The days of 3D printing as solely a rapid prototyping tool for the automotive industry are over. Advances in additive manufacturing (AM) mean that, today, automakers are increasingly integrating 3D printing into their production lines.

In fact, 94 per cent of automotive stakeholders are planning to expand their 3D printing capabilities, states Jabil’s survey conducted in 2018.

In this article, we’ll dive into the benefits that 3D printing offers automakers and explore how the technology is being integrated into automotive production processes today. Plus, we’ll look at the current challenges of adopting 3D printing for end-use car parts, as well as what the future holds for 3D printing in the automotive sector.

The benefits of 3D printing for the automotive industry

1. Design innovation

3D printing can be used to create complex, intricate designs that would otherwise not be possible with traditional manufacturing methods. This capability is particularly beneficial when creating customized functional parts.

As weight reduction is a key area of concern for automotive OEMs – lighter vehicles typically have lower fuel consumption – design engineers can also benefit from combining 3D printing with tools like topology optimization and generative design. These can be used to remove material in specified areas and create parts with optimized weight and performance.

2. Simplified assembly

Part consolidation is another way in which automotive OEMs can benefit from 3D printing. Since traditional manufacturing methods lack the design freedom of 3D printing, multiple components must typically be produced to create a final component.

With part consolidation, multiple parts of a component can be integrated into a single component at the design stage. Due to its complexity, the consolidated design can often be produced only with the help of 3D printing.

With this approach, 3D printing can simplify the assembly process by reducing the number of components needed at the assembly stage. Overcoming the need for multiple parts helps to reduce both material usage and assembly time or costs.

3. Customisation

With manufacturing leaning ever further towards mass customisation, automotive OEMs must, increasingly, find ways to create vehicles tailored to the needs of their customers. 3D printing offers a cost-effective and flexible way to produce customised parts.

Within the luxury and motorsports segment of the industry, companies are already using the technology to produce personalised parts for both the interior and exterior parts of a vehicle.

Offering customisation options to customers is one way automakers aim to improve customer experience and increase their competitive advantage.

One segment of the automotive industry that has adopted 3D printing for customisation, is that of luxury vehicles. In a segment where small production runs are the norm, 3D printing can be used to create parts, tailored to specific customer requirements, in a relatively short time frame.

Mini is a good example: the German-British automaker turned to 3D printing to enable customers to order customised parts, such as trim components and door handles.

Porsche 3D prints custom seats

In another example, Porsche has introduced a new concept for sports car seats that leverages 3D printing for customisation.

The new seats feature polyurethane 3D-printed central seat and backrest cushion sections, which can be customised by three firmness levels: hard, medium and soft.

Porsche plans to 3D print 40 prototype seats for use on European racetracks, as early as May 2020, with customer feedback being used to develop the final street-legal models for mid-2021.

Down the line, Porsche wants to expand seat customisation beyond firmness and colour, by personalising the seat to customer’s specific body contour.

Printing has the potential to transform the product design stage, with customers having a greater say in how their vehicles will look.

3D printing materials for automotive applications

Many automotive applications require materials that combine toughness and ductility with heat and chemical resistance. 3D printing with high-strength polymers (nylon, PEEK), plastics (ABS, ASA) and metals (aluminium, steel alloys, titanium), are therefore the most common options for producing functional car components and tooling.

Now, there is also the possibility of 3D printing with carbon fibre composites, which opens another door to making even lighter car components.

Integrating 3D printing into the automotive production process

Product development and validation

With the possibility of producing multiple design iterations in a shorter amount of time (and at little additional cost), 3D printing is an effective tool for product development. Typically, a part must go through several design cycles before the final design is agreed upon.

With 3D printing, this stage can be sped up dramatically. Additionally, cost-efficient design improvements can be made relatively quickly since the technology does not require expensive tooling to produce a prototype.

Using 3D printing for prototyping, testing and performance validation is currently one of the most popular applications of the technology within the automotive industry.

Low production costs, enabled by 3D printing, mean that design engineers can first check the fit and function of a component before investing in expensive and typically labour-intensive moulds for end-part production.

Design verification with 3D printing at Audi

Before a new vehicle goes into production, the Audi Pre-Series Center in Ingolstadt, builds physical models and prototypes for the brand, to be able to evaluate new designs and concepts.

The use of polymer 3D printing has become an integral part of the automotive design process at the Audi Pre-Series Center, enabling the team to overcome limitations of conventional processes and accelerate design verification.

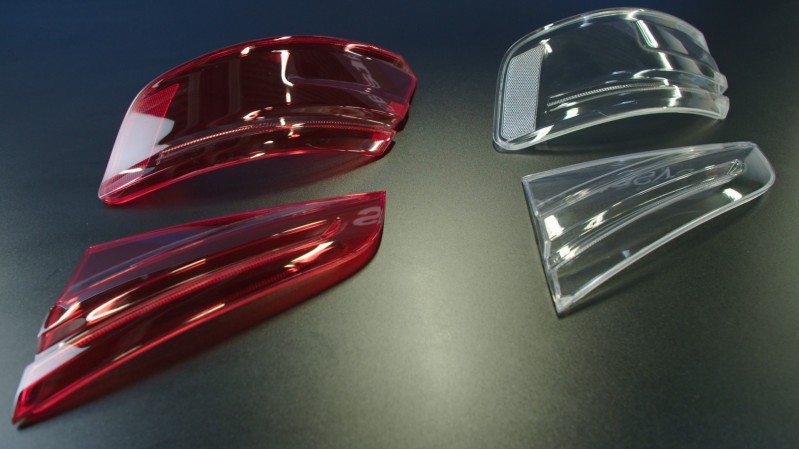

Take tail-light covers, for example. Traditionally, the prototypes of these parts are produced using milling or moulding. The main challenge with these production techniques is that the multi-coloured covers of the tail-light housing must be produced separately and then assembled. This increases lead times for design verification and subsequently delays time-to-market.

Using multi-colour 3D printing technology from Stratasys, enables the team to create entirely transparent, multi-coloured tail-light covers in a single print, eliminating the need for what was previously a multi-step process.

To produce tail-light covers, Audi expects to reduce prototyping lead times by up to 50 per cent, thanks to 3D printing.

Tooling

While prototyping remains the primary application of 3D printing within the automotive industry, using the technology for tooling is rapidly catching on.

The Volkswagen Europa assembly plant is already using AM to produce tooling equipment in-house, rather than sourcing it from third-party providers.

The company began to use 3D printing for tooling in 2014, for a pilot project. The success of the pilot convinced Volkswagen to switch a large part of its production of tooling to 3D printing.

Using the technology for this application brings many advantages.

Producing its tooling internally reduces tool production costs for the car manufacturer by 90 per cent – and cuts lead times from weeks to just a few days. To take one example, a tool like a liftgate badge would reportedly take 35 days to develop using traditional manufacturing and cost up to €400. With 3D printing, the same tool can be produced in four days at a cost of just €10.

Using 3D printing for tooling is said to have saved Volkswagen nearly €325,000 in 2017, whilst improving ergonomics, productivity and operator satisfaction.

When it comes to manufacturing aids, 3D printing is rapidly growing as an alternative to more established ways of manufacturing tools. In a few years, we’ll likely see more automotive OEMs switching to 3D-printed tooling to improve the efficiency of their production and the performance of their tools.

Spare parts

Automakers can leverage the benefits of 3D printing to create spare parts on demand.

With high inventory costs associated with storing spare (and often rarely ordered) parts, 3D printing provides a cost-effective means to produce parts needed on time and on demand, leading to improved delivery times, reduced inventory costs and a simplified supply chain.

Daimler Buses is looking to 3D print spare parts

At the beginning of 2020, Daimler Buses announced its plans to develop a new business model: directly producing spare parts in-house for customers via 3D printing.

At present Daimler Buses’ Centre of Competence for 3D printing is examining more than 300,000 bus spare parts in detail for such printing. Around 200 have so far been identified as suitable, such as covers, handles and a diverse range of brackets.

One of the key drivers of switching to 3D printing for such parts is the ability to speed up part production and delivery. Daimler Buses states that these processes take only a few days as opposed to several months.

An additional benefit of 3D printing, cited by Daimler Buses, includes improved material efficiency: the technology produces considerably less waste and any unused material can be immediately used for the next 3D printing order.

End-part production

Recent advances in AM technology and materials unlocked 3D printing to produce small and medium-size end-use parts. According to Jabil’s 2018 survey of automotive OEMs, 40 per cent envision that 3D printing will help with the production of end-use car components.

End-use 3D-printed automotive parts can range from exterior components to inner parts, such as bellows, complex ducting, mounting brackets and engine components.

One example is Ford: last year, the company announced the start of 3D printing production of structural components.

The parts in question include Ford Focus HVAC (Heating, Ventilation and Cooling) Lever Arm Service Parts, Ford F-150 Raptor Auxiliary Plugs and Ford Mustang GT500 Electric Parking Brake Brackets.

These components are produced using Carbon’s Digital Light Synthesis (DLS) 3D printing technology and EPX (epoxy) 82 material and have passed all of Ford’s performance standards and requirements.

3D printing in motorsports

The use of AM as a competitive advantage for race car development is standard practice today.

In motorsports, 3D printing has become an indispensable tool for producing durable and accurate parts for wind tunnel testing. Another advantage is speed: if a design change is necessary, AM makes it easier to produce components that can be tested in the wind tunnel, much faster.

Many race car teams are also exploring 3D printing in the production of end-use car components. For example, Alfa Romeo Sauber F1 team 3D prints a metal roll hoop – a critical safety structure which protects the driver in case of a rollover.

Notably, this part is made from Scalmalloy, a lightweight metal developed specifically for AM. By combining this material with Selective Laser Melting (SLM) technology, Sauber F1 can produce a much lighter roll hoop with complex internal features for structural integrity. It has also been able to reduce production lead times by around 25 per cent.

3D printing challenges in the automotive industry

Mass production

While automotive OEMs are increasingly incorporating AM systems into development and production, one challenge to wider adoption is production volumes. With over 92 million cars produced in 2019 alone, the automotive industry is heavily reliant on mass series production.

At its current stage, 3D printing cannot produce parts at the volume and speed required by the automotive industry. The technology, therefore, should not be a replacement for traditional manufacturing methods, well-suited to mass volumes, but as a complementary tool for lower volume, customised production.

That said, 3D printing hardware manufacturers are developing higher-volume production methods to suit the requirements of the automotive industry. One of them is metal binder jetting, developed by the likes of HP, Desktop Metal, ExOne and also GE Additive.

In addition to metal, binder jetting 3D printers can use powdered materials, such as plastic, sand and ceramics and a bonding agent, to rapidly build up a part layer-by-layer, using data from a digital design file.

Unlike a 3D printer, that uses a laser or an electron beam and makes one or two parts at a time, a binder jetting machine can, for example, make dozens of brackets at once, because the printing area is far larger and the layers are built up much faster.

However, metal binder jetting is only in the early stages of its adoption in the automotive industry. According to Matthias Schmidt-Lehr, a managing partner at consulting firm Ampower GmbH & Co, binder jetting technology is between five and ten years away from being able to produce parts at automotive volumes.

Build sizes

Another challenge faced by automakers is the limited build size of many AM systems. Although larger parts can be produced with 3D printing technology, this must be done in the form of modular parts. These, in turn, must currently be assembled or attached through other processes, such as welding.

However, large-scale additive manufacturing is an important and growing area of research, with technologies that can support larger build sizes, such as Wire Arc Additive Manufacturing (WAAM) and Big Area Additive Manufacturing (BAAM), actively being researched and developed.

AM skills gap

Additional investment in developing AM-specific skills must also be addressed if the technology is to take off more widely. Design for AM, as well as the operation and maintenance of AM systems, materials and post-processing, are all vital skills that must be developed and nurtured.

While much has been said on the current skills gap for AM, partnerships with universities and internal training programmes are one way of ensuring a skilled talent pool, able to work with the particularities of AM technology.

3D printing in automotive: the road ahead

As automakers continue to find new applications for 3D printing, one thing is clear: the use of 3D printing for end-part production is increasingly gaining traction. The latest report from SmarTech Analysis, a 3D printing research firm, supports this trend by stating that the use of AM for automotive production is set to become a $10 billion business by 2030.

In this context, the automotive industry is likely to witness even more 3D-printed functional components, such as brackets, housings and even engine parts.

And perhaps a vision of a more distant future, the prospect of 3D printing an entire car may not be so far-fetched.

US automaker, Local Motors, has already been testing a 3D-printed, autonomous electric shuttle, called Ollie, designed for local, low-speed transportation.

Most of Ollie’s components have been 3D printed, including the roof and lower body of the vehicle.

While it will take some time to see fully 3D-printed vehicles on the roads, projects like Local Motors’ Ollie could take us one step closer to that exciting possibility.