”

In this regard, the success of 3D Systems’ NextDent 5100 was particularly noted.

In line with 3D System’s financial strategy, the operating expenses of the company were brought down to $87 million in Q1 2019 from $95.3 million. A decrease in R&D revenue to $21.9 million in Q1 2019 from $25.8 million in Q1 2018 was reported.

Overall 3D Systems’ net loss increased from $20,971 to $24,350 in Q1 2019.

Managing operating costs

Joshi said, “We reduced operating expenses both year-over-year and sequentially […] GAAP operating expenses decreased 9% to $87 million.” The reductions also included cuts to the R&D expenses by 15%.

John McMullen also added, “While cash use and generation will continue to fluctuate from period-to-period, we expect to generate organic free cash flow in 2019 as we significantly reduce inventory through the end of the year and reduce capital expenditures compared to the prior year.”

| Operating expenses: | Q1 2019 | Q1 2018 | Variance $ millions | % |

| Selling, general and administrative | 65,107 | 69,452 | -4,345 | -6.26% |

| Research and development | 21,903 | 25,882 | -3,979 | -15.37% |

| Total operating expenses | 87,010 | 95,334 | -8,324 | -8.73% |

Integrated powder management unit

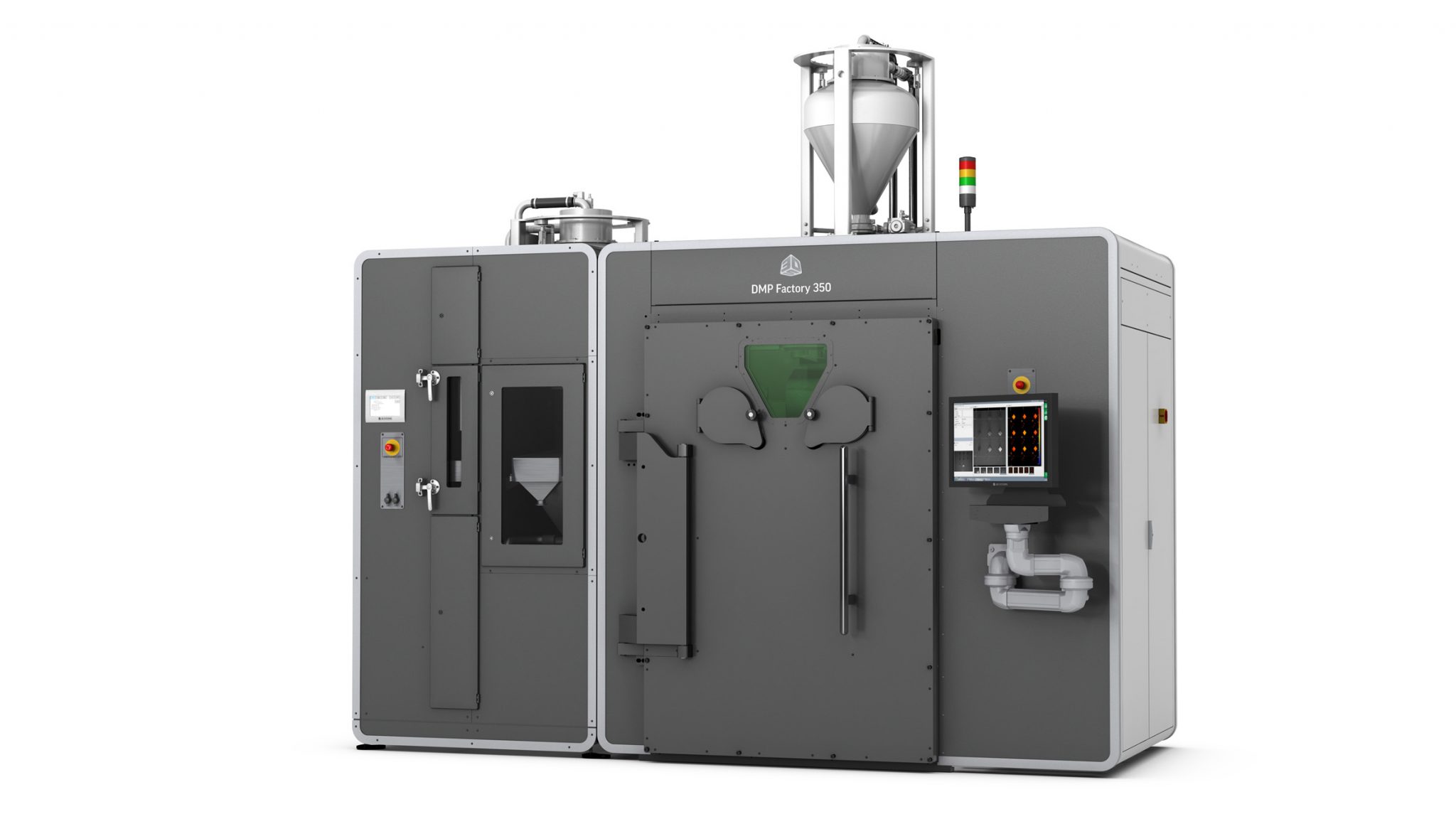

Last year, 3D Systems introduced the DMP line of metal 3D printers. In the last quarter of 2018, 3D Systems shipped three of its DMP machines: the DMP Flex 350, the DMP Factory 350, and DMP Factory 500.

However, Joshi explained, “During the first quarter, as the DMP Factory 350 systems had more rigorous use [as more customers began to use the systems], we identified a technical issue in the Powder Management Unit resulting in level of reliability and robustness below our standards.”

Joshi clarified that the loss in the metal segment revenues in Q1 2019 is not due to poor sales of 3D Systems’ machines. But only has to do with the technical issues related to the powder management system with DMP 350 which negatively impacted the revenues by $8 million.

Joshi explained further, “our metal business actually did extremely well except for the 350 Powder Management Unit shipment that I talked about […] So our metal business is absolutely growing year-over-year. What we had expected that we will be able to ship the other metal units is where that $8 million problem that I’m talking about […] We had orders for these units that we would not able to ship because of the technical issue.”

“We expect to continue to ramp sales of our DMP printers and put in place technical enhancements for the Powder Management Unit this year.”

Furthermore, to counter the revenue decrease in on-demand manufacturing, 3D Systems launched an online portal for on-demand services, last month. “The portal standardizes and automates export-related processes, which we believe helps us return to growth in our on-demand services,” said Joshi.

Restructuring the business

Vyomesh Joshi also spoke of restructuring the business to save costs. VJ said, “We are migrating to two primary businesses within the company.” One will cover plastic and metal hardware, and materials and on-demand services, and the other will be responsible for software and healthcare workflow solutions.

Joshi emphasized this point, saying, “We are focused on improving our cost structure and continue to refine the organization and operations to drive profitable growth.”

“We have taken actions to accelerate previously planned cost reductions and we will be taking additional steps over the coming quarters to reduce total 2019 expenses by $10 million to $15 million on top of our original plans for this year.”

Q2 expectations and future goals

Going ahead, CFO John McMullen explained that for 3D Systems Q2 of FY 2019 will not be very different from Q1.

Joshi clarified further, “As far as the metals issues getting all solved in Q2 will not happen. This is really something that we will continue to see in Q2. And then in second half, we will be able to ship [the powder management unit]”

Furthermore, 3D Systems has reiterated that it is positive about the growth and sales of its 3D printing materials. Joshi said, “we expect materials growth to improve in the second half of 2019 and we plan to launch new materials for plastics this year, which we believe will help fuel additional growth later this year and into 2020.”

Joshi adds “the core business, which is our SLA machines, our SLS machines, our MJP machines; this core will also continue to grow. So as our legacy [printers] decline being offset by our core and new materials, that’s why we are confident that in second half of 2019, we’re going to see positive materials growth.”

In conclusion, the CEO of 3D Systems’ insisted that the sales of metal 3D printers is going strong. Furthermore, he added that “we’re going to continue to drive more growth in the dental business,” and 3D System’s SLA machines will boost this growth.

“The next will be the Figure 4 with the new materials. I feel very good about that. We will continue to grow our wax-based MJP printer and then, the last one is our SLS machine with 6100 [ProX SLS 6100].”

These latest financial results for 3D Systems may have left long-term investors dissatisfied, however at least one investor may be smiling. As we reported, a significant options trade was made prior to the publication of these financial results and is likely to have netted a substantial profit.

2019 Awards are near. Vote now for the best enterprise 3D printer of the year.

To learn more about financial trends in the additive manufacturing industry, subscribe to our 3D printing newsletter. You can also join us on Facebook and Twitter.

For jobs in the industry, visit our Jobs page.

Featured image shows Vyomesh Joshi onstage during IMTS 2016, putting the customer at the center of strategy. Photo by Michael Petch.

Leave A Comment